Branded currency, issued by specific companies or brands, offers customers exclusive rewards and loyalty benefits, enhancing brand engagement through tangible value. Digital wallets provide a convenient, secure method to store multiple payment options electronically, facilitating quick transactions across various merchants. Explore the key differences and advantages between branded currency and digital wallets to optimize your payment strategy.

Why it is important

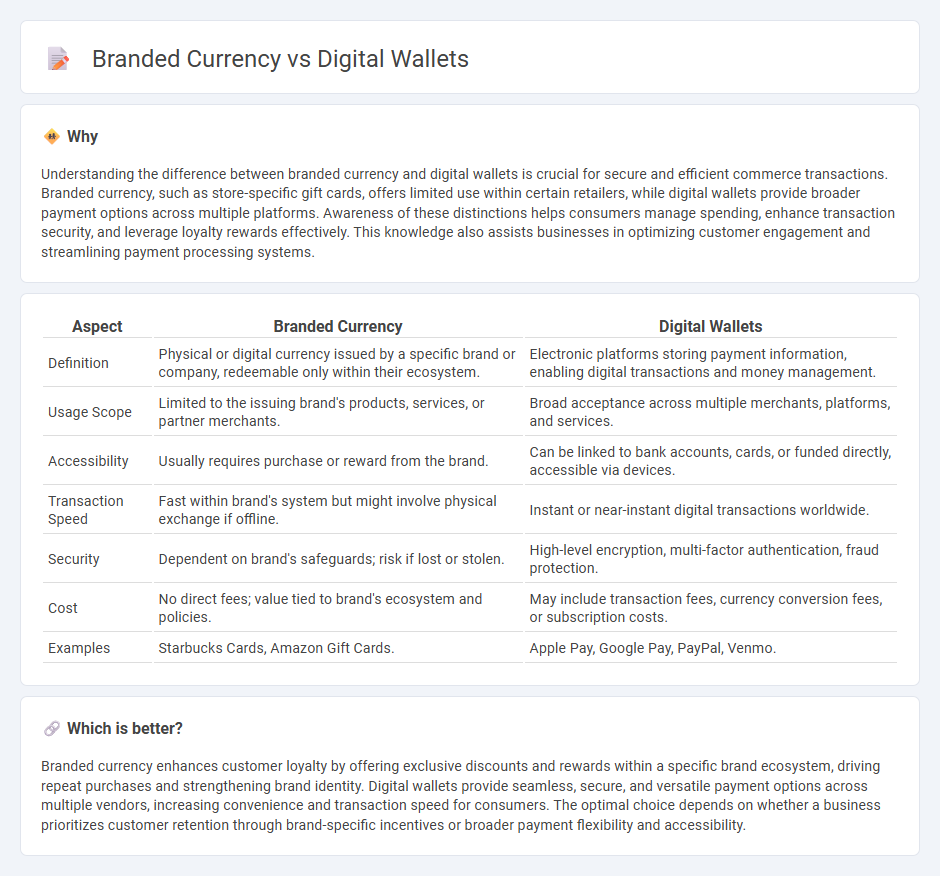

Understanding the difference between branded currency and digital wallets is crucial for secure and efficient commerce transactions. Branded currency, such as store-specific gift cards, offers limited use within certain retailers, while digital wallets provide broader payment options across multiple platforms. Awareness of these distinctions helps consumers manage spending, enhance transaction security, and leverage loyalty rewards effectively. This knowledge also assists businesses in optimizing customer engagement and streamlining payment processing systems.

Comparison Table

| Aspect | Branded Currency | Digital Wallets |

|---|---|---|

| Definition | Physical or digital currency issued by a specific brand or company, redeemable only within their ecosystem. | Electronic platforms storing payment information, enabling digital transactions and money management. |

| Usage Scope | Limited to the issuing brand's products, services, or partner merchants. | Broad acceptance across multiple merchants, platforms, and services. |

| Accessibility | Usually requires purchase or reward from the brand. | Can be linked to bank accounts, cards, or funded directly, accessible via devices. |

| Transaction Speed | Fast within brand's system but might involve physical exchange if offline. | Instant or near-instant digital transactions worldwide. |

| Security | Dependent on brand's safeguards; risk if lost or stolen. | High-level encryption, multi-factor authentication, fraud protection. |

| Cost | No direct fees; value tied to brand's ecosystem and policies. | May include transaction fees, currency conversion fees, or subscription costs. |

| Examples | Starbucks Cards, Amazon Gift Cards. | Apple Pay, Google Pay, PayPal, Venmo. |

Which is better?

Branded currency enhances customer loyalty by offering exclusive discounts and rewards within a specific brand ecosystem, driving repeat purchases and strengthening brand identity. Digital wallets provide seamless, secure, and versatile payment options across multiple vendors, increasing convenience and transaction speed for consumers. The optimal choice depends on whether a business prioritizes customer retention through brand-specific incentives or broader payment flexibility and accessibility.

Connection

Branded currency enhances consumer loyalty by offering exclusive rewards redeemable through digital wallets, streamlining transactions and increasing user engagement. Digital wallets facilitate seamless integration of branded currency, allowing users to store, access, and spend digital tokens effortlessly in various retail ecosystems. The synergy between branded currency and digital wallets drives personalized promotional strategies while providing valuable data analytics for merchants and brands.

Key Terms

Mobile Payments

Mobile payments leverage digital wallets like Apple Pay and Google Wallet, offering seamless, contactless transactions via smartphones. Branded currencies, such as Starbucks Stars or Amazon Coins, create loyalty-driven ecosystems within specific brands, enhancing customer retention through exclusive rewards. Explore the evolving landscape of mobile payments to understand how digital wallets and branded currencies reshape consumer behavior.

Loyalty Points

Digital wallets integrate loyalty points seamlessly, allowing users to collect and redeem rewards across multiple brands with ease. Branded currencies, often specific to a single company, create exclusive loyalty ecosystems but limit flexibility and cross-platform usability. Explore how these approaches impact customer engagement and maximize your loyalty program's value.

Gift Cards

Digital wallets offer the convenience of storing multiple gift cards and branded currencies securely in one place, facilitating faster and seamless transactions. Branded currency, often tied to specific retailers or services, provides exclusive discounts and loyalty rewards that enhance customer retention and spending. Explore how integrating digital wallets with branded gift card programs can maximize consumer engagement and boost sales.

Source and External Links

Digital wallet - Wikipedia - A digital wallet is an electronic device or software that allows users to make electronic transactions, store payment methods, and hold digital versions of IDs and loyalty cards, supporting both online and point-of-sale purchases with technologies like NFC.

15 Types of Digital Wallets: Comprehensive Guide - DashDevs - Digital wallets come in two main types: centralized wallets managed by institutions (e.g., PayPal, Apple Pay) and decentralized wallets operating on blockchain for self-custody of cryptocurrencies (e.g., MetaMask, Trust Wallet), each with distinct security and usage features.

What is a digital wallet and how do they work? - Ramp - Digital wallets store payment information like bank accounts and cards digitally, enabling users to pay online or in stores via smartphones, often including storage of tickets and identification, and have become widely adopted globally for seamless transactions.

dowidth.com

dowidth.com