Scenario planning explores multiple future possibilities to prepare adaptive strategies, focusing on external uncertainties and trends impacting business environments. Business modeling defines the structure, value propositions, and revenue mechanisms of an enterprise, emphasizing operational and financial frameworks for sustainable growth. Discover how integrating scenario planning and business modeling can enhance strategic decision-making and resilience.

Why it is important

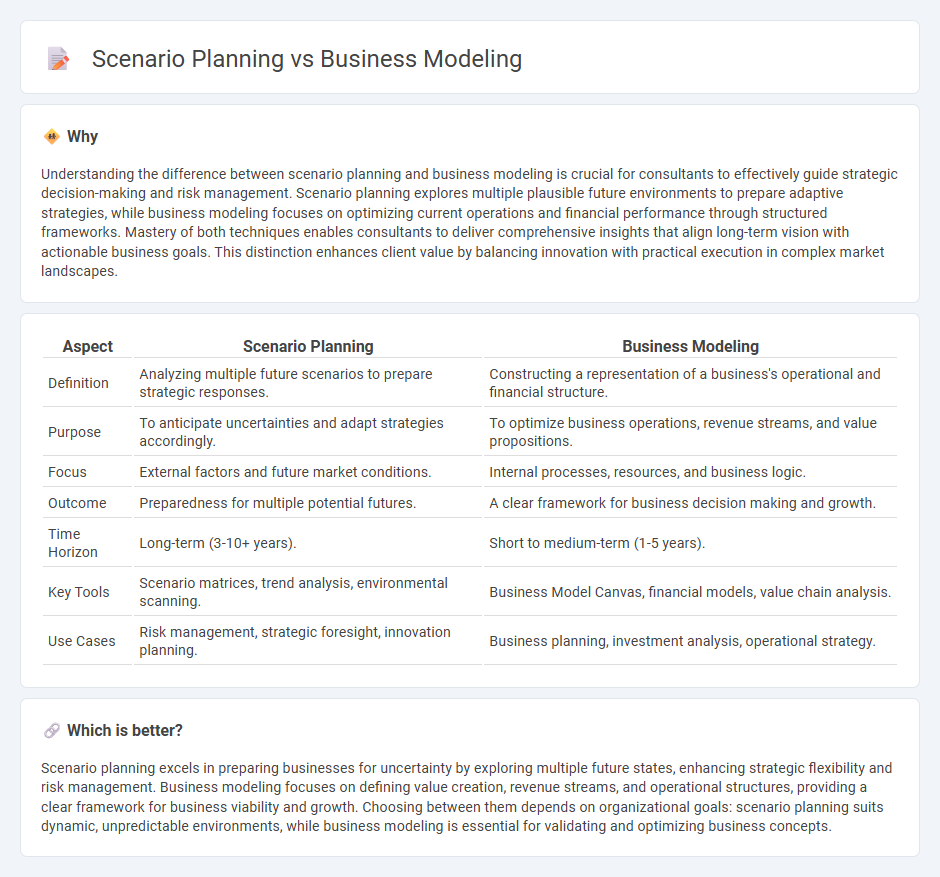

Understanding the difference between scenario planning and business modeling is crucial for consultants to effectively guide strategic decision-making and risk management. Scenario planning explores multiple plausible future environments to prepare adaptive strategies, while business modeling focuses on optimizing current operations and financial performance through structured frameworks. Mastery of both techniques enables consultants to deliver comprehensive insights that align long-term vision with actionable business goals. This distinction enhances client value by balancing innovation with practical execution in complex market landscapes.

Comparison Table

| Aspect | Scenario Planning | Business Modeling |

|---|---|---|

| Definition | Analyzing multiple future scenarios to prepare strategic responses. | Constructing a representation of a business's operational and financial structure. |

| Purpose | To anticipate uncertainties and adapt strategies accordingly. | To optimize business operations, revenue streams, and value propositions. |

| Focus | External factors and future market conditions. | Internal processes, resources, and business logic. |

| Outcome | Preparedness for multiple potential futures. | A clear framework for business decision making and growth. |

| Time Horizon | Long-term (3-10+ years). | Short to medium-term (1-5 years). |

| Key Tools | Scenario matrices, trend analysis, environmental scanning. | Business Model Canvas, financial models, value chain analysis. |

| Use Cases | Risk management, strategic foresight, innovation planning. | Business planning, investment analysis, operational strategy. |

Which is better?

Scenario planning excels in preparing businesses for uncertainty by exploring multiple future states, enhancing strategic flexibility and risk management. Business modeling focuses on defining value creation, revenue streams, and operational structures, providing a clear framework for business viability and growth. Choosing between them depends on organizational goals: scenario planning suits dynamic, unpredictable environments, while business modeling is essential for validating and optimizing business concepts.

Connection

Scenario planning and business modeling are interconnected as both tools help organizations anticipate future uncertainties and make strategic decisions. Scenario planning generates multiple plausible future conditions, which business models then quantify and simulate to evaluate financial and operational impacts. This integration enhances strategic agility by enabling firms to test assumptions and optimize resource allocation under different market environments.

Key Terms

Value Proposition (Business Modeling)

Business modeling centers on defining and refining the value proposition to clearly articulate how products or services solve customer problems and deliver specific benefits. This approach maps out key components such as customer segments, revenue streams, and cost structures to create a comprehensive blueprint for sustainable competitive advantage. Explore detailed frameworks and examples to enhance your understanding of effective value proposition design.

Assumptions Analysis (Scenario Planning)

Assumptions Analysis in scenario planning involves systematically identifying and testing critical assumptions that underpin business strategies to anticipate potential risks and opportunities. Unlike business modeling, which primarily quantifies outcomes based on fixed variables, scenario planning explores a range of plausible futures by challenging these assumptions to enhance strategic flexibility. Discover how mastering Assumptions Analysis can improve decision-making and resilience in dynamic markets.

Revenue Streams (Business Modeling)

Business modeling highlights Revenue Streams by identifying diverse sources of income such as product sales, subscription fees, and licensing, enabling clear financial forecasting and strategic prioritization. Scenario planning, however, explores how different market conditions impact these Revenue Streams, preparing businesses to adapt their income strategies under varied economic, competitive, or regulatory scenarios. Discover how integrating these approaches can optimize revenue resilience and growth.

Source and External Links

Business Model: What It Is and How To Define Yours - A business model defines a company's value proposition, target customers, solutions, pricing, and growth, and can be built through 10 steps including identifying the market, defining the problem, creating pricing strategy, and validating the model for profitability and challenges.

Business model - A business model describes how an organization creates, delivers, and captures value economically or otherwise, encompassing organizational structures, processes, offerings, and strategies, often serving as a framework for innovation and growth.

What is a Business Model? - A business model is a simplified representation of how a company makes money, often described using nine building blocks that outline the core aspects of how a business operates and generates revenue.

dowidth.com

dowidth.com