Returnless refunds allow customers to receive full reimbursement without returning the product, reducing return shipping costs and streamlining the refund process. Gift card reimbursement offers store credit instead of cash, encouraging repeat purchases and improving customer retention while managing refund expenses. Explore the benefits and drawbacks of each method to optimize your commerce strategy.

Why it is important

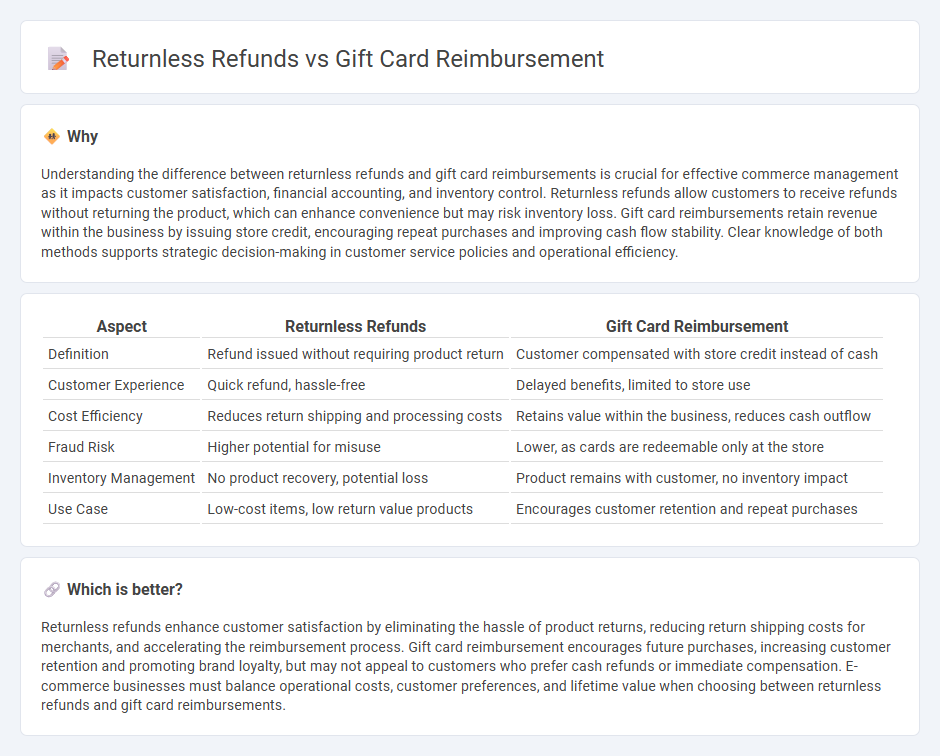

Understanding the difference between returnless refunds and gift card reimbursements is crucial for effective commerce management as it impacts customer satisfaction, financial accounting, and inventory control. Returnless refunds allow customers to receive refunds without returning the product, which can enhance convenience but may risk inventory loss. Gift card reimbursements retain revenue within the business by issuing store credit, encouraging repeat purchases and improving cash flow stability. Clear knowledge of both methods supports strategic decision-making in customer service policies and operational efficiency.

Comparison Table

| Aspect | Returnless Refunds | Gift Card Reimbursement |

|---|---|---|

| Definition | Refund issued without requiring product return | Customer compensated with store credit instead of cash |

| Customer Experience | Quick refund, hassle-free | Delayed benefits, limited to store use |

| Cost Efficiency | Reduces return shipping and processing costs | Retains value within the business, reduces cash outflow |

| Fraud Risk | Higher potential for misuse | Lower, as cards are redeemable only at the store |

| Inventory Management | No product recovery, potential loss | Product remains with customer, no inventory impact |

| Use Case | Low-cost items, low return value products | Encourages customer retention and repeat purchases |

Which is better?

Returnless refunds enhance customer satisfaction by eliminating the hassle of product returns, reducing return shipping costs for merchants, and accelerating the reimbursement process. Gift card reimbursement encourages future purchases, increasing customer retention and promoting brand loyalty, but may not appeal to customers who prefer cash refunds or immediate compensation. E-commerce businesses must balance operational costs, customer preferences, and lifetime value when choosing between returnless refunds and gift card reimbursements.

Connection

Returnless refunds enhance customer satisfaction by allowing refunds without the need for product returns, streamlining the reverse logistics process. Gift card reimbursement often complements returnless policies by providing customers with store credit instead of direct monetary refunds, promoting repeat purchases. This synergy reduces operational costs for e-commerce retailers while maintaining positive customer engagement and loyalty.

Key Terms

Store Credit

Store credit offers customers immediate purchasing power within the same retailer, enhancing retention by keeping funds in-house after returns. Gift card reimbursement ensures customer satisfaction by providing a reusable payment method, but may delay repurchasing compared to direct store credit. Explore the benefits of both methods to optimize your return policies and improve customer loyalty.

Refund Policy

Gift card reimbursement offers customers a store credit option after a return, preserving revenue while maintaining customer satisfaction within the refund policy framework. Returnless refunds eliminate the need for product returns by issuing immediate refunds, thus reducing operational costs but requiring clear policy guidelines to prevent abuse. Explore how these methods impact refund policies and customer experiences to optimize your return strategy.

Digital Wallet

Gift card reimbursement offers a seamless way to recover funds without product returns, optimizing customer satisfaction through immediate digital wallet credits. Returnless refunds eliminate return logistics altogether, enhancing convenience and lowering operational costs by directly refunding the customer's digital wallet or payment method. Explore how integrating digital wallets transforms refund strategies and improves user experience.

Source and External Links

Refunds for Returns or Canceled Purchases with Gift Cards - Refunds for returns or canceled purchases made with Visa or Mastercard gift cards are possible if the card is valid and in possession, with refunds credited back to the original gift card within about 10 business days; lost or discarded cards have limited recourse depending on card type.

Can I be reimbursed if I pay for goods/services with a gift card? - Payments made with gift cards are generally not reimbursable in formal corporate or university reimbursement settings, as preferred payment methods exclude gift cards.

What To Do with Gift Cards if a Store is Out of Business? - If a store goes out of business, gift cards may no longer be valid, but some stores continue to accept them until closing, and in bankruptcy cases, acceptance depends on court authorization; consumer protections vary by situation.

dowidth.com

dowidth.com