Peer-to-peer payments enable direct monetary transfers between individuals using apps like Venmo and Zelle, emphasizing convenience and speed in personal transactions. Mobile wallets, such as Apple Pay and Google Wallet, store multiple payment methods securely and facilitate in-store and online purchases through NFC technology. Explore the differences in security, usage, and benefits to understand which option suits your financial needs best.

Why it is important

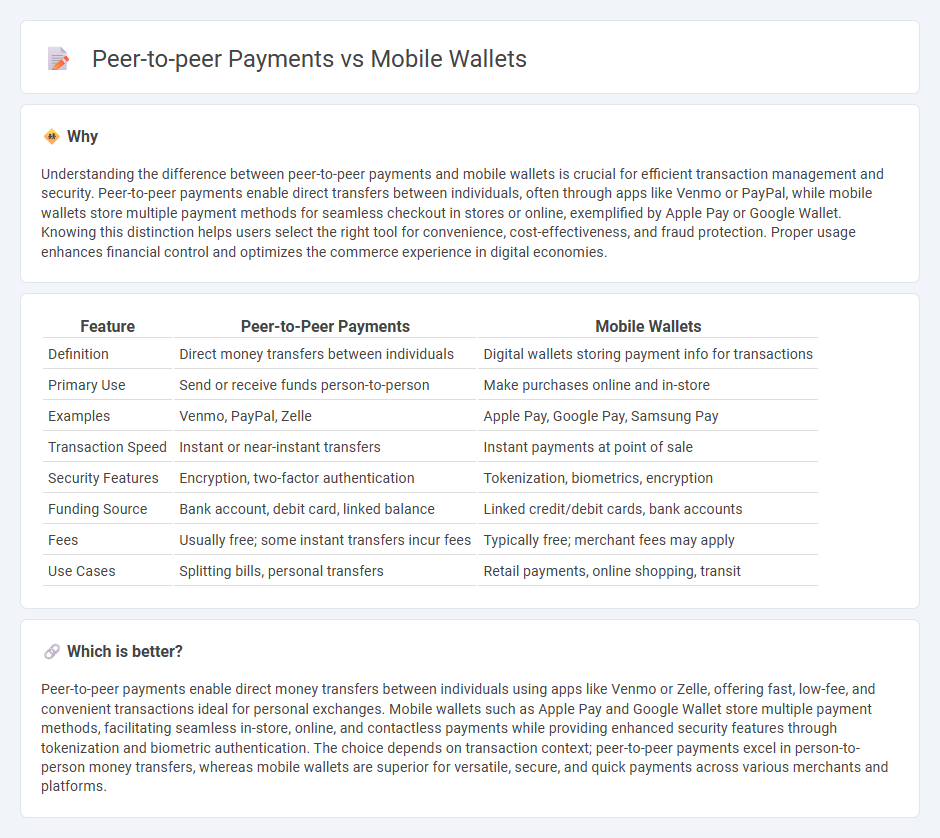

Understanding the difference between peer-to-peer payments and mobile wallets is crucial for efficient transaction management and security. Peer-to-peer payments enable direct transfers between individuals, often through apps like Venmo or PayPal, while mobile wallets store multiple payment methods for seamless checkout in stores or online, exemplified by Apple Pay or Google Wallet. Knowing this distinction helps users select the right tool for convenience, cost-effectiveness, and fraud protection. Proper usage enhances financial control and optimizes the commerce experience in digital economies.

Comparison Table

| Feature | Peer-to-Peer Payments | Mobile Wallets |

|---|---|---|

| Definition | Direct money transfers between individuals | Digital wallets storing payment info for transactions |

| Primary Use | Send or receive funds person-to-person | Make purchases online and in-store |

| Examples | Venmo, PayPal, Zelle | Apple Pay, Google Pay, Samsung Pay |

| Transaction Speed | Instant or near-instant transfers | Instant payments at point of sale |

| Security Features | Encryption, two-factor authentication | Tokenization, biometrics, encryption |

| Funding Source | Bank account, debit card, linked balance | Linked credit/debit cards, bank accounts |

| Fees | Usually free; some instant transfers incur fees | Typically free; merchant fees may apply |

| Use Cases | Splitting bills, personal transfers | Retail payments, online shopping, transit |

Which is better?

Peer-to-peer payments enable direct money transfers between individuals using apps like Venmo or Zelle, offering fast, low-fee, and convenient transactions ideal for personal exchanges. Mobile wallets such as Apple Pay and Google Wallet store multiple payment methods, facilitating seamless in-store, online, and contactless payments while providing enhanced security features through tokenization and biometric authentication. The choice depends on transaction context; peer-to-peer payments excel in person-to-person money transfers, whereas mobile wallets are superior for versatile, secure, and quick payments across various merchants and platforms.

Connection

Peer-to-peer payments rely heavily on mobile wallets to facilitate instant, secure transfers between users without traditional banking intermediaries. Mobile wallets store digital currencies and payment credentials, enabling seamless transactions through apps or QR codes. This integration enhances convenience and speeds up commerce by supporting real-time financial exchanges within digital ecosystems.

Key Terms

Digital Wallet Integration

Mobile wallets enable seamless digital wallet integration by securely storing multiple payment methods such as credit cards, cryptocurrencies, and loyalty programs within a single app, enhancing user convenience and security. Peer-to-peer payments leverage digital wallet platforms for instantaneous fund transfers between individuals using phone numbers or QR codes, emphasizing speed and ease of transaction. Explore how digital wallet integration is revolutionizing mobile financial interactions to learn more about their evolving capabilities.

Transaction Fees

Mobile wallets often impose flat or percentage-based transaction fees, varying by provider and payment method, typically ranging from 1% to 3%. Peer-to-peer payments frequently offer lower or no fees for standard transfers, especially between users of the same platform, but may charge fees for instant transfers or credit card funding. Explore detailed fee structures and compare costs to make informed choices for your financial transactions.

Real-time Settlement

Mobile wallets facilitate instant fund transfers by linking users' bank accounts or cards directly to their devices, enabling real-time settlements for transactions at retail stores and online platforms. Peer-to-peer (P2P) payment systems allow individuals to send money seamlessly using phone numbers or email addresses, with many leveraging blockchain technology or banking networks to ensure near-instantaneous clearing and settlement. Explore the evolving landscape of digital payments and how real-time settlement enhances financial convenience and security.

Source and External Links

Mobile Wallet - Definition, Types, How To Use, Pros, Cons - A mobile wallet is a virtual wallet app on a smartphone or tablet that stores credit, debit, and loyalty card information securely with encryption, allowing convenient in-store payments through scanned QR codes or personal identification formats.

What is a Digital Wallet? See our Guide | Insights - Worldpay - Digital wallets are cloud-based mobile apps that use NFC technology for contactless payments via smartphones or smartwatches, secured by encryption, tokenization, biometric verification, and operate like traditional credit or debit cards at payment terminals.

Understanding Mobile Wallets: Benefits, Types, and Market Insights - Mobile wallets offer convenience by eliminating the need for cash or physical cards, enhance security with advanced encryption, support contactless payments, and often integrate with other apps while providing rewards and loyalty programs.

dowidth.com

dowidth.com