Peer-to-peer payments enable users to transfer funds directly between individuals using mobile apps or digital wallets, streamlining personal transactions without intermediaries. Payment gateways facilitate secure online processing of credit card and debit card transactions for businesses, integrating with e-commerce platforms to manage purchases efficiently. Explore the advantages and use cases of peer-to-peer payments versus payment gateways to optimize your commercial transactions.

Why it is important

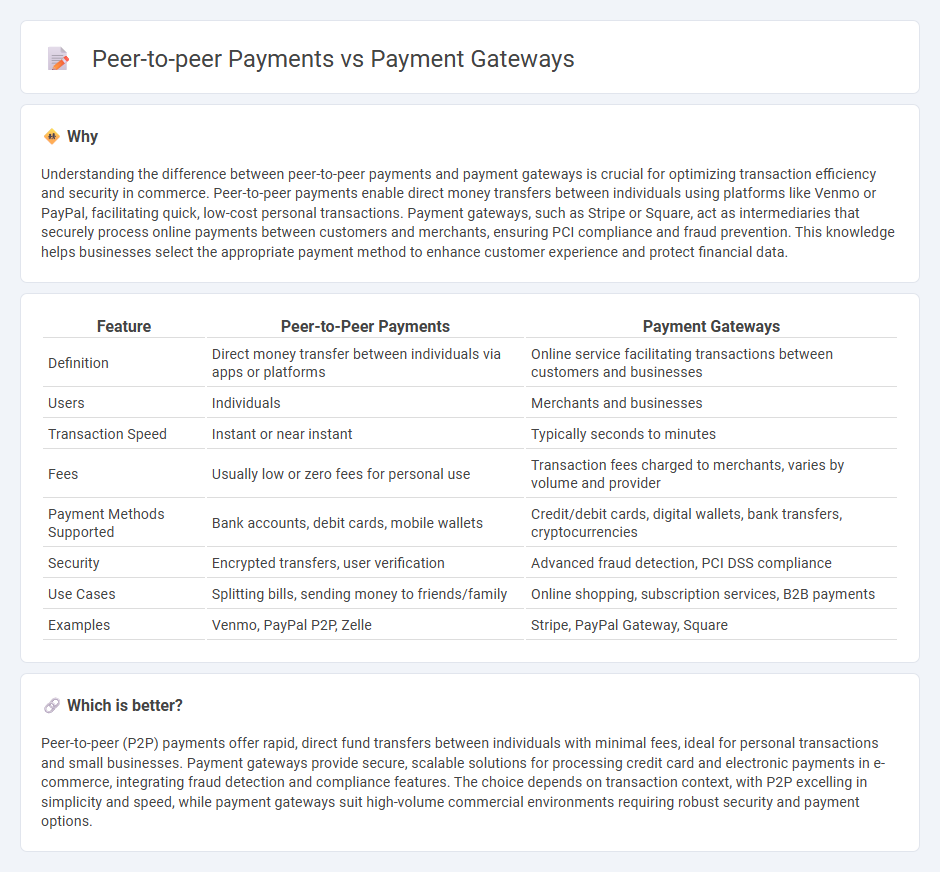

Understanding the difference between peer-to-peer payments and payment gateways is crucial for optimizing transaction efficiency and security in commerce. Peer-to-peer payments enable direct money transfers between individuals using platforms like Venmo or PayPal, facilitating quick, low-cost personal transactions. Payment gateways, such as Stripe or Square, act as intermediaries that securely process online payments between customers and merchants, ensuring PCI compliance and fraud prevention. This knowledge helps businesses select the appropriate payment method to enhance customer experience and protect financial data.

Comparison Table

| Feature | Peer-to-Peer Payments | Payment Gateways |

|---|---|---|

| Definition | Direct money transfer between individuals via apps or platforms | Online service facilitating transactions between customers and businesses |

| Users | Individuals | Merchants and businesses |

| Transaction Speed | Instant or near instant | Typically seconds to minutes |

| Fees | Usually low or zero fees for personal use | Transaction fees charged to merchants, varies by volume and provider |

| Payment Methods Supported | Bank accounts, debit cards, mobile wallets | Credit/debit cards, digital wallets, bank transfers, cryptocurrencies |

| Security | Encrypted transfers, user verification | Advanced fraud detection, PCI DSS compliance |

| Use Cases | Splitting bills, sending money to friends/family | Online shopping, subscription services, B2B payments |

| Examples | Venmo, PayPal P2P, Zelle | Stripe, PayPal Gateway, Square |

Which is better?

Peer-to-peer (P2P) payments offer rapid, direct fund transfers between individuals with minimal fees, ideal for personal transactions and small businesses. Payment gateways provide secure, scalable solutions for processing credit card and electronic payments in e-commerce, integrating fraud detection and compliance features. The choice depends on transaction context, with P2P excelling in simplicity and speed, while payment gateways suit high-volume commercial environments requiring robust security and payment options.

Connection

Peer-to-peer payments rely on payment gateways to securely process and authorize transactions between users, ensuring seamless fund transfers. Payment gateways facilitate real-time communication between the user's bank and the recipient's account, enabling secure authentication and fraud prevention. This connectivity enhances the efficiency and safety of digital commerce by streamlining peer-to-peer financial exchanges.

Key Terms

Transaction Processing

Payment gateways facilitate secure transaction processing by acting as intermediaries between merchants and financial institutions, ensuring encrypted data transmission and fraud prevention. Peer-to-peer payments process transactions directly between individuals through digital wallets or apps, bypassing traditional merchant channels for faster fund transfers. Explore further to understand the operational differences and benefits of each payment method.

Intermediary

Payment gateways act as intermediaries by processing transactions between customers and merchants, ensuring secure and efficient payment authorizations. Peer-to-peer (P2P) payments bypass traditional intermediaries, enabling direct transfers between individuals through digital platforms. Explore the key differences and implications of these payment methods for seamless financial transactions.

Direct Transfer

Payment gateways facilitate transactions by securely processing credit card or digital wallet payments through a merchant's platform, while peer-to-peer payments enable individuals to transfer funds directly between accounts without intermediaries, often via mobile apps. Direct Transfer in peer-to-peer payments emphasizes instantaneous fund movement from sender to receiver, minimizing delays and fees typical in gateway-processed transactions. Discover more about how Direct Transfer revolutionizes personal and business finance by exploring its benefits and technology.

Source and External Links

Payment Gateways in 2025: Main Types + How They Work - Payment gateways are merchant services that process credit card payments for both e-commerce and physical stores, with popular providers including PayPal, Square, Stripe, and Apple Pay, each offering different features like fraud protection, mobile payments, and integration options.

8 Best Payment Gateways of July 2025 - Leading payment gateway options in 2025 include Authorize.net for complex needs, Stripe for developer-friendly API integrations, and PayPal Braintree for accepting PayPal and Venmo, with each service differing in pricing, contract terms, and supported payment methods.

Payment gateway - A payment gateway is a technology that authorizes and processes credit card or direct payments for online and in-person transactions, acting as an intermediary between the merchant, customer, and financial institutions to securely transfer payment information.

dowidth.com

dowidth.com