Zero-based budgeting requires justifying every expense from scratch, aligning resources directly with strategic priorities. Bottom-up budgeting aggregates detailed input from individual departments to form a comprehensive financial plan. Explore the key differences and strategic applications of these budgeting approaches to optimize your consulting practice.

Why it is important

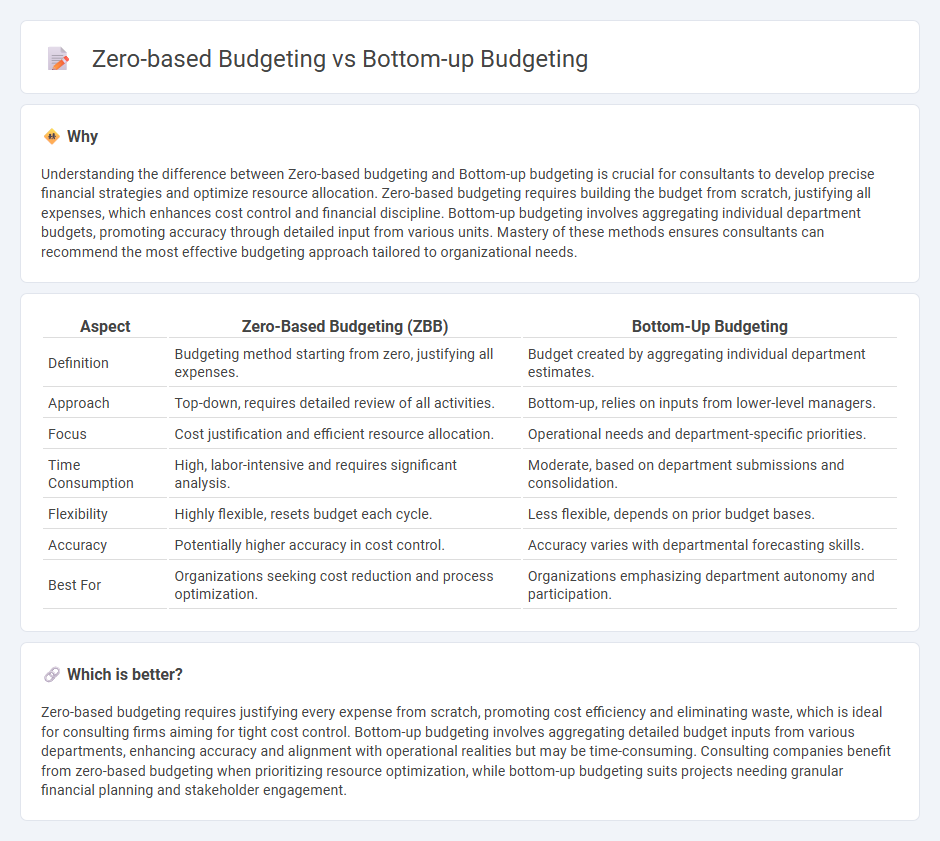

Understanding the difference between Zero-based budgeting and Bottom-up budgeting is crucial for consultants to develop precise financial strategies and optimize resource allocation. Zero-based budgeting requires building the budget from scratch, justifying all expenses, which enhances cost control and financial discipline. Bottom-up budgeting involves aggregating individual department budgets, promoting accuracy through detailed input from various units. Mastery of these methods ensures consultants can recommend the most effective budgeting approach tailored to organizational needs.

Comparison Table

| Aspect | Zero-Based Budgeting (ZBB) | Bottom-Up Budgeting |

|---|---|---|

| Definition | Budgeting method starting from zero, justifying all expenses. | Budget created by aggregating individual department estimates. |

| Approach | Top-down, requires detailed review of all activities. | Bottom-up, relies on inputs from lower-level managers. |

| Focus | Cost justification and efficient resource allocation. | Operational needs and department-specific priorities. |

| Time Consumption | High, labor-intensive and requires significant analysis. | Moderate, based on department submissions and consolidation. |

| Flexibility | Highly flexible, resets budget each cycle. | Less flexible, depends on prior budget bases. |

| Accuracy | Potentially higher accuracy in cost control. | Accuracy varies with departmental forecasting skills. |

| Best For | Organizations seeking cost reduction and process optimization. | Organizations emphasizing department autonomy and participation. |

Which is better?

Zero-based budgeting requires justifying every expense from scratch, promoting cost efficiency and eliminating waste, which is ideal for consulting firms aiming for tight cost control. Bottom-up budgeting involves aggregating detailed budget inputs from various departments, enhancing accuracy and alignment with operational realities but may be time-consuming. Consulting companies benefit from zero-based budgeting when prioritizing resource optimization, while bottom-up budgeting suits projects needing granular financial planning and stakeholder engagement.

Connection

Zero-based budgeting and bottom-up budgeting intersect in their detailed approach to financial planning, as both require building budgets from the ground up. Zero-based budgeting mandates justification of every expense starting from zero, closely aligning with bottom-up budgeting's focus on aggregating input from individual departments. This connection enhances accuracy and accountability by involving granular analysis and organizational participation in budget formulation.

Key Terms

Cost Allocation

Bottom-up budgeting allocates costs by aggregating detailed expenses from individual departments, ensuring each unit's operational needs are accurately funded based on historical data and specific requirements. Zero-based budgeting requires every cost allocation to be justified from scratch each cycle, emphasizing cost efficiency and eliminating unnecessary expenditures regardless of previous budgets. Explore more about how these methodologies impact financial strategy and resource optimization.

Expense Justification

Bottom-up budgeting allocates expenses by aggregating detailed inputs from lower organizational levels, ensuring alignment with operational needs but often based on historical costs. Zero-based budgeting requires every expense to be justified from scratch, promoting cost efficiency and resource optimization by eliminating outdated or unnecessary expenditures. Explore more to understand how each method impacts financial control and organizational strategy.

Budget Baseline

Bottom-up budgeting focuses on creating the budget starting from individual departments or units, aggregating their financial needs to establish a realistic budget baseline based on actual operational requirements. Zero-based budgeting resets the budget to zero each period, requiring justification for all expenses to build the budget baseline from scratch, ensuring resource allocation aligns tightly with current priorities and goals. Explore further to understand which budgeting approach best optimizes your organization's financial planning.

Source and External Links

Top-Down versus Bottom-Up Budgeting - Bottom-up budgeting is a method where budgets are first created by individual departments, detailing their goals and project costs, then aggregated and submitted to senior management for review and approval, empowering departments with ownership of their planning process.

Bottom-Up Budgeting - Definition for Finance Leaders - This budgeting method starts at the department level where each unit lists its needs and estimated costs, which are then summed to form the organization's overall budget, relying on departmental managers' detailed input for accuracy.

Bottom-up budgeting: A short guide for finance leaders - Bottom-up budgeting flows information upward from employees at the departmental level, with departments conducting cost analyses and then submitting budgets that are reviewed and adjusted before final organization-wide publication.

dowidth.com

dowidth.com