Growth audits analyze market positioning, customer acquisition strategies, and operational scalability to identify opportunities for business expansion. Financial health checks assess cash flow, profitability, balance sheet strength, and debt management to ensure sustainable financial stability. Discover how combining these assessments can drive strategic decision-making and long-term success.

Why it is important

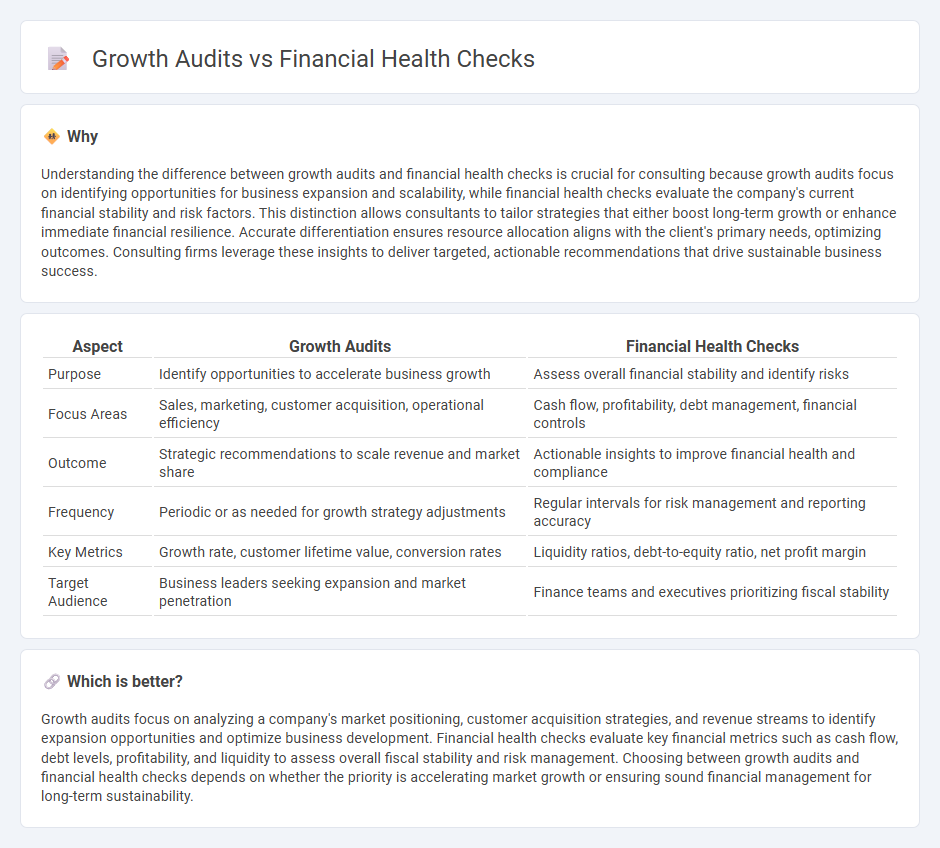

Understanding the difference between growth audits and financial health checks is crucial for consulting because growth audits focus on identifying opportunities for business expansion and scalability, while financial health checks evaluate the company's current financial stability and risk factors. This distinction allows consultants to tailor strategies that either boost long-term growth or enhance immediate financial resilience. Accurate differentiation ensures resource allocation aligns with the client's primary needs, optimizing outcomes. Consulting firms leverage these insights to deliver targeted, actionable recommendations that drive sustainable business success.

Comparison Table

| Aspect | Growth Audits | Financial Health Checks |

|---|---|---|

| Purpose | Identify opportunities to accelerate business growth | Assess overall financial stability and identify risks |

| Focus Areas | Sales, marketing, customer acquisition, operational efficiency | Cash flow, profitability, debt management, financial controls |

| Outcome | Strategic recommendations to scale revenue and market share | Actionable insights to improve financial health and compliance |

| Frequency | Periodic or as needed for growth strategy adjustments | Regular intervals for risk management and reporting accuracy |

| Key Metrics | Growth rate, customer lifetime value, conversion rates | Liquidity ratios, debt-to-equity ratio, net profit margin |

| Target Audience | Business leaders seeking expansion and market penetration | Finance teams and executives prioritizing fiscal stability |

Which is better?

Growth audits focus on analyzing a company's market positioning, customer acquisition strategies, and revenue streams to identify expansion opportunities and optimize business development. Financial health checks evaluate key financial metrics such as cash flow, debt levels, profitability, and liquidity to assess overall fiscal stability and risk management. Choosing between growth audits and financial health checks depends on whether the priority is accelerating market growth or ensuring sound financial management for long-term sustainability.

Connection

Growth audits analyze business strategies, market positioning, and operational efficiency to identify expansion opportunities, while financial health checks assess a company's fiscal stability, cash flow, and profitability. Both tools provide a comprehensive overview that helps consultants pinpoint underlying issues and align financial resources with growth initiatives. This integrated approach ensures sustainable scalability by balancing strategic ambitions with sound financial management.

Key Terms

Profitability Analysis

Financial health checks evaluate a company's current fiscal stability by analyzing liquidity, solvency, and cash flow metrics, while growth audits concentrate on identifying opportunities to enhance revenue and market share through strategic initiatives. Profitability analysis bridges both approaches by assessing gross margin, operating income, and net profit trends to pinpoint strengths and weaknesses in financial performance. Explore deeper insights into profitability analysis to optimize financial strategies and drive sustainable growth.

Revenue Streams Assessment

Revenue streams assessment in financial health checks emphasizes analyzing cash flow stability and expense management to ensure sustainable operations. Growth audits target the scalability and diversification of revenue sources, identifying opportunities for market expansion and product innovation. Explore the differences in depth to optimize your business strategy effectively.

Scalability Evaluation

Financial health checks assess cash flow stability, liquidity ratios, and debt levels to ensure current fiscal stability, while growth audits focus on scalability evaluation by analyzing market potential, operational capacity, and revenue expansion strategies. Scalability evaluation involves scrutinizing business model adaptability, technology integration, and customer acquisition cost to support sustainable growth. Discover how combining these assessments can optimize your company's long-term success.

Source and External Links

How to Complete a Financial Health Check - A financial health check involves reviewing your budget, debts, savings, retirement accounts, estate plan, and insurance to assess your finances and help reach your financial goals, ideally done annually or after major life events.

Financial health check: Evaluate your financial health - To evaluate your financial health, start by defining your financial goals, organizing financial records, and assessing your current situation to make informed decisions toward achieving short- and long-term objectives.

Free Financial Health Check - BECU offers free one-on-one financial health coaching to help members budget, improve credit, manage spending, and work toward their financial goals with the support of certified financial coaches.

dowidth.com

dowidth.com