Zero-based budgeting allocates resources from a zero base, requiring justification for all expenses, while activity-based budgeting focuses on budgeting based on activities that drive costs. Both methods enhance financial efficiency but differ in approach: zero-based budgeting emphasizes cost justification, whereas activity-based budgeting links budgets to operational activities. Discover which budgeting strategy aligns best with your organizational goals.

Why it is important

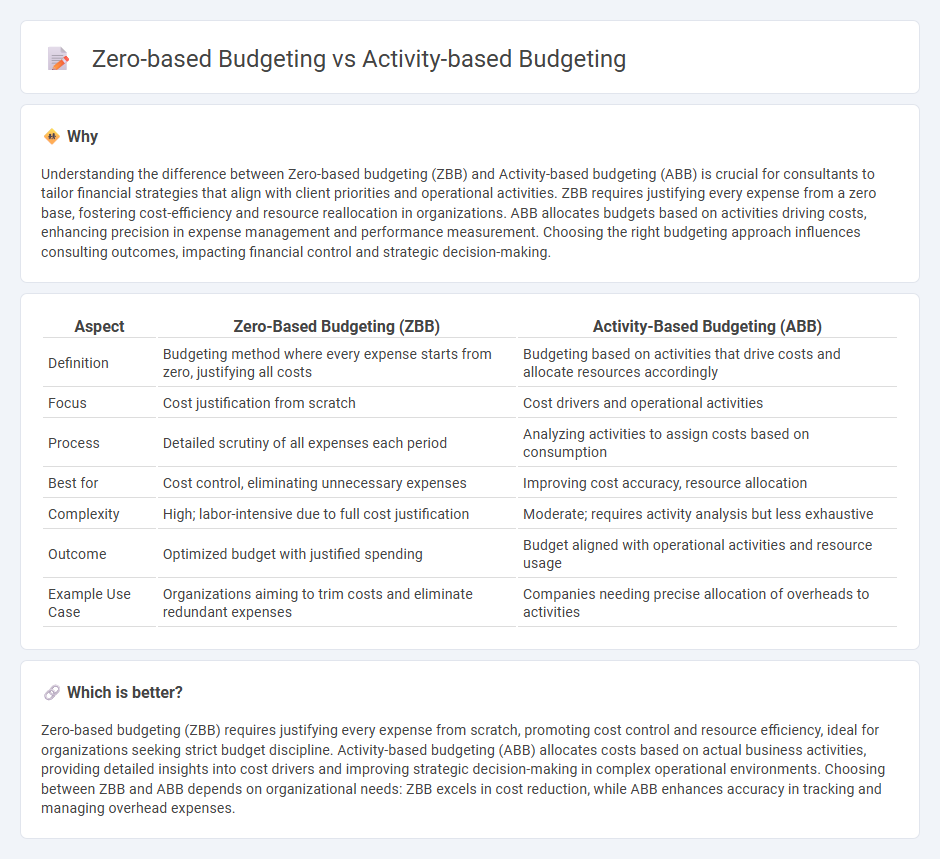

Understanding the difference between Zero-based budgeting (ZBB) and Activity-based budgeting (ABB) is crucial for consultants to tailor financial strategies that align with client priorities and operational activities. ZBB requires justifying every expense from a zero base, fostering cost-efficiency and resource reallocation in organizations. ABB allocates budgets based on activities driving costs, enhancing precision in expense management and performance measurement. Choosing the right budgeting approach influences consulting outcomes, impacting financial control and strategic decision-making.

Comparison Table

| Aspect | Zero-Based Budgeting (ZBB) | Activity-Based Budgeting (ABB) |

|---|---|---|

| Definition | Budgeting method where every expense starts from zero, justifying all costs | Budgeting based on activities that drive costs and allocate resources accordingly |

| Focus | Cost justification from scratch | Cost drivers and operational activities |

| Process | Detailed scrutiny of all expenses each period | Analyzing activities to assign costs based on consumption |

| Best for | Cost control, eliminating unnecessary expenses | Improving cost accuracy, resource allocation |

| Complexity | High; labor-intensive due to full cost justification | Moderate; requires activity analysis but less exhaustive |

| Outcome | Optimized budget with justified spending | Budget aligned with operational activities and resource usage |

| Example Use Case | Organizations aiming to trim costs and eliminate redundant expenses | Companies needing precise allocation of overheads to activities |

Which is better?

Zero-based budgeting (ZBB) requires justifying every expense from scratch, promoting cost control and resource efficiency, ideal for organizations seeking strict budget discipline. Activity-based budgeting (ABB) allocates costs based on actual business activities, providing detailed insights into cost drivers and improving strategic decision-making in complex operational environments. Choosing between ZBB and ABB depends on organizational needs: ZBB excels in cost reduction, while ABB enhances accuracy in tracking and managing overhead expenses.

Connection

Zero-based budgeting and Activity-based budgeting are connected through their focus on detailed cost analysis to enhance financial efficiency in consulting projects. Zero-based budgeting requires starting from a "zero base," justifying all expenses, while Activity-based budgeting allocates costs based on actual activities driving resource consumption. Both methodologies support consultants in optimizing budget allocation by identifying and prioritizing value-driving activities and eliminating unnecessary expenditures.

Key Terms

Cost Allocation

Activity-based budgeting allocates costs by identifying activities that drive expenses and assigning budget based on these cost drivers, improving precision in resource distribution. Zero-based budgeting requires each expense to be justified from scratch, promoting cost efficiency by eliminating unnecessary expenditures without historical bias. Explore detailed comparisons to optimize your budgeting strategy and enhance financial performance.

Justification of Expenses

Activity-based budgeting allocates funds based on the cost of specific activities necessary to achieve organizational goals, ensuring expenses are directly tied to operational tasks. Zero-based budgeting requires each expense to be justified from scratch every period, regardless of previous budgets, promoting rigorous evaluation and elimination of unnecessary costs. Explore detailed comparisons to understand which budgeting method optimizes your financial planning and expense justification.

Budget Baseline

Activity-based budgeting allocates resources by analyzing specific activities driving costs, ensuring a detailed alignment of budget with operational needs, while zero-based budgeting requires building the entire budget from scratch, justifying every expense without relying on previous budgets as baselines. The budget baseline in activity-based budgeting is established through activity cost drivers and performance metrics, providing a more precise and dynamic foundation. Explore comprehensive insights to understand the strategic advantages of each budgeting method and optimize your financial planning.

Source and External Links

Activity-based Budgeting (ABB) Explained (Pros, Cons + Generator) - Activity-based budgeting is a detailed budgeting method that identifies business activities, estimates activity levels, and calculates total costs by multiplying cost per unit of activity by expected activity units.

What is activity-based budgeting (ABB)? - Prophix - ABB allocates resources based on identified activities and cost drivers, monitoring performance to ensure budgeting aligns with company goals and allows for proactive adjustments.

What is activity-based budgeting and how it can help trim costs - BILL - Activity-based budgeting involves analyzing cost drivers relative to activities, estimating costs per activity, and multiplying by activity levels to predict expenses, ideal for companies with financial data or undergoing changes.

dowidth.com

dowidth.com