Branded currency represents a specific company or brand's value exchange system, often used to foster customer loyalty and enhance brand identity, contrasting with fiat currency, which is government-issued legal tender used universally for all transactions within an economy. Branded currencies typically operate within limited ecosystems, such as store credits or loyalty points, while fiat currencies maintain widespread acceptance and stability backed by governmental authority. Explore the key distinctions and economic impacts of branded versus fiat currency to deepen your understanding of modern commerce.

Why it is important

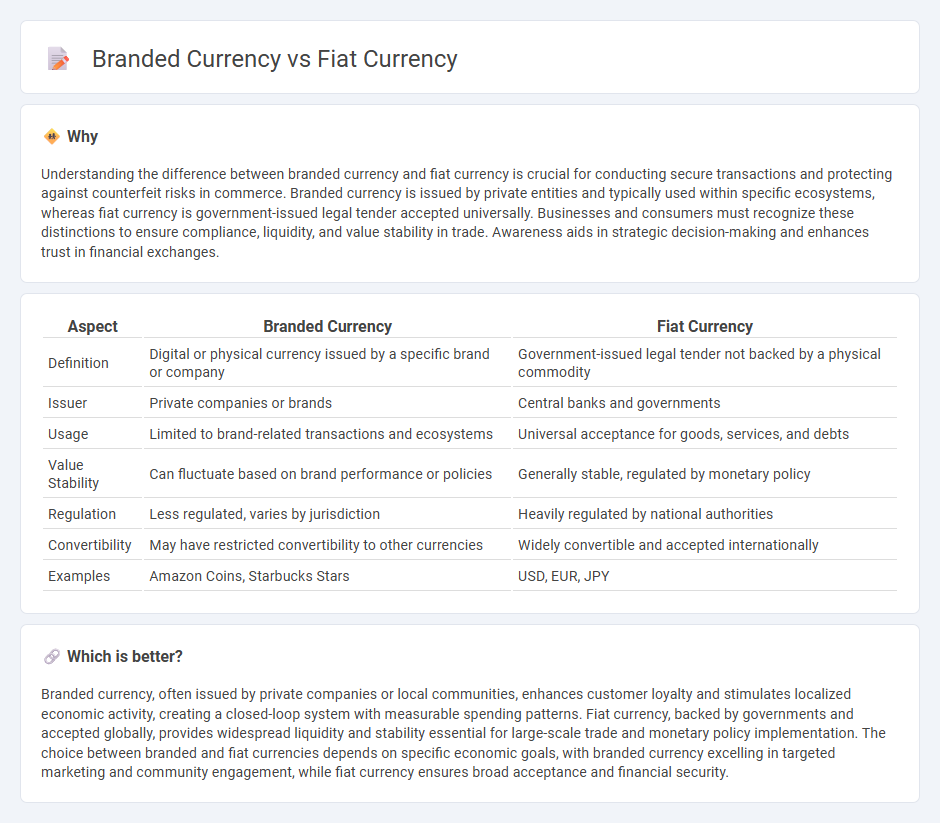

Understanding the difference between branded currency and fiat currency is crucial for conducting secure transactions and protecting against counterfeit risks in commerce. Branded currency is issued by private entities and typically used within specific ecosystems, whereas fiat currency is government-issued legal tender accepted universally. Businesses and consumers must recognize these distinctions to ensure compliance, liquidity, and value stability in trade. Awareness aids in strategic decision-making and enhances trust in financial exchanges.

Comparison Table

| Aspect | Branded Currency | Fiat Currency |

|---|---|---|

| Definition | Digital or physical currency issued by a specific brand or company | Government-issued legal tender not backed by a physical commodity |

| Issuer | Private companies or brands | Central banks and governments |

| Usage | Limited to brand-related transactions and ecosystems | Universal acceptance for goods, services, and debts |

| Value Stability | Can fluctuate based on brand performance or policies | Generally stable, regulated by monetary policy |

| Regulation | Less regulated, varies by jurisdiction | Heavily regulated by national authorities |

| Convertibility | May have restricted convertibility to other currencies | Widely convertible and accepted internationally |

| Examples | Amazon Coins, Starbucks Stars | USD, EUR, JPY |

Which is better?

Branded currency, often issued by private companies or local communities, enhances customer loyalty and stimulates localized economic activity, creating a closed-loop system with measurable spending patterns. Fiat currency, backed by governments and accepted globally, provides widespread liquidity and stability essential for large-scale trade and monetary policy implementation. The choice between branded and fiat currencies depends on specific economic goals, with branded currency excelling in targeted marketing and community engagement, while fiat currency ensures broad acceptance and financial security.

Connection

Branded currency and fiat currency intersect through their shared function as mediums of exchange, yet they differ in origin and acceptance. Fiat currency is government-issued money declared legal tender, while branded currency is created by private entities or businesses to incentivize loyalty and promote specific commercial ecosystems. Both influence consumer behavior and market dynamics by enabling transactions, but branded currency often operates within limited networks compared to the universal acceptance of fiat currency.

Key Terms

Legal Tender

Fiat currency is government-issued money that is recognized as legal tender, meaning it must be accepted for debts and financial transactions within the issuing country. Branded currency, often used in closed-loop systems or promotional contexts, lacks legal tender status and is not universally accepted for payments. Explore the distinctions between legal tender regulations and currency acceptance to understand their economic impact.

Issuer Authority

Fiat currency is issued and regulated by a nation's central bank or government, granting it legal tender status and widespread acceptance. In contrast, branded currency is created by private companies or organizations, often backed by specific products, services, or ecosystems, with value reliant on issuer credibility. Explore how issuer authority impacts trust and usability in different currency systems.

Exchangeability

Fiat currency relies on government decree and widespread acceptance, enabling seamless exchangeability across national borders and markets. Branded currency, often tied to specific companies or ecosystems, offers limited exchangeability, restricting its use to particular platforms or communities. Explore the differences further to understand their impact on global and niche financial transactions.

Source and External Links

Fiat Money - Corporate Finance Institute - Fiat currency is government-issued money without intrinsic value, established as legal tender by government regulation, whose value depends on supply, demand, and trust in the issuing government rather than backing by physical commodities like gold.

Fiat currency | TRM Glossary - Fiat currency is money issued by governments that holds value because of trust and legal status, with central banks controlling its supply to maintain economic stability, unlike commodity-backed money.

Fiat Money: Definition, History, and How It Works - Business Insider - Fiat money refers to currency backed by government decree and public trust rather than a physical commodity, giving governments control over monetary policy but also risk of inflation if mismanaged.

dowidth.com

dowidth.com