Wellbeing auditing focuses on assessing employee health, satisfaction, and workplace culture, while financial auditing evaluates the accuracy of financial statements and compliance with regulations. Both audits provide critical insights but target different organizational dimensions: one emphasizing human capital and the other financial integrity. Discover how integrating wellbeing and financial audits can enhance overall business performance.

Why it is important

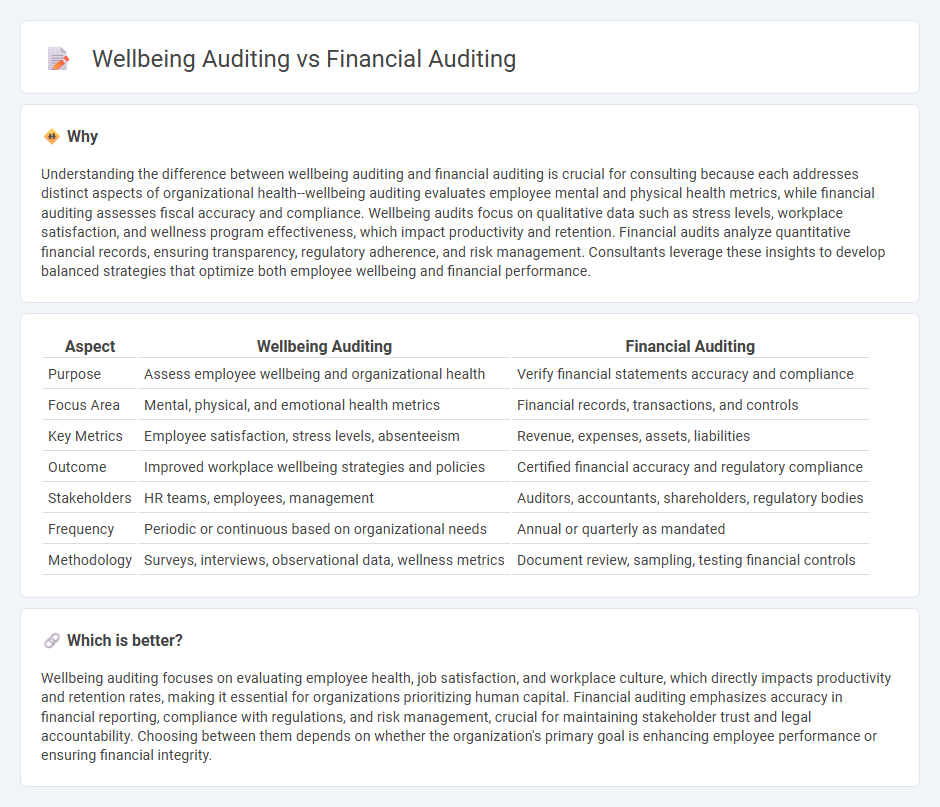

Understanding the difference between wellbeing auditing and financial auditing is crucial for consulting because each addresses distinct aspects of organizational health--wellbeing auditing evaluates employee mental and physical health metrics, while financial auditing assesses fiscal accuracy and compliance. Wellbeing audits focus on qualitative data such as stress levels, workplace satisfaction, and wellness program effectiveness, which impact productivity and retention. Financial audits analyze quantitative financial records, ensuring transparency, regulatory adherence, and risk management. Consultants leverage these insights to develop balanced strategies that optimize both employee wellbeing and financial performance.

Comparison Table

| Aspect | Wellbeing Auditing | Financial Auditing |

|---|---|---|

| Purpose | Assess employee wellbeing and organizational health | Verify financial statements accuracy and compliance |

| Focus Area | Mental, physical, and emotional health metrics | Financial records, transactions, and controls |

| Key Metrics | Employee satisfaction, stress levels, absenteeism | Revenue, expenses, assets, liabilities |

| Outcome | Improved workplace wellbeing strategies and policies | Certified financial accuracy and regulatory compliance |

| Stakeholders | HR teams, employees, management | Auditors, accountants, shareholders, regulatory bodies |

| Frequency | Periodic or continuous based on organizational needs | Annual or quarterly as mandated |

| Methodology | Surveys, interviews, observational data, wellness metrics | Document review, sampling, testing financial controls |

Which is better?

Wellbeing auditing focuses on evaluating employee health, job satisfaction, and workplace culture, which directly impacts productivity and retention rates, making it essential for organizations prioritizing human capital. Financial auditing emphasizes accuracy in financial reporting, compliance with regulations, and risk management, crucial for maintaining stakeholder trust and legal accountability. Choosing between them depends on whether the organization's primary goal is enhancing employee performance or ensuring financial integrity.

Connection

Wellbeing auditing and financial auditing are interconnected through their shared focus on organizational health and sustainability, with wellbeing audits assessing employee mental and physical health, which directly impacts productivity and financial performance. Financial auditing evaluates fiscal accountability and resource allocation, ensuring investments in wellbeing programs generate measurable returns. Integrating these audits provides a comprehensive view of how employee wellbeing initiatives influence financial outcomes and long-term business success.

Key Terms

Compliance

Financial auditing primarily focuses on compliance with accounting standards, regulatory requirements, and accurate financial reporting to ensure transparency and prevent fraud. Wellbeing auditing assesses organizational practices related to employee health, safety, work-life balance, and mental health compliance with labor laws and wellness regulations. Explore the distinctions and benefits of each audit type to enhance your organization's compliance strategies.

Risk Assessment

Financial auditing centers on evaluating financial risk through thorough examination of accounting records, internal controls, and compliance with regulatory standards to ensure accuracy and prevent fraud. Wellbeing auditing assesses organizational risk by evaluating employee health, safety, and overall workplace environment factors that affect morale and productivity. Explore deeper insights into risk assessment methodologies in both financial and wellbeing audits here.

Employee Engagement

Financial auditing evaluates company records to ensure accuracy, compliance, and transparency, mainly focusing on fiscal performance and risk management. Wellbeing auditing centers on assessing employee engagement, workplace satisfaction, and mental health to enhance productivity and reduce turnover. Discover how integrating wellbeing audits with financial audits can foster a more resilient, motivated workforce.

Source and External Links

A Comprehensive Guide to Financial Audits - A financial audit evaluates an organization's financial statements to determine their accuracy and compliance, involving systematic reviews crucial for business transparency and stakeholder assurance.

Understanding Financial Audits: Importance and Benefits - Financial audits are systematic, independent examinations of financial records aimed at ensuring accuracy, regulatory compliance, and improving transparency to build stakeholder confidence.

Financial audit - Wikipedia - Financial audits provide reasonable assurance that financial statements fairly represent an organization's financial position, conducted according to international auditing standards to reduce risks of misstatements due to error or fraud.

dowidth.com

dowidth.com