Peer-to-peer payments enable instant money transfers between individuals using mobile apps and digital wallets, offering convenience and reduced transaction fees. Credit card payments, widely accepted globally, provide buyer protection, rewards, and credit-building opportunities but often involve higher processing fees and potential interest charges. Explore the differences between these payment methods to choose the best option for your financial needs.

Why it is important

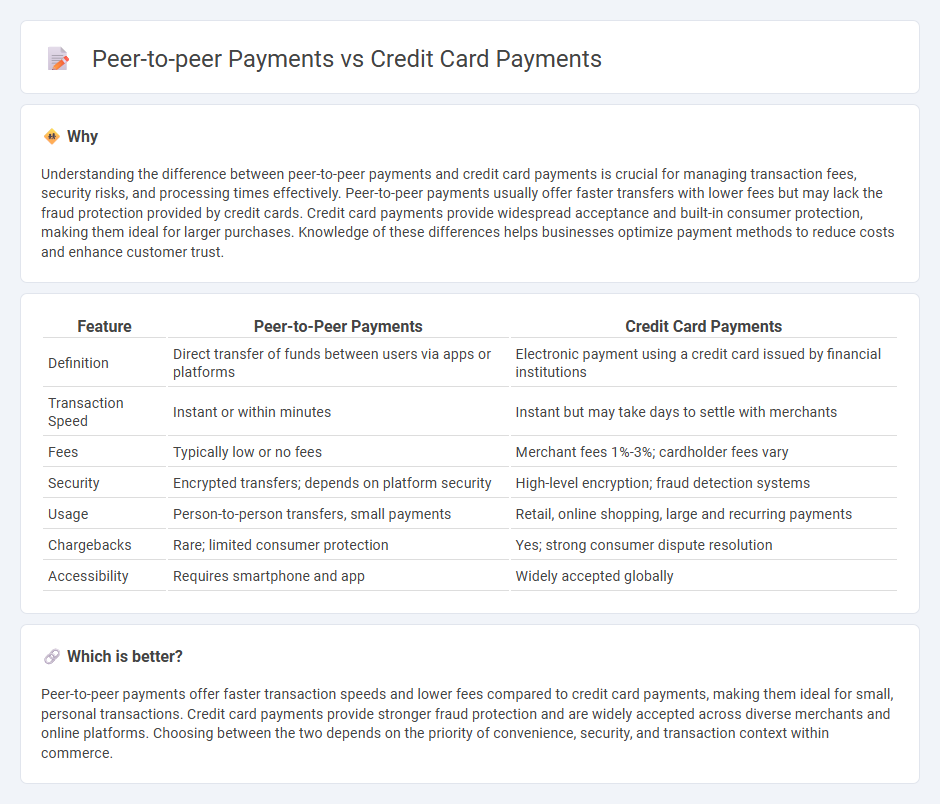

Understanding the difference between peer-to-peer payments and credit card payments is crucial for managing transaction fees, security risks, and processing times effectively. Peer-to-peer payments usually offer faster transfers with lower fees but may lack the fraud protection provided by credit cards. Credit card payments provide widespread acceptance and built-in consumer protection, making them ideal for larger purchases. Knowledge of these differences helps businesses optimize payment methods to reduce costs and enhance customer trust.

Comparison Table

| Feature | Peer-to-Peer Payments | Credit Card Payments |

|---|---|---|

| Definition | Direct transfer of funds between users via apps or platforms | Electronic payment using a credit card issued by financial institutions |

| Transaction Speed | Instant or within minutes | Instant but may take days to settle with merchants |

| Fees | Typically low or no fees | Merchant fees 1%-3%; cardholder fees vary |

| Security | Encrypted transfers; depends on platform security | High-level encryption; fraud detection systems |

| Usage | Person-to-person transfers, small payments | Retail, online shopping, large and recurring payments |

| Chargebacks | Rare; limited consumer protection | Yes; strong consumer dispute resolution |

| Accessibility | Requires smartphone and app | Widely accepted globally |

Which is better?

Peer-to-peer payments offer faster transaction speeds and lower fees compared to credit card payments, making them ideal for small, personal transactions. Credit card payments provide stronger fraud protection and are widely accepted across diverse merchants and online platforms. Choosing between the two depends on the priority of convenience, security, and transaction context within commerce.

Connection

Peer-to-peer payments and credit card payments are interconnected through the use of digital wallets and payment platforms that integrate credit card networks to facilitate instant transfers. Credit card information is often tokenized within peer-to-peer apps, allowing users to send or receive money seamlessly while leveraging credit card rewards and security features. This integration enhances transactional convenience and broadens access to credit-backed funds in digital commerce ecosystems.

Key Terms

Interchange Fees

Credit card payments involve interchange fees paid by merchants to card issuers, typically ranging from 1% to 3% per transaction, which cover processing and fraud protection costs. Peer-to-peer (P2P) payments like Venmo or Zelle usually have lower or no interchange fees, relying on alternative revenue models such as premium services or instant transfer fees. Explore detailed comparisons and cost implications to understand which payment method best suits your financial needs.

Digital Wallets

Digital wallets streamline credit card payments by securely storing card information and enabling quick transactions through NFC or QR code scanning, enhancing user convenience and transaction speed. Peer-to-peer payments via digital wallets facilitate instant fund transfers directly between users without intermediaries, promoting seamless social and commercial exchanges. Explore how digital wallets are revolutionizing both credit card and peer-to-peer payments for deeper insights.

Settlement Time

Credit card payments typically take 1-3 business days for settlement due to the involvement of multiple intermediaries and the batch processing systems used by banks. Peer-to-peer payments, facilitated by platforms like Venmo or Zelle, often settle instantly or within minutes, leveraging real-time payment networks and direct fund transfers between users. Explore the details of settlement mechanics in digital transactions for a deeper understanding.

Source and External Links

Credit Card Payments and Statements FAQ from Bank of America - You can pay your credit card through Online Banking, mobile app, or by transferring from a Bank of America account using convenient step-by-step methods online or on mobile devices.

How Do Credit Card Payments Work? - Experian - Credit card payments are due monthly and can be paid online, by phone, or mail; paying the full statement balance each month helps avoid interest and improve credit health, with options to pay the minimum or more as desired.

How to Accept Credit Card Payments: A Small Business Guide | CO - To accept credit card payments in business, options include in-person payment terminals, mobile POS systems, and apps with card readers, letting business owners process customer payments easily and securely.

dowidth.com

dowidth.com