Native checkout streamlines the buying process by keeping customers within the merchant's website, enhancing user experience and reducing cart abandonment rates. Third-party payment gateways offer robust security features and support for multiple payment methods but often redirect users away from the site, which may disrupt the purchase flow. Explore the benefits and trade-offs of each option to optimize your e-commerce strategy.

Why it is important

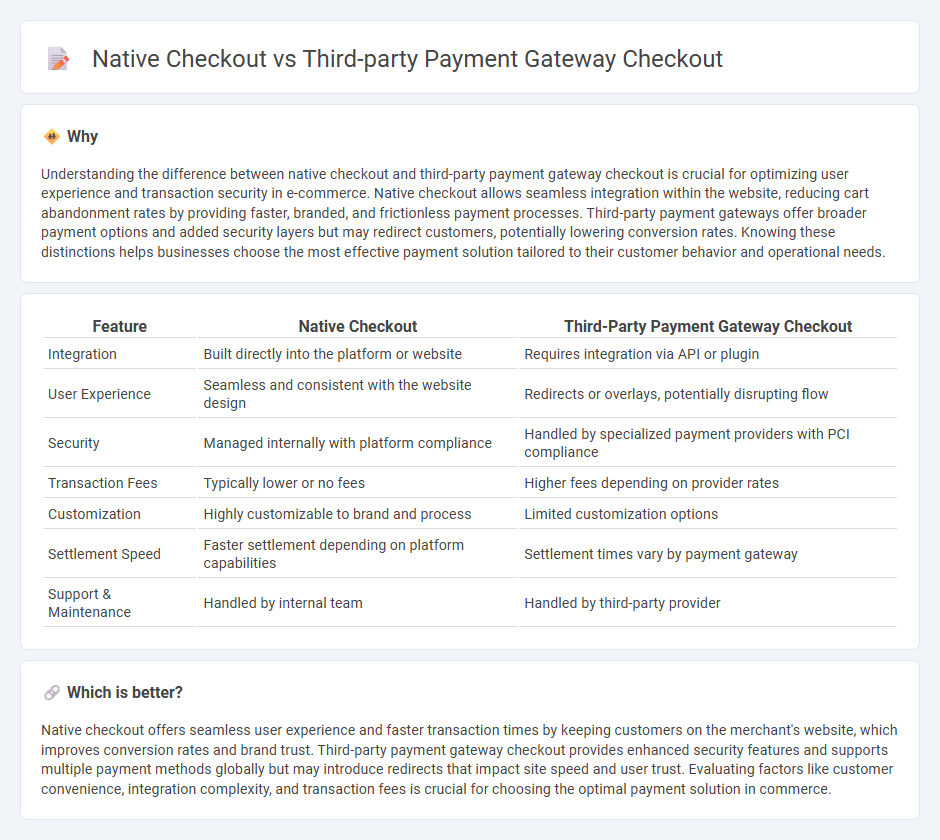

Understanding the difference between native checkout and third-party payment gateway checkout is crucial for optimizing user experience and transaction security in e-commerce. Native checkout allows seamless integration within the website, reducing cart abandonment rates by providing faster, branded, and frictionless payment processes. Third-party payment gateways offer broader payment options and added security layers but may redirect customers, potentially lowering conversion rates. Knowing these distinctions helps businesses choose the most effective payment solution tailored to their customer behavior and operational needs.

Comparison Table

| Feature | Native Checkout | Third-Party Payment Gateway Checkout |

|---|---|---|

| Integration | Built directly into the platform or website | Requires integration via API or plugin |

| User Experience | Seamless and consistent with the website design | Redirects or overlays, potentially disrupting flow |

| Security | Managed internally with platform compliance | Handled by specialized payment providers with PCI compliance |

| Transaction Fees | Typically lower or no fees | Higher fees depending on provider rates |

| Customization | Highly customizable to brand and process | Limited customization options |

| Settlement Speed | Faster settlement depending on platform capabilities | Settlement times vary by payment gateway |

| Support & Maintenance | Handled by internal team | Handled by third-party provider |

Which is better?

Native checkout offers seamless user experience and faster transaction times by keeping customers on the merchant's website, which improves conversion rates and brand trust. Third-party payment gateway checkout provides enhanced security features and supports multiple payment methods globally but may introduce redirects that impact site speed and user trust. Evaluating factors like customer convenience, integration complexity, and transaction fees is crucial for choosing the optimal payment solution in commerce.

Connection

Native checkout and third-party payment gateway checkout connect through seamless integration of payment APIs, enabling online stores to offer diverse payment options while ensuring secure transaction processing. Native checkout improves user experience by streamlining payments within the merchant's platform, whereas third-party gateways provide robust fraud protection and compliance with global payment standards like PCI DSS. The combination enhances conversion rates, reduces cart abandonment, and supports multiple currencies and payment methods for international commerce.

Key Terms

User Experience

Third-party payment gateway checkout often offers users a familiar and secure environment, fostering trust and reducing friction during transactions with features like saved payment methods and fraud protection. Native checkout integrates seamlessly into the brand's interface, providing a faster, more cohesive user journey without redirecting customers, which can improve conversion rates. Explore more insights to determine the best checkout solution for optimizing your user experience and boosting sales.

Payment Security

Third-party payment gateway checkout offers robust fraud detection and encryption protocols managed by specialized security teams, reducing vulnerabilities during transaction processing. Native checkout solutions integrate directly with the merchant's platform, providing tighter control over data handling but requiring significant investment in security infrastructure to prevent breaches. Explore the key differences in payment security between these methods to choose the best option for your business.

Data Ownership

Native checkout processes transactions directly within the merchant's platform, ensuring full control and ownership of customer data, which enhances data security and compliance. Third-party payment gateway checkouts rely on external providers, transferring sensitive data handling and potentially limiting access to detailed customer insights. Explore the advantages of native checkout solutions to maximize data ownership and strengthen your e-commerce strategy.

Source and External Links

Understanding Shop Pay and third-party payments - Bankful - Third-party payment gateways can be integrated alongside native checkout solutions like Shopify's Shop Pay, allowing customers to choose between options, though Shop Pay transactions themselves are processed via Shopify Payments, not the third-party provider.

Third-Party Payment Processor Explained: Guide for Merchants - Noda - Third-party payment processors act as intermediaries handling payment authorization and settlement between customers, merchants, and banks, enabling businesses to accept online payments without managing their own merchant accounts.

Third-party payment providers - Shopify Support - When using an external third-party payment provider, customer checkout occurs on a payment page hosted outside the merchant's site, unlike with direct providers that allow in-store checkout completion.

dowidth.com

dowidth.com