Peer-to-peer payments enable individuals to transfer funds instantly using mobile apps or digital wallets, offering convenience and speed for personal transactions. Wire transfers, typically executed through banks, provide secure and reliable funds transfer for larger or international transactions, albeit with longer processing times and higher fees. Explore the key differences and benefits to determine the best payment method for your financial needs.

Why it is important

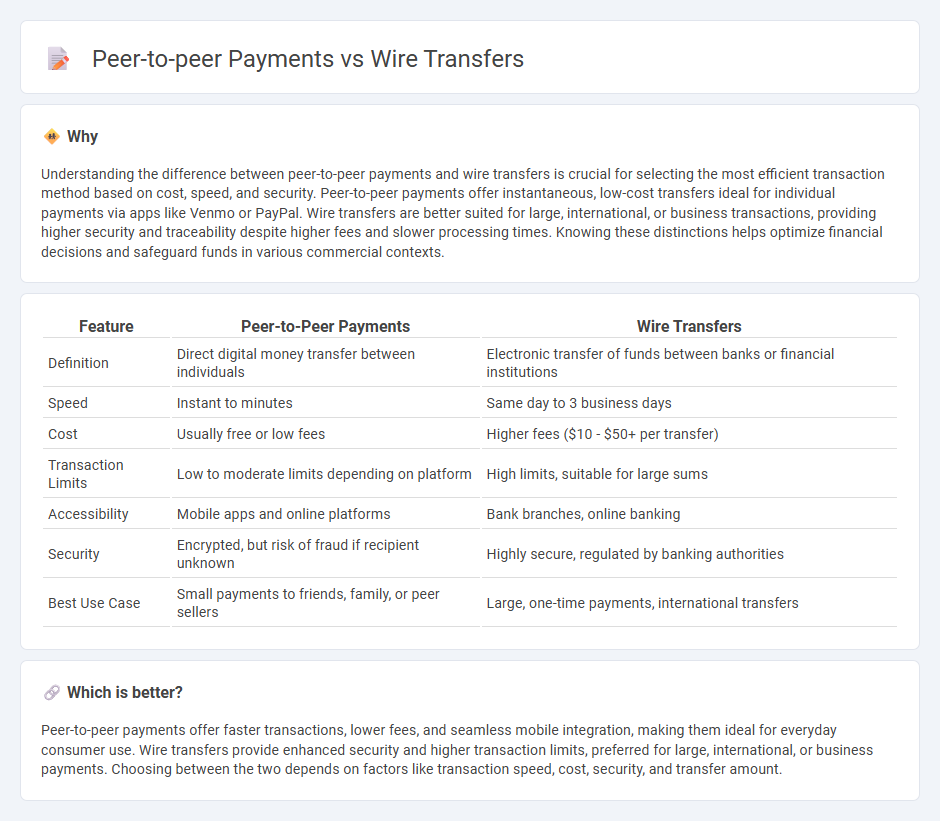

Understanding the difference between peer-to-peer payments and wire transfers is crucial for selecting the most efficient transaction method based on cost, speed, and security. Peer-to-peer payments offer instantaneous, low-cost transfers ideal for individual payments via apps like Venmo or PayPal. Wire transfers are better suited for large, international, or business transactions, providing higher security and traceability despite higher fees and slower processing times. Knowing these distinctions helps optimize financial decisions and safeguard funds in various commercial contexts.

Comparison Table

| Feature | Peer-to-Peer Payments | Wire Transfers |

|---|---|---|

| Definition | Direct digital money transfer between individuals | Electronic transfer of funds between banks or financial institutions |

| Speed | Instant to minutes | Same day to 3 business days |

| Cost | Usually free or low fees | Higher fees ($10 - $50+ per transfer) |

| Transaction Limits | Low to moderate limits depending on platform | High limits, suitable for large sums |

| Accessibility | Mobile apps and online platforms | Bank branches, online banking |

| Security | Encrypted, but risk of fraud if recipient unknown | Highly secure, regulated by banking authorities |

| Best Use Case | Small payments to friends, family, or peer sellers | Large, one-time payments, international transfers |

Which is better?

Peer-to-peer payments offer faster transactions, lower fees, and seamless mobile integration, making them ideal for everyday consumer use. Wire transfers provide enhanced security and higher transaction limits, preferred for large, international, or business payments. Choosing between the two depends on factors like transaction speed, cost, security, and transfer amount.

Connection

Peer-to-peer payments and wire transfers are connected by their function of enabling direct electronic money transfers between individuals or entities. Both methods utilize secure financial networks to facilitate quick movement of funds, though peer-to-peer payments typically offer faster transactions via mobile apps, while wire transfers are preferred for higher-value or international transfers due to their reliability and traceability. Integration of these payment systems enhances financial accessibility and efficiency in digital commerce.

Key Terms

Intermediary banks

Wire transfers often rely on intermediary banks to facilitate the movement of funds between institutions, especially in international transactions, which can increase processing time and fees. Peer-to-peer payments, however, typically bypass intermediary banks by using direct connections between users via mobile apps or online platforms, enabling faster and more cost-effective transactions. Discover how these differences impact transaction speed and cost by exploring more detailed comparisons.

Real-time settlement

Wire transfers typically take several hours to a few business days to settle due to bank processing times and intermediaries involved. Peer-to-peer payment platforms like Venmo, Zelle, and PayPal enable real-time or near-instantaneous fund transfers between users, enhancing convenience and liquidity. Explore how these settlement speeds impact your financial transactions and which method suits your needs best.

Digital wallets

Digital wallets streamline both wire transfers and peer-to-peer (P2P) payments by enabling instant access to funds and reducing transaction fees. Wire transfers typically involve banks and longer processing times, while P2P payments through digital wallets offer faster, user-friendly methods for direct money transfer between individuals. Explore our detailed guide to understand how digital wallets optimize these payment options for convenience and speed.

Source and External Links

SchoolsFirst FCU | Wire Transfer - Wire transfers are electronic funds transfers between people or institutions, commonly used for urgent payments like emergencies, down payments, or debt payoff; to initiate one, you provide sending and receiving bank details, including routing numbers and beneficiary info, with fees typically around $20 for domestic and $45 for international wires.

The ins and outs of wire transfers - Wire transfers electronically send money quickly and securely, favored for urgent or large transactions both domestically and internationally, usually completing the same day or within a few days, and require detailed recipient banking information.

Differences Between Wire Transfer and Bank Transfers - Wire transfers offer faster processing times than ACH transfers, often delivering funds the same or next business day, are more costly especially internationally, and can send money both domestically and internationally, unlike standard bank transfers that are usually domestic only.

dowidth.com

dowidth.com