Zero-based budgeting requires organizations to justify every expense from scratch for each budgeting period, ensuring precise cost control and optimal resource allocation. Rolling forecasting continuously updates financial projections by incorporating the latest data, enhancing agility and responsiveness in dynamic markets. Discover more about how these strategic approaches improve financial planning efficacy.

Why it is important

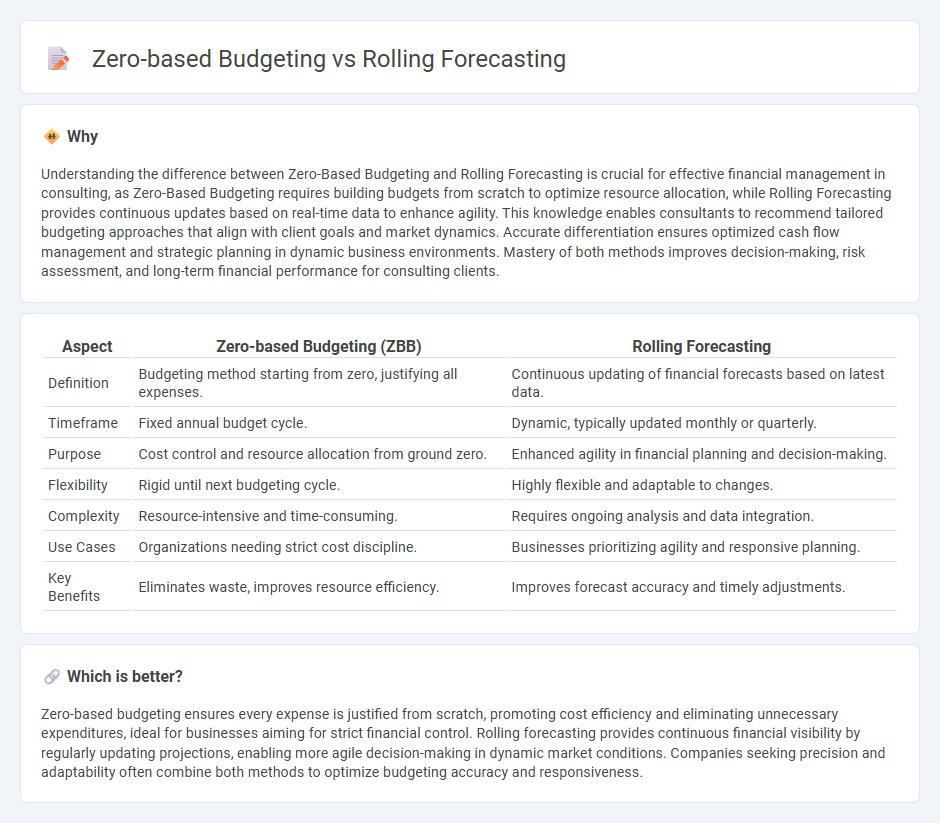

Understanding the difference between Zero-Based Budgeting and Rolling Forecasting is crucial for effective financial management in consulting, as Zero-Based Budgeting requires building budgets from scratch to optimize resource allocation, while Rolling Forecasting provides continuous updates based on real-time data to enhance agility. This knowledge enables consultants to recommend tailored budgeting approaches that align with client goals and market dynamics. Accurate differentiation ensures optimized cash flow management and strategic planning in dynamic business environments. Mastery of both methods improves decision-making, risk assessment, and long-term financial performance for consulting clients.

Comparison Table

| Aspect | Zero-based Budgeting (ZBB) | Rolling Forecasting |

|---|---|---|

| Definition | Budgeting method starting from zero, justifying all expenses. | Continuous updating of financial forecasts based on latest data. |

| Timeframe | Fixed annual budget cycle. | Dynamic, typically updated monthly or quarterly. |

| Purpose | Cost control and resource allocation from ground zero. | Enhanced agility in financial planning and decision-making. |

| Flexibility | Rigid until next budgeting cycle. | Highly flexible and adaptable to changes. |

| Complexity | Resource-intensive and time-consuming. | Requires ongoing analysis and data integration. |

| Use Cases | Organizations needing strict cost discipline. | Businesses prioritizing agility and responsive planning. |

| Key Benefits | Eliminates waste, improves resource efficiency. | Improves forecast accuracy and timely adjustments. |

Which is better?

Zero-based budgeting ensures every expense is justified from scratch, promoting cost efficiency and eliminating unnecessary expenditures, ideal for businesses aiming for strict financial control. Rolling forecasting provides continuous financial visibility by regularly updating projections, enabling more agile decision-making in dynamic market conditions. Companies seeking precision and adaptability often combine both methods to optimize budgeting accuracy and responsiveness.

Connection

Zero-based budgeting and rolling forecasting are connected through their shared focus on enhancing financial agility and accuracy in consulting. Zero-based budgeting requires building budgets from scratch, prioritizing activities based on current needs, which complements rolling forecasting's continuous update of financial projections. Together, these techniques enable consultants to allocate resources efficiently and adjust strategies dynamically in response to evolving business conditions.

Key Terms

Continuous Updating

Rolling forecasting offers a dynamic approach by continuously updating financial projections based on real-time data, enhancing adaptability over traditional zero-based budgeting, which allocates resources from a clean slate each cycle without interim adjustments. This method improves forecasting accuracy and strategic agility, essential for businesses operating in volatile markets. Discover how integrating rolling forecasting can transform your budgeting process and optimize financial planning.

Baseline Reset

Rolling forecasting updates financial projections continuously based on current data, providing dynamic adaptability to changing market conditions. Zero-based budgeting requires building budgets from a baseline of zero, challenging all expenses to justify their necessity, which creates a strict cost management framework. Explore the strategic benefits of baseline reset to optimize your financial planning by delving deeper into these budgeting techniques.

Cost Control

Rolling forecasting provides continuous updates to financial projections, allowing organizations to react swiftly to cost fluctuations and improve expense management. Zero-based budgeting requires building budgets from scratch each cycle, promoting rigorous cost control by justifying all expenses rather than relying on historical data. Explore detailed comparisons to understand which method best suits your organization's cost control objectives.

Source and External Links

What Is a Rolling Forecast? Pros, Cons, and Best Practices - NetSuite - A rolling forecast continuously drops a completed period and adds a new future period, keeping the forecast window constant and always forward-looking.

What Is a Rolling Forecast? | Workday US - Rolling forecasts are dynamically updated financial plans that focus on key business drivers and are refreshed monthly or quarterly to reflect the latest data and market conditions.

8 Steps to Implementing Rolling Forecasts | Anaplan - Unlike traditional budgets tied to a fiscal year, rolling forecasts provide a continuous, updated outlook that helps organizations stay agile and responsive to changing business environments.

dowidth.com

dowidth.com