Due diligence deep dive involves a comprehensive assessment of financial, legal, and operational aspects to identify risks and validate business value during mergers and acquisitions. Cost reduction analysis focuses on identifying inefficiencies and implementing strategies to lower expenses, improve profitability, and optimize resource allocation. Explore our detailed insights to understand which consulting approach best suits your organizational goals.

Why it is important

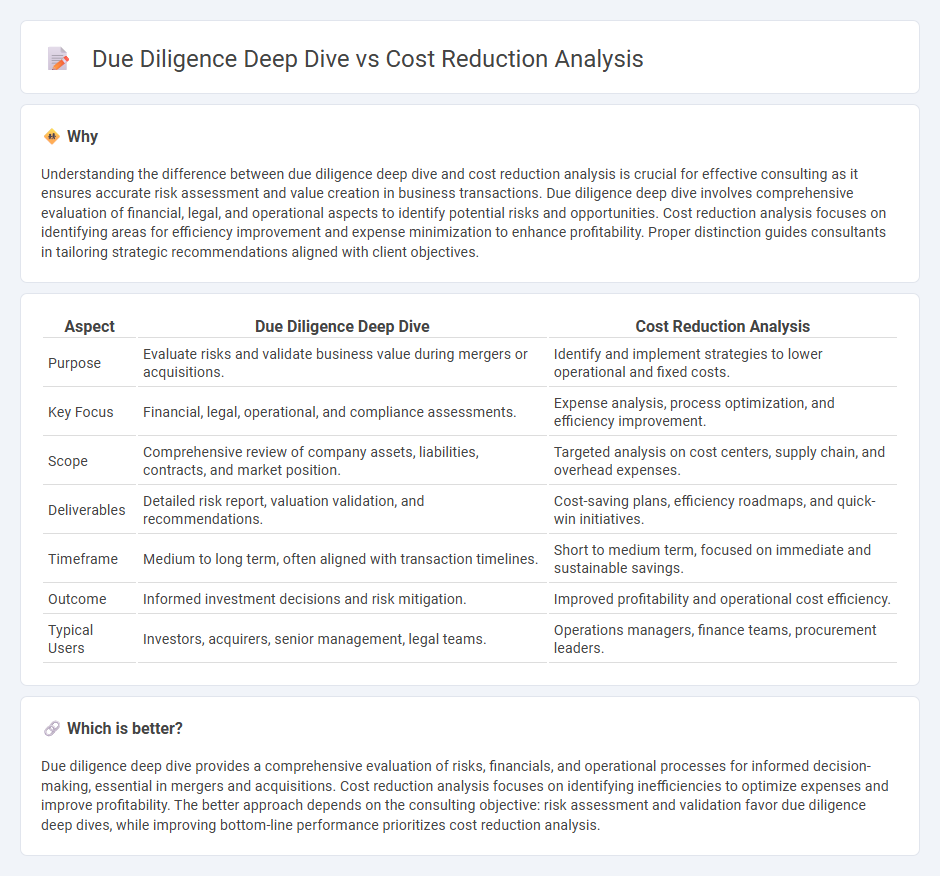

Understanding the difference between due diligence deep dive and cost reduction analysis is crucial for effective consulting as it ensures accurate risk assessment and value creation in business transactions. Due diligence deep dive involves comprehensive evaluation of financial, legal, and operational aspects to identify potential risks and opportunities. Cost reduction analysis focuses on identifying areas for efficiency improvement and expense minimization to enhance profitability. Proper distinction guides consultants in tailoring strategic recommendations aligned with client objectives.

Comparison Table

| Aspect | Due Diligence Deep Dive | Cost Reduction Analysis |

|---|---|---|

| Purpose | Evaluate risks and validate business value during mergers or acquisitions. | Identify and implement strategies to lower operational and fixed costs. |

| Key Focus | Financial, legal, operational, and compliance assessments. | Expense analysis, process optimization, and efficiency improvement. |

| Scope | Comprehensive review of company assets, liabilities, contracts, and market position. | Targeted analysis on cost centers, supply chain, and overhead expenses. |

| Deliverables | Detailed risk report, valuation validation, and recommendations. | Cost-saving plans, efficiency roadmaps, and quick-win initiatives. |

| Timeframe | Medium to long term, often aligned with transaction timelines. | Short to medium term, focused on immediate and sustainable savings. |

| Outcome | Informed investment decisions and risk mitigation. | Improved profitability and operational cost efficiency. |

| Typical Users | Investors, acquirers, senior management, legal teams. | Operations managers, finance teams, procurement leaders. |

Which is better?

Due diligence deep dive provides a comprehensive evaluation of risks, financials, and operational processes for informed decision-making, essential in mergers and acquisitions. Cost reduction analysis focuses on identifying inefficiencies to optimize expenses and improve profitability. The better approach depends on the consulting objective: risk assessment and validation favor due diligence deep dives, while improving bottom-line performance prioritizes cost reduction analysis.

Connection

Due diligence deep dive systematically evaluates a company's financial, operational, and legal aspects to identify potential risks and inefficiencies. Cost reduction analysis leverages insights from due diligence to pinpoint areas where expenses can be minimized without compromising quality or performance. Together, they enable consulting professionals to craft targeted strategies that enhance profitability and operational efficiency.

Key Terms

**Cost Reduction Analysis:**

Cost Reduction Analysis systematically identifies areas to lower operational expenses by examining procurement, labor, and process efficiencies, targeting both immediate savings and sustainable financial improvements. Unlike Due Diligence Deep Dive, which provides comprehensive risk and value assessments for transactions, Cost Reduction Analysis centers exclusively on enhancing profitability through expense management. Explore detailed strategies and tools for effective Cost Reduction Analysis to maximize your organization's financial performance.

Operational Efficiency

Cost reduction analysis targets identifying specific expense-cutting opportunities to enhance operational efficiency, focusing on streamlining processes and eliminating waste. Due diligence deep dive provides a comprehensive assessment of operational workflows, risks, and capabilities to validate business viability and uncover hidden challenges. Discover more about optimizing operational efficiency through detailed cost and due diligence evaluations.

Process Optimization

Cost reduction analysis zeroes in on identifying inefficiencies within operational workflows to streamline expenses and boost profitability. Due diligence deep dives assess comprehensive process integrity, uncovering risks and compliance gaps critical for informed investment decisions. Explore how these methodologies complement each other in achieving sustainable process optimization.

Source and External Links

What is a Cost Reduction Analysis? - A cost reduction analysis is a systematic process of identifying, analyzing, and implementing measures to decrease a company's costs while maintaining product or service quality, ultimately improving profitability and competitiveness.

Cost reduction strategies: A guide for businesses - Conducting a cost reduction analysis involves gathering detailed expense data, categorizing costs, identifying cost drivers, benchmarking against industry standards, and applying cost-benefit analyses to prioritize actionable savings strategies.

15 Proven Cost Reduction Strategies That Drive Real Results - Effective cost reduction can include strategies such as renegotiating vendor contracts to save an average of 9.2% on contract value, consolidating suppliers to simplify operations and reduce costs, and implementing technological tools like e-procurement software.

dowidth.com

dowidth.com