Corporate venturing involves established companies investing in or partnering with startups to drive innovation and gain strategic advantages, often through equity stakes and long-term collaboration. Accelerator programs focus on rapidly scaling early-stage startups by providing mentorship, resources, and access to networks within a fixed, intensive timeframe. Explore the distinct benefits and strategic applications of corporate venturing versus accelerator programs to optimize your innovation strategy.

Why it is important

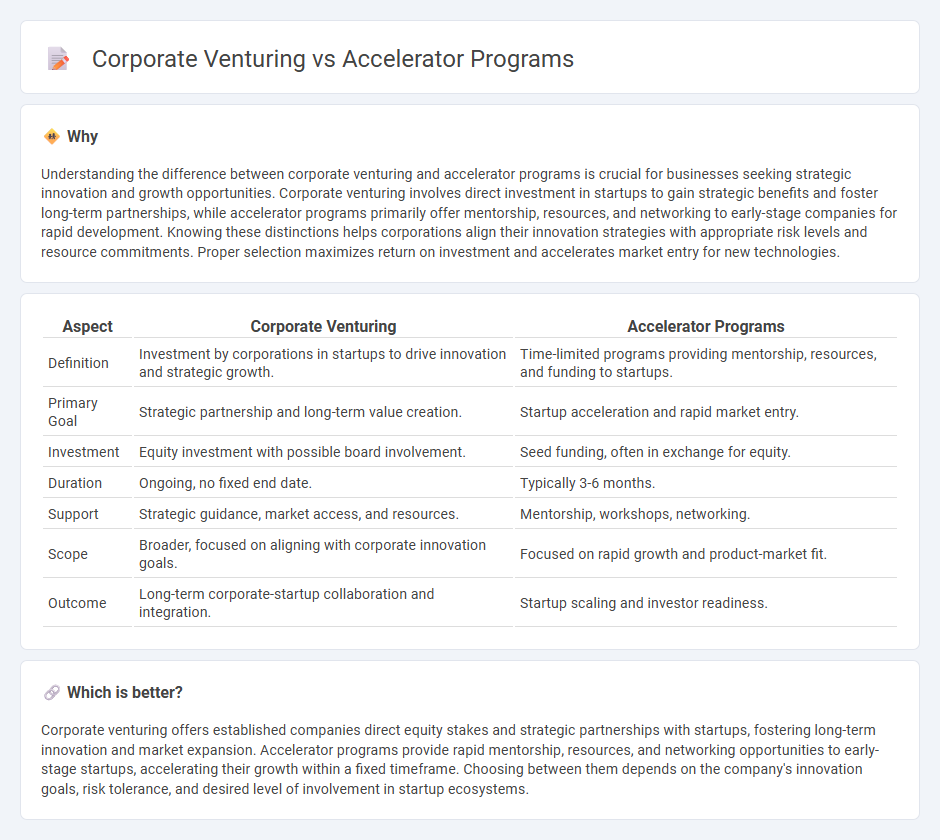

Understanding the difference between corporate venturing and accelerator programs is crucial for businesses seeking strategic innovation and growth opportunities. Corporate venturing involves direct investment in startups to gain strategic benefits and foster long-term partnerships, while accelerator programs primarily offer mentorship, resources, and networking to early-stage companies for rapid development. Knowing these distinctions helps corporations align their innovation strategies with appropriate risk levels and resource commitments. Proper selection maximizes return on investment and accelerates market entry for new technologies.

Comparison Table

| Aspect | Corporate Venturing | Accelerator Programs |

|---|---|---|

| Definition | Investment by corporations in startups to drive innovation and strategic growth. | Time-limited programs providing mentorship, resources, and funding to startups. |

| Primary Goal | Strategic partnership and long-term value creation. | Startup acceleration and rapid market entry. |

| Investment | Equity investment with possible board involvement. | Seed funding, often in exchange for equity. |

| Duration | Ongoing, no fixed end date. | Typically 3-6 months. |

| Support | Strategic guidance, market access, and resources. | Mentorship, workshops, networking. |

| Scope | Broader, focused on aligning with corporate innovation goals. | Focused on rapid growth and product-market fit. |

| Outcome | Long-term corporate-startup collaboration and integration. | Startup scaling and investor readiness. |

Which is better?

Corporate venturing offers established companies direct equity stakes and strategic partnerships with startups, fostering long-term innovation and market expansion. Accelerator programs provide rapid mentorship, resources, and networking opportunities to early-stage startups, accelerating their growth within a fixed timeframe. Choosing between them depends on the company's innovation goals, risk tolerance, and desired level of involvement in startup ecosystems.

Connection

Corporate venturing and accelerator programs are interconnected as both aim to drive innovation by investing in and supporting startups aligned with a corporation's strategic goals. Corporate venturing provides funding and resources, while accelerator programs offer mentorship, networking, and development support to accelerate startup growth. This synergy enhances market competitiveness and accelerates the adoption of emerging technologies within established companies.

Key Terms

Startups

Accelerator programs provide startups with intensive mentorship, funding, and access to networks within a fixed timeframe to accelerate their growth rapidly. Corporate venturing involves established companies investing directly into startups or launching innovation labs to foster long-term strategic partnerships and technology integration. Explore how these approaches impact startup scalability and innovation by diving deeper into their unique benefits and challenges.

Strategic Investment

Accelerator programs provide startups with mentorship, resources, and market access, accelerating innovation while corporate venturing invests strategically in startups to align with long-term business goals and enhance competitive advantage. These approaches differ in focus, with accelerators emphasizing growth and development, whereas corporate venturing centers on strategic investment and integration within the parent company's ecosystem. Explore how strategic investment through corporate venturing can drive innovation synergy and competitive growth.

Innovation Ecosystem

Accelerator programs accelerate the growth of startups by providing mentorship, funding, and access to industry networks, fostering rapid innovation within the ecosystem. Corporate venturing involves large companies investing in or partnering with startups to integrate new technologies and business models, enhancing competitive advantage and market reach. Explore how these distinct approaches shape dynamic innovation ecosystems and drive sustainable growth.

Source and External Links

Best Startup Accelerators & Programs in 2025 - StartupBlink - This article highlights top global accelerator programs like 500 Startups, Merck Accelerator, and Seedstars, describing their focus areas, equity terms, and support offerings for startups and entrepreneurs around the world.

32 Best Startup Accelerators 2025 - An overview of top startup accelerators including Y Combinator, Techstars, and Microsoft Accelerator, with details on funding, mentorship, industry focus, and program benefits for early-stage and high-growth tech startups.

Business Accelerator - EforAll - A free, year-long accelerator program offered twice yearly that provides immersive business training, mentorship, and professional networking to entrepreneurs at any stage, including those with ideas, hobbies, or existing businesses.

dowidth.com

dowidth.com