Acquihire strategy focuses on acquiring startups primarily to gain talented teams, using existing company structures and resources to accelerate growth and innovation. Greenfield investment involves establishing new operations from the ground up, allowing full control over the development process but requiring more time and capital commitment. Explore detailed comparisons of acquihire strategy versus greenfield investment to determine the optimal approach for your business expansion goals.

Why it is important

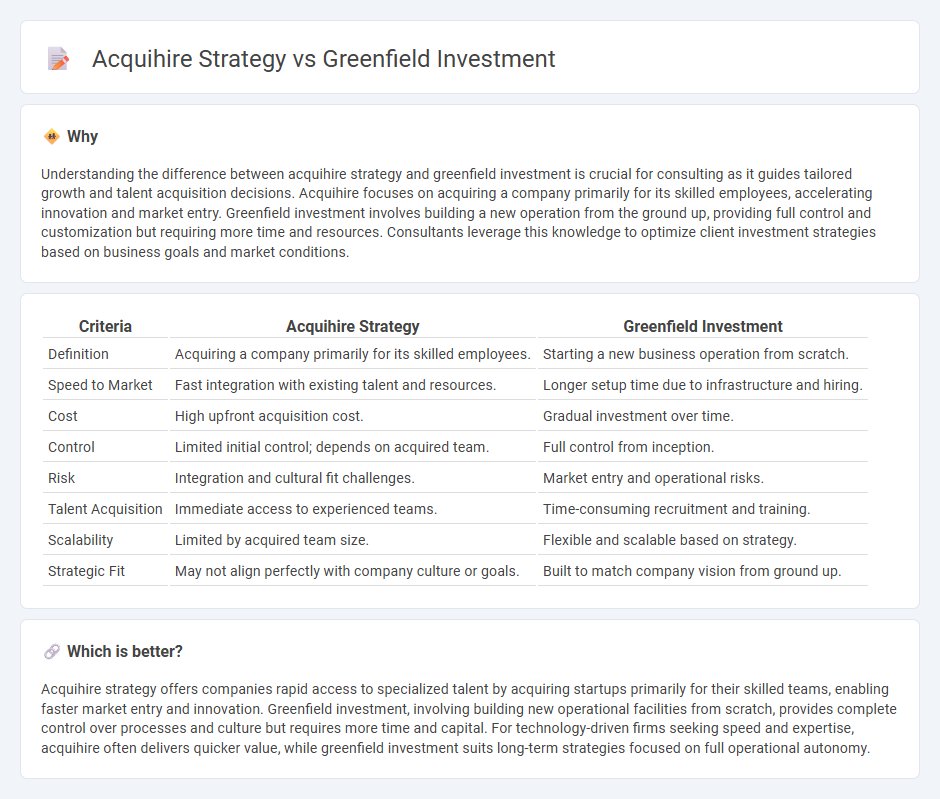

Understanding the difference between acquihire strategy and greenfield investment is crucial for consulting as it guides tailored growth and talent acquisition decisions. Acquihire focuses on acquiring a company primarily for its skilled employees, accelerating innovation and market entry. Greenfield investment involves building a new operation from the ground up, providing full control and customization but requiring more time and resources. Consultants leverage this knowledge to optimize client investment strategies based on business goals and market conditions.

Comparison Table

| Criteria | Acquihire Strategy | Greenfield Investment |

|---|---|---|

| Definition | Acquiring a company primarily for its skilled employees. | Starting a new business operation from scratch. |

| Speed to Market | Fast integration with existing talent and resources. | Longer setup time due to infrastructure and hiring. |

| Cost | High upfront acquisition cost. | Gradual investment over time. |

| Control | Limited initial control; depends on acquired team. | Full control from inception. |

| Risk | Integration and cultural fit challenges. | Market entry and operational risks. |

| Talent Acquisition | Immediate access to experienced teams. | Time-consuming recruitment and training. |

| Scalability | Limited by acquired team size. | Flexible and scalable based on strategy. |

| Strategic Fit | May not align perfectly with company culture or goals. | Built to match company vision from ground up. |

Which is better?

Acquihire strategy offers companies rapid access to specialized talent by acquiring startups primarily for their skilled teams, enabling faster market entry and innovation. Greenfield investment, involving building new operational facilities from scratch, provides complete control over processes and culture but requires more time and capital. For technology-driven firms seeking speed and expertise, acquihire often delivers quicker value, while greenfield investment suits long-term strategies focused on full operational autonomy.

Connection

Acquihire strategy and greenfield investment are connected through their roles in business expansion and talent acquisition. Acquihire involves acquiring a company primarily for its skilled workforce, which enhances the acquiring firm's capabilities in new markets or technologies. Greenfield investment complements this by establishing new operational facilities from scratch, allowing the firm to leverage the acquired talent in building innovative projects or entering untapped regions.

Key Terms

Market Entry

Greenfield investment enables companies to establish new operations from the ground up, offering full control over market entry strategies and local customization. Acquihire strategy, on the other hand, focuses on acquiring talented teams to rapidly gain market presence and expertise without building infrastructure. Explore the strategic advantages and challenges of each approach to optimize your market entry plan.

Talent Acquisition

Greenfield investment involves establishing a new operation from the ground up, enabling complete control over talent acquisition processes and cultural integration. Acquihire strategy centers on acquiring a company primarily to access its skilled workforce, often accelerating access to specialized talent and innovation. Explore these distinct talent acquisition strategies to determine the best fit for your organizational growth and innovation goals.

Integration

Greenfield investment involves establishing new operations from the ground up, allowing full control over integration processes and corporate culture alignment. Acquihire strategy focuses on acquiring talent by purchasing a startup primarily for its skilled team, necessitating rapid cultural and operational integration to retain key employees. Explore deeper insights into how these strategies impact post-acquisition integration effectiveness.

Source and External Links

What are Greenfield Investments? - Greenfield investment is when companies build new business operations or facilities from scratch in a foreign country, creating new jobs and boosting the economy with long-term strategic investments controlled by the investor.

Greenfield vs Brownfield Investing - Greenfield investing involves developing new projects on previously unused land and allows investors to build projects tailored exactly to their specifications, often requiring significant upfront capital.

Greenfield Investment - Definition, Advantages and ... - Greenfield investment is a form of foreign direct investment where a company establishes new facilities from the ground up abroad to achieve high control over operations and potentially gain tax incentives.

dowidth.com

dowidth.com