Consulting services in prompt engineering advisory focus on optimizing AI prompt designs to enhance model efficiency and accuracy, leveraging expertise in natural language processing and machine learning algorithms. Financial advisory consulting provides strategic guidance on investment, risk management, and wealth optimization, tailored to individual or corporate financial goals. Explore how specialized consulting approaches can transform your business outcomes by diving deeper into prompt engineering and financial advisory services.

Why it is important

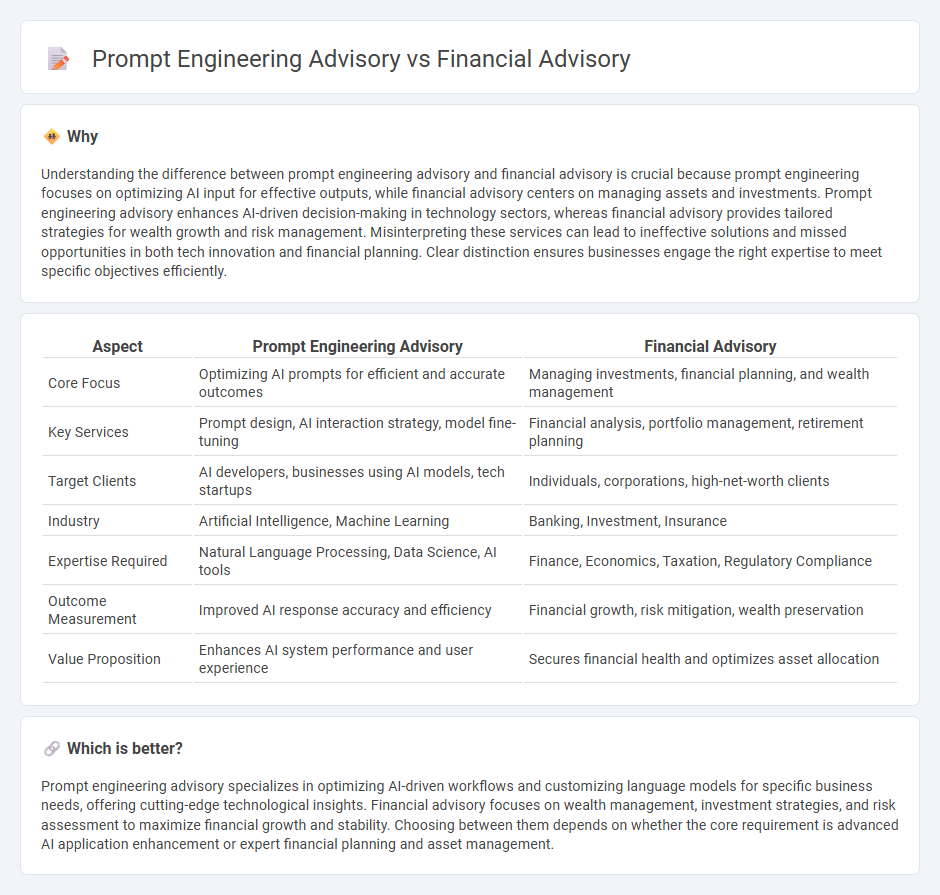

Understanding the difference between prompt engineering advisory and financial advisory is crucial because prompt engineering focuses on optimizing AI input for effective outputs, while financial advisory centers on managing assets and investments. Prompt engineering advisory enhances AI-driven decision-making in technology sectors, whereas financial advisory provides tailored strategies for wealth growth and risk management. Misinterpreting these services can lead to ineffective solutions and missed opportunities in both tech innovation and financial planning. Clear distinction ensures businesses engage the right expertise to meet specific objectives efficiently.

Comparison Table

| Aspect | Prompt Engineering Advisory | Financial Advisory |

|---|---|---|

| Core Focus | Optimizing AI prompts for efficient and accurate outcomes | Managing investments, financial planning, and wealth management |

| Key Services | Prompt design, AI interaction strategy, model fine-tuning | Financial analysis, portfolio management, retirement planning |

| Target Clients | AI developers, businesses using AI models, tech startups | Individuals, corporations, high-net-worth clients |

| Industry | Artificial Intelligence, Machine Learning | Banking, Investment, Insurance |

| Expertise Required | Natural Language Processing, Data Science, AI tools | Finance, Economics, Taxation, Regulatory Compliance |

| Outcome Measurement | Improved AI response accuracy and efficiency | Financial growth, risk mitigation, wealth preservation |

| Value Proposition | Enhances AI system performance and user experience | Secures financial health and optimizes asset allocation |

Which is better?

Prompt engineering advisory specializes in optimizing AI-driven workflows and customizing language models for specific business needs, offering cutting-edge technological insights. Financial advisory focuses on wealth management, investment strategies, and risk assessment to maximize financial growth and stability. Choosing between them depends on whether the core requirement is advanced AI application enhancement or expert financial planning and asset management.

Connection

Prompt engineering advisory enhances financial advisory by leveraging advanced AI-driven models to analyze complex market data and generate precise investment strategies. Financial advisory benefits from prompt engineering through improved risk assessment, portfolio optimization, and real-time decision support. Integrating these consultative services results in data-driven insights that elevate client financial outcomes and operational efficiency.

Key Terms

Financial advisory:

Financial advisory encompasses expert guidance on investments, tax planning, retirement strategies, and risk management to optimize clients' financial health. Professionals use data-driven analysis and market insights to tailor personalized financial plans aimed at wealth growth and sustainability. Explore more to understand how specialized financial advisory can transform your economic future.

Valuation

Financial advisory specializes in valuation by analyzing market trends, asset performance, and financial statements to determine the worth of businesses or investments. Prompt engineering advisory focuses on optimizing AI-generated outputs through iterative testing and refinement, ensuring accurate and high-value data interpretation for decision-making processes. Explore comprehensive strategies in both fields to enhance your valuation expertise.

Risk Assessment

Financial advisory risk assessment involves analyzing market trends, creditworthiness, and regulatory compliance to mitigate potential financial losses. Prompt engineering advisory focuses on evaluating input-output reliability, algorithmic biases, and data integrity to manage risks in AI-driven processes. Explore deeper insights into risk assessment methodologies for both advisory domains.

Source and External Links

Best Financial Advisors: Top Firms For 2025 | Bankrate - Bankrate offers guidance on choosing financial advisors, emphasizing understanding the type of relationship you want, how advisors get paid (fee-only versus commissions), and checking credentials like CFP or CFA to find trusted money advice tailored to your needs.

Ameriprise Financial: Financial Planning Advice and Financial ... - Ameriprise Financial specializes in personalized financial planning and advice, providing ongoing support through secure online tools and focusing on client-specific goals to help them stay on track toward their financial objectives.

NAPFA: The National Association of Personal Financial Advisors - NAPFA is a leading association of fee-only, fiduciary financial advisors who maintain high ethical and competency standards, offering comprehensive, client-centered financial planning that aligns solely with client interests.

dowidth.com

dowidth.com