Regenerative business models focus on restoring and enhancing natural systems while promoting long-term economic, social, and environmental health, going beyond traditional sustainability goals. ESG integration prioritizes environmental, social, and governance criteria within business strategies to manage risks and create value for stakeholders. Explore how consulting can guide organizations in adopting regenerative practices alongside effective ESG frameworks.

Why it is important

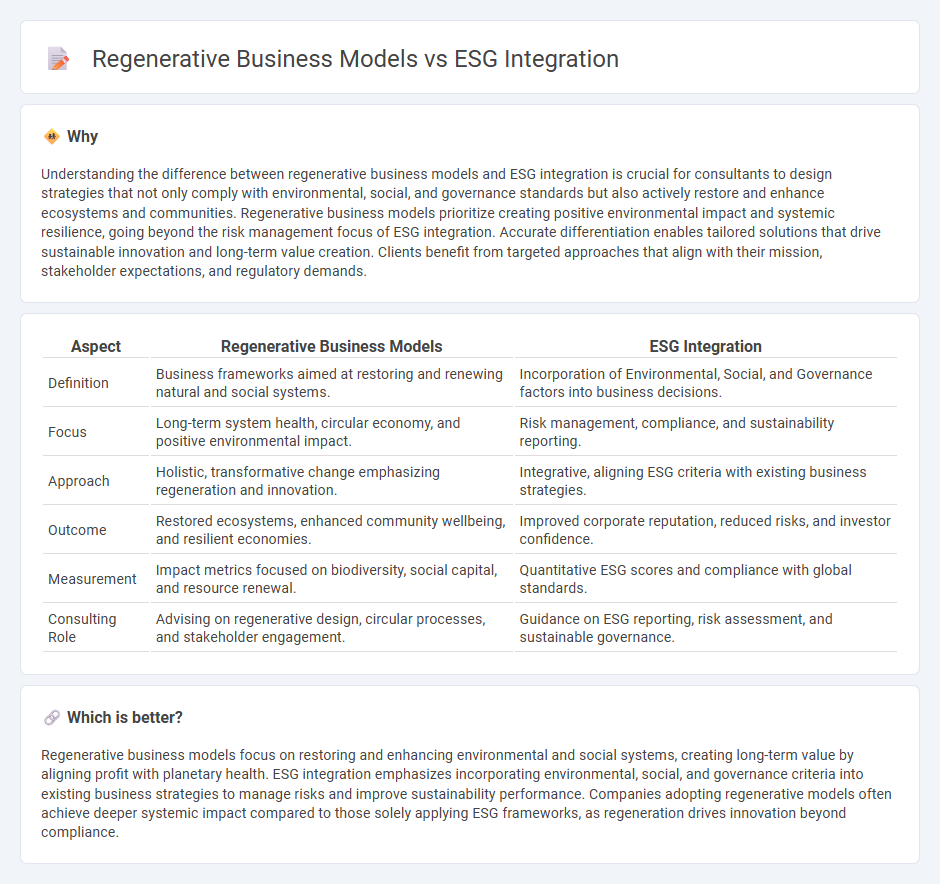

Understanding the difference between regenerative business models and ESG integration is crucial for consultants to design strategies that not only comply with environmental, social, and governance standards but also actively restore and enhance ecosystems and communities. Regenerative business models prioritize creating positive environmental impact and systemic resilience, going beyond the risk management focus of ESG integration. Accurate differentiation enables tailored solutions that drive sustainable innovation and long-term value creation. Clients benefit from targeted approaches that align with their mission, stakeholder expectations, and regulatory demands.

Comparison Table

| Aspect | Regenerative Business Models | ESG Integration |

|---|---|---|

| Definition | Business frameworks aimed at restoring and renewing natural and social systems. | Incorporation of Environmental, Social, and Governance factors into business decisions. |

| Focus | Long-term system health, circular economy, and positive environmental impact. | Risk management, compliance, and sustainability reporting. |

| Approach | Holistic, transformative change emphasizing regeneration and innovation. | Integrative, aligning ESG criteria with existing business strategies. |

| Outcome | Restored ecosystems, enhanced community wellbeing, and resilient economies. | Improved corporate reputation, reduced risks, and investor confidence. |

| Measurement | Impact metrics focused on biodiversity, social capital, and resource renewal. | Quantitative ESG scores and compliance with global standards. |

| Consulting Role | Advising on regenerative design, circular processes, and stakeholder engagement. | Guidance on ESG reporting, risk assessment, and sustainable governance. |

Which is better?

Regenerative business models focus on restoring and enhancing environmental and social systems, creating long-term value by aligning profit with planetary health. ESG integration emphasizes incorporating environmental, social, and governance criteria into existing business strategies to manage risks and improve sustainability performance. Companies adopting regenerative models often achieve deeper systemic impact compared to those solely applying ESG frameworks, as regeneration drives innovation beyond compliance.

Connection

Regenerative business models prioritize restoring ecosystems and social systems while creating economic value, directly aligning with Environmental, Social, and Governance (ESG) criteria that emphasize sustainable and ethical practices. Integrating ESG into consulting frameworks drives companies to adopt regenerative approaches, enhancing long-term resilience and stakeholder trust. This synergy fosters a transition from linear consumption to circular economy principles, promoting innovation and holistic impact measurement.

Key Terms

Sustainability Metrics

ESG integration emphasizes measuring environmental, social, and governance factors to mitigate risks and improve corporate accountability, utilizing sustainability metrics like carbon footprint, water usage, and social impact scores. Regenerative business models go beyond sustainability by actively restoring and revitalizing ecosystems, focusing on circular economy principles and enhanced biodiversity metrics to create long-term value. Discover how aligning ESG practices with regenerative strategies can transform sustainability efforts and drive innovation.

Impact Measurement

ESG integration emphasizes assessing environmental, social, and governance factors to manage risks and drive sustainable business practices, using standardized impact measurement frameworks like SASB or GRI. Regenerative business models aim to restore and enhance natural and social systems, going beyond sustainability by creating positive impacts through circular economy principles and biomimicry, requiring innovative metrics such as the Regenerative Effectiveness Metric (REM). Explore how impact measurement evolves from ESG compliance to regenerative value creation for deeper business transformation.

Value Creation

ESG integration emphasizes aligning environmental, social, and governance criteria with existing business operations to enhance risk management and stakeholder trust. Regenerative business models prioritize restoring and regenerating natural and social systems, creating long-term value through positive impact beyond conventional sustainability practices. Explore how these approaches redefine value creation and drive resilient growth.

Source and External Links

The board's guide to ESG integration - ESG integration is the process of using ESG data to inform investment decisions and embedding ESG into corporate strategy, requiring a company-wide, robust approach rather than siloed initiatives.

ESG integration - Zurich defines ESG integration as a four-part approach involving training, data, process integration, and active ownership to combine financial and sustainability goals for long-term risk-adjusted returns.

ESG integration in listed equity: A technical guide - The PRI defines ESG integration as including ESG factors in investment analysis through a governance-supported five-stage process to better manage risks and improve returns in listed equity investing.

dowidth.com

dowidth.com