Revenue operations consulting focuses on optimizing sales, marketing, and customer success processes to drive sustainable growth and improve revenue efficiency. Financial consulting centers on managing budgets, forecasting, and financial planning to enhance profitability and ensure fiscal health. Explore the distinct benefits of each consulting approach to elevate your business strategy.

Why it is important

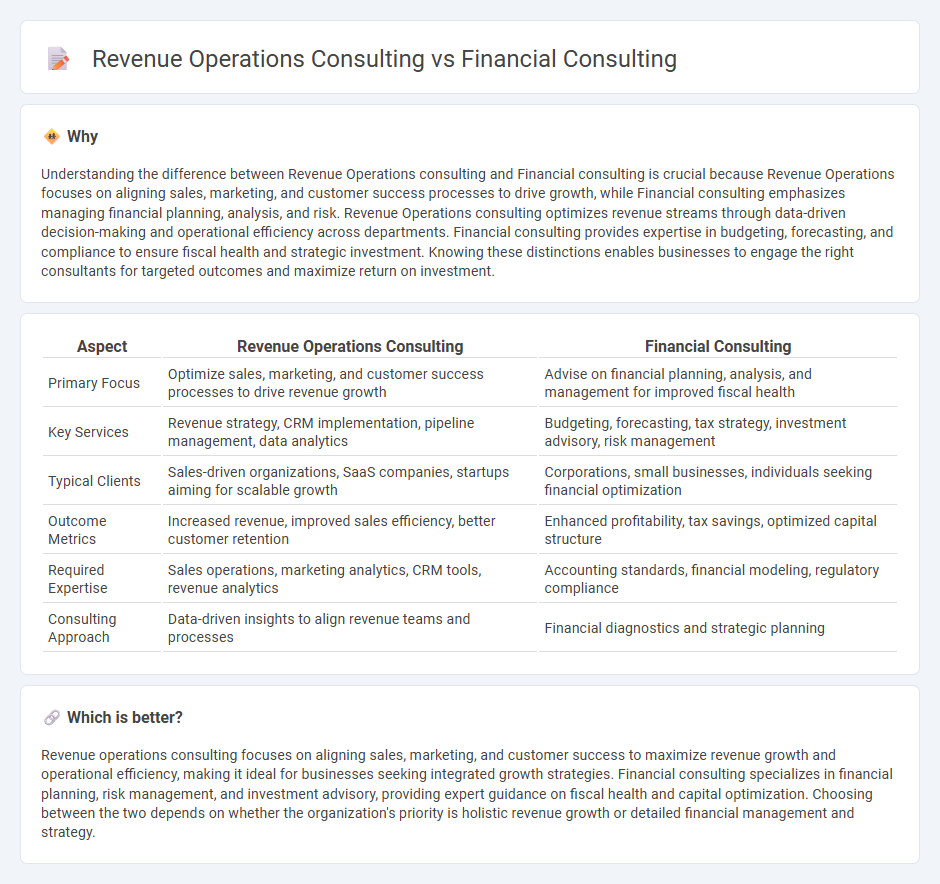

Understanding the difference between Revenue Operations consulting and Financial consulting is crucial because Revenue Operations focuses on aligning sales, marketing, and customer success processes to drive growth, while Financial consulting emphasizes managing financial planning, analysis, and risk. Revenue Operations consulting optimizes revenue streams through data-driven decision-making and operational efficiency across departments. Financial consulting provides expertise in budgeting, forecasting, and compliance to ensure fiscal health and strategic investment. Knowing these distinctions enables businesses to engage the right consultants for targeted outcomes and maximize return on investment.

Comparison Table

| Aspect | Revenue Operations Consulting | Financial Consulting |

|---|---|---|

| Primary Focus | Optimize sales, marketing, and customer success processes to drive revenue growth | Advise on financial planning, analysis, and management for improved fiscal health |

| Key Services | Revenue strategy, CRM implementation, pipeline management, data analytics | Budgeting, forecasting, tax strategy, investment advisory, risk management |

| Typical Clients | Sales-driven organizations, SaaS companies, startups aiming for scalable growth | Corporations, small businesses, individuals seeking financial optimization |

| Outcome Metrics | Increased revenue, improved sales efficiency, better customer retention | Enhanced profitability, tax savings, optimized capital structure |

| Required Expertise | Sales operations, marketing analytics, CRM tools, revenue analytics | Accounting standards, financial modeling, regulatory compliance |

| Consulting Approach | Data-driven insights to align revenue teams and processes | Financial diagnostics and strategic planning |

Which is better?

Revenue operations consulting focuses on aligning sales, marketing, and customer success to maximize revenue growth and operational efficiency, making it ideal for businesses seeking integrated growth strategies. Financial consulting specializes in financial planning, risk management, and investment advisory, providing expert guidance on fiscal health and capital optimization. Choosing between the two depends on whether the organization's priority is holistic revenue growth or detailed financial management and strategy.

Connection

Revenue operations consulting and financial consulting are interconnected through their shared goal of optimizing business performance by aligning revenue generation with financial management. Revenue operations consulting focuses on streamlining sales, marketing, and customer success processes to maximize revenue growth, while financial consulting provides insights into budgeting, forecasting, and financial planning to ensure sustainable profitability. Together, they enable organizations to implement data-driven strategies that enhance revenue predictability and financial efficiency.

Key Terms

**Financial Consulting:**

Financial consulting specializes in optimizing an organization's financial management, including budgeting, forecasting, tax strategies, and risk assessment to enhance overall fiscal health. It leverages expertise in accounting principles, regulatory compliance, and investment analysis to drive informed business decisions and improve profitability. Explore our financial consulting services to unlock tailored strategies that maximize your company's financial performance.

Financial Analysis

Financial consulting emphasizes in-depth financial analysis, including budgeting, forecasting, and investment strategies to optimize a company's financial health and performance. Revenue operations consulting integrates financial analysis with sales, marketing, and customer success data to streamline revenue growth and operational efficiency. Discover how these consulting approaches can enhance your business's financial decisions and revenue generation strategies.

Risk Management

Financial consulting emphasizes assessing financial risks, including market volatility, credit risk, and liquidity challenges, to safeguard an organization's assets and ensure regulatory compliance. Revenue operations consulting, on the other hand, concentrates on optimizing the revenue cycle by identifying operational risks in sales, marketing, and customer success processes that impact revenue predictability and growth. Explore more to understand how tailored risk management strategies in each consulting domain can drive sustainable business success.

Source and External Links

What Is a Financial Consultant? - A financial consultant is a type of advisor who analyzes your current financial situation and creates a strategic plan to help you reach your long-term goals, with services that may include investment recommendations, retirement planning, and--depending on their credentials--tax or insurance advice.

What Is a Financial Consultant and What Do They Do? - Financial consultants offer personalized advice to help clients build wealth, providing services such as financial planning, investment guidance, retirement and estate planning, and specialized support in areas like taxes or insurance, with the specific offerings depending on their certifications and expertise.

Plan and Invest with a Professional Advisor - At firms like Charles Schwab, a Financial Consultant acts as your go-to contact for creating tailored financial plans, offering guidance on investments, retirement, education savings, and life events, with access to a full range of financial services and specialists as needed, typically at no direct cost for the consultation itself.

dowidth.com

dowidth.com