Operational due diligence focuses on evaluating a company's internal processes, financial performance, and management efficiency to ensure sound investment decisions. Integrity due diligence assesses ethical practices, compliance with regulations, and potential reputational risks related to business conduct. Explore further to understand how these due diligence types safeguard your investments and corporate reputation.

Why it is important

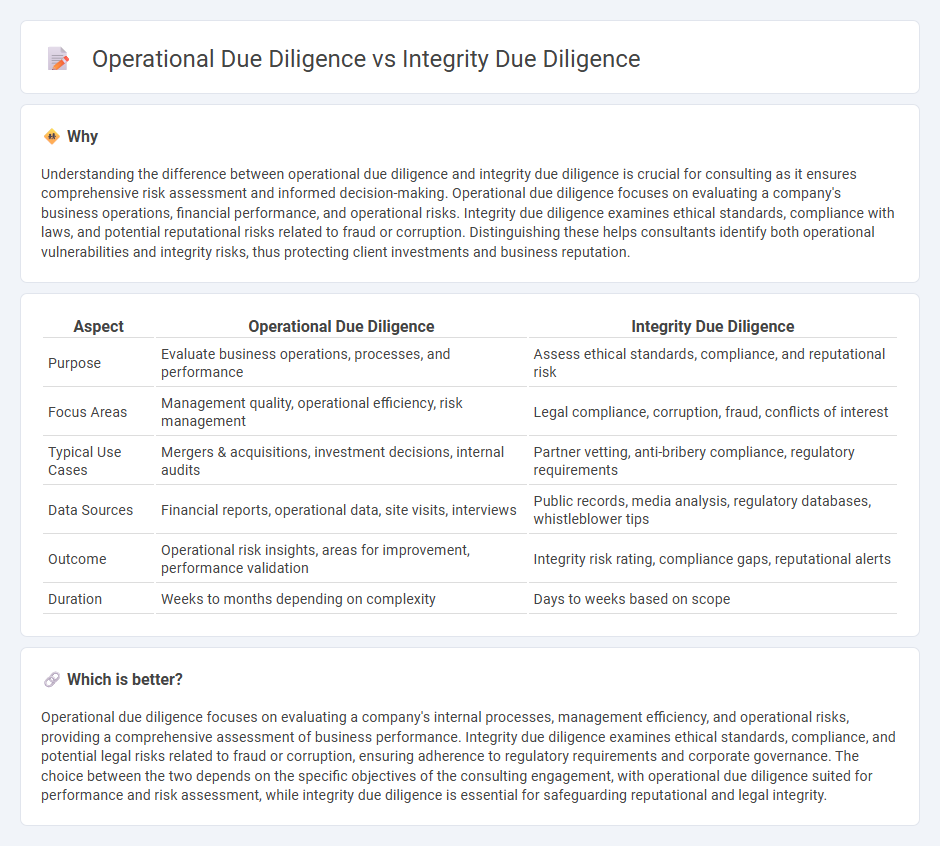

Understanding the difference between operational due diligence and integrity due diligence is crucial for consulting as it ensures comprehensive risk assessment and informed decision-making. Operational due diligence focuses on evaluating a company's business operations, financial performance, and operational risks. Integrity due diligence examines ethical standards, compliance with laws, and potential reputational risks related to fraud or corruption. Distinguishing these helps consultants identify both operational vulnerabilities and integrity risks, thus protecting client investments and business reputation.

Comparison Table

| Aspect | Operational Due Diligence | Integrity Due Diligence |

|---|---|---|

| Purpose | Evaluate business operations, processes, and performance | Assess ethical standards, compliance, and reputational risk |

| Focus Areas | Management quality, operational efficiency, risk management | Legal compliance, corruption, fraud, conflicts of interest |

| Typical Use Cases | Mergers & acquisitions, investment decisions, internal audits | Partner vetting, anti-bribery compliance, regulatory requirements |

| Data Sources | Financial reports, operational data, site visits, interviews | Public records, media analysis, regulatory databases, whistleblower tips |

| Outcome | Operational risk insights, areas for improvement, performance validation | Integrity risk rating, compliance gaps, reputational alerts |

| Duration | Weeks to months depending on complexity | Days to weeks based on scope |

Which is better?

Operational due diligence focuses on evaluating a company's internal processes, management efficiency, and operational risks, providing a comprehensive assessment of business performance. Integrity due diligence examines ethical standards, compliance, and potential legal risks related to fraud or corruption, ensuring adherence to regulatory requirements and corporate governance. The choice between the two depends on the specific objectives of the consulting engagement, with operational due diligence suited for performance and risk assessment, while integrity due diligence is essential for safeguarding reputational and legal integrity.

Connection

Operational due diligence evaluates a company's internal processes, risk management, and compliance frameworks to ensure operational efficiency and reduce vulnerabilities. Integrity due diligence assesses ethical standards, corporate governance, and potential reputational risks linked to fraud, corruption, or regulatory breaches. Integrating both practices provides a comprehensive risk profile, enabling informed decisions in mergers, acquisitions, or partnerships by uncovering hidden liabilities and ensuring adherence to legal and ethical standards.

Key Terms

Integrity Due Diligence:

Integrity Due Diligence primarily examines the ethical conduct, compliance with laws, and potential reputational risks associated with a business or individual, focusing on anti-bribery, corruption, and background checks. Operational Due Diligence assesses the efficiency, processes, and capabilities of business operations to evaluate management quality and operational risks. Explore detailed insights on how Integrity Due Diligence safeguards your investments by mitigating hidden ethical and legal risks.

Background Checks

Integrity due diligence centers on comprehensive background checks to identify potential risks related to fraud, corruption, and ethical violations by scrutinizing personal, financial, and reputational histories. Operational due diligence assesses a company's internal processes, systems, and management capabilities, with background checks confirming the credibility and qualifications of key personnel. Explore the nuances of these due diligence types to enhance risk mitigation strategies effectively.

Reputational Risk

Integrity due diligence primarily assesses reputational risks by examining ethical conduct, legal compliance, and background checks of individuals or entities involved. Operational due diligence focuses on evaluating business processes, operational capabilities, and risk management systems but integrates reputational risk as part of broader operational impact assessments. Explore detailed analyses to understand how these due diligence types mitigate reputational risk effectively.

Source and External Links

Integrity due diligence - Deloitte - Integrity due diligence (IDD) involves identifying and mitigating bribery, corruption, and reputational risks related to third parties through independent background checking, using a flexible, risk-based approach tailored to the client's needs from desktop reviews to in-depth investigations.

Integrity Due Diligence Policy - Nordic Investment Bank - IDD is a risk-based process to assess integrity risks such as corruption, fraud, and money laundering in transactions and counterparties, enabling informed decisions and protecting organizational reputation.

How Integrity Due Diligence Can Protect Your Company - RSM US - Integrity due diligence gathers independent information to assess corruption and integrity risks posed by third parties and business partners, helping companies manage risks strategically and comply with global anti-corruption laws.

dowidth.com

dowidth.com