Returnless refunds allow customers to receive a full refund without the hassle of sending back the purchased item, improving customer satisfaction and reducing logistics costs for merchants. Store credit, on the other hand, encourages repeat purchases by offering a balance redeemable for future orders but may limit immediate customer liquidity. Explore the advantages and trade-offs of returnless refunds versus store credit to optimize your commerce strategies.

Why it is important

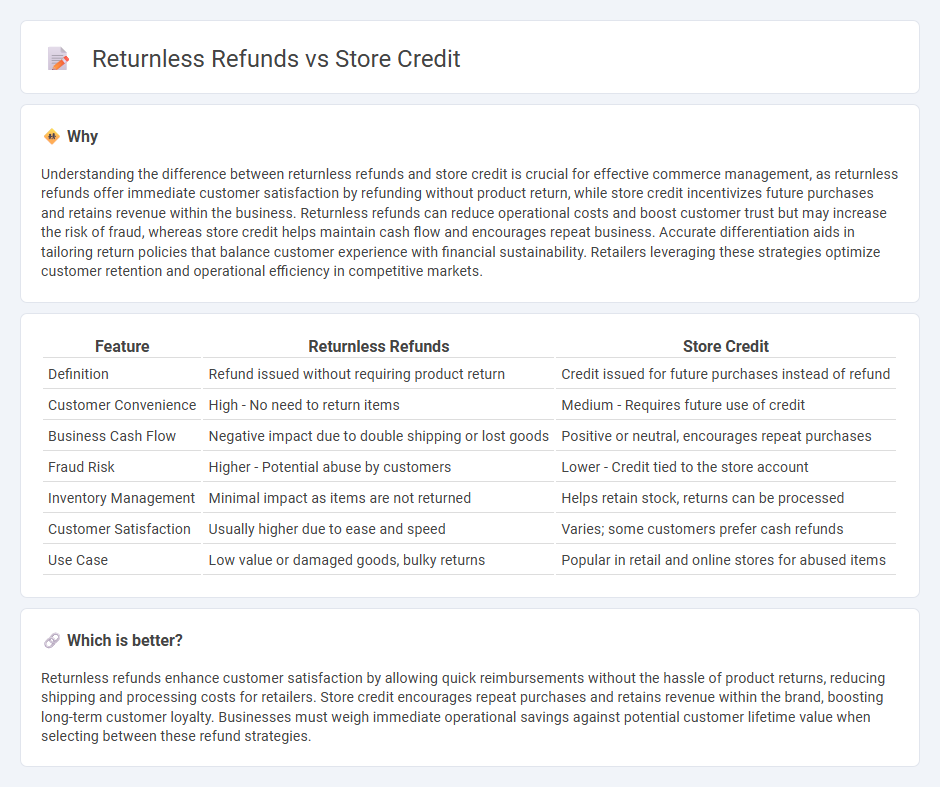

Understanding the difference between returnless refunds and store credit is crucial for effective commerce management, as returnless refunds offer immediate customer satisfaction by refunding without product return, while store credit incentivizes future purchases and retains revenue within the business. Returnless refunds can reduce operational costs and boost customer trust but may increase the risk of fraud, whereas store credit helps maintain cash flow and encourages repeat business. Accurate differentiation aids in tailoring return policies that balance customer experience with financial sustainability. Retailers leveraging these strategies optimize customer retention and operational efficiency in competitive markets.

Comparison Table

| Feature | Returnless Refunds | Store Credit |

|---|---|---|

| Definition | Refund issued without requiring product return | Credit issued for future purchases instead of refund |

| Customer Convenience | High - No need to return items | Medium - Requires future use of credit |

| Business Cash Flow | Negative impact due to double shipping or lost goods | Positive or neutral, encourages repeat purchases |

| Fraud Risk | Higher - Potential abuse by customers | Lower - Credit tied to the store account |

| Inventory Management | Minimal impact as items are not returned | Helps retain stock, returns can be processed |

| Customer Satisfaction | Usually higher due to ease and speed | Varies; some customers prefer cash refunds |

| Use Case | Low value or damaged goods, bulky returns | Popular in retail and online stores for abused items |

Which is better?

Returnless refunds enhance customer satisfaction by allowing quick reimbursements without the hassle of product returns, reducing shipping and processing costs for retailers. Store credit encourages repeat purchases and retains revenue within the brand, boosting long-term customer loyalty. Businesses must weigh immediate operational savings against potential customer lifetime value when selecting between these refund strategies.

Connection

Returnless refunds improve customer satisfaction by allowing refunds without the need for product returns, reducing processing time and shipping costs. Store credit offers an alternative by encouraging customers to make future purchases, boosting brand loyalty and retaining revenue within the business. Both strategies optimize operational efficiency and enhance customer experience, balancing cost management with increased repeat sales.

Key Terms

Customer Retention

Store credit encourages customer retention by providing a flexible option for future purchases, which keeps customers engaged with the brand. Returnless refunds streamline the refund process, enhancing customer satisfaction and reducing friction in the purchase experience. Explore detailed strategies to maximize customer loyalty with store credit and returnless refund policies.

Refund Policy

A clear refund policy distinguishes between store credit and returnless refunds by outlining specific conditions and benefits for each option. Store credit allows customers to receive a monetary value for future purchases, promoting repeated business, while returnless refunds provide instant reimbursement without requiring product returns, enhancing convenience and customer satisfaction. Explore detailed guidelines on refund policies to optimize your customer experience and service efficiency.

Operational Costs

Store credit minimizes cash flow disruptions by retaining funds within the business, reducing immediate operational costs associated with refunds. Returnless refunds eliminate reverse logistics expenses and restocking labor, further lowering transaction overhead. Explore how these approaches impact your company's bottom line and operational efficiency.

Source and External Links

What Is Store Credit? How To Use It To Sell More (2025) - Shopify - Store credit is a digital or physical balance given by retailers to customers after returns, which can only be used for future purchases in the same store to encourage loyalty and retain revenue within the business.

What is Store Credit? - ReturnGO - Store credit acts as a refund alternative that customers use for future store purchases, helping reduce refund rates, build customer loyalty, and encourage repeat shopping by keeping value within the business.

What Is a Store Credit? Meaning, Benefits, & Guide (2024) - 99minds - Store credit is a store-specific internal currency used for future purchases, not transferable or expiring usually, strategically improving customer retention and turning returns into future sales opportunities.

dowidth.com

dowidth.com