Peer-to-peer payments enable instant digital money transfers between individuals using mobile apps or online platforms, offering convenience and speed unmatched by traditional methods. Checks, while still used for their paper trail and formal record-keeping, involve slower processing times and higher chances of delays or errors. Explore deeper insights into how these payment methods impact modern commerce efficiency and security.

Why it is important

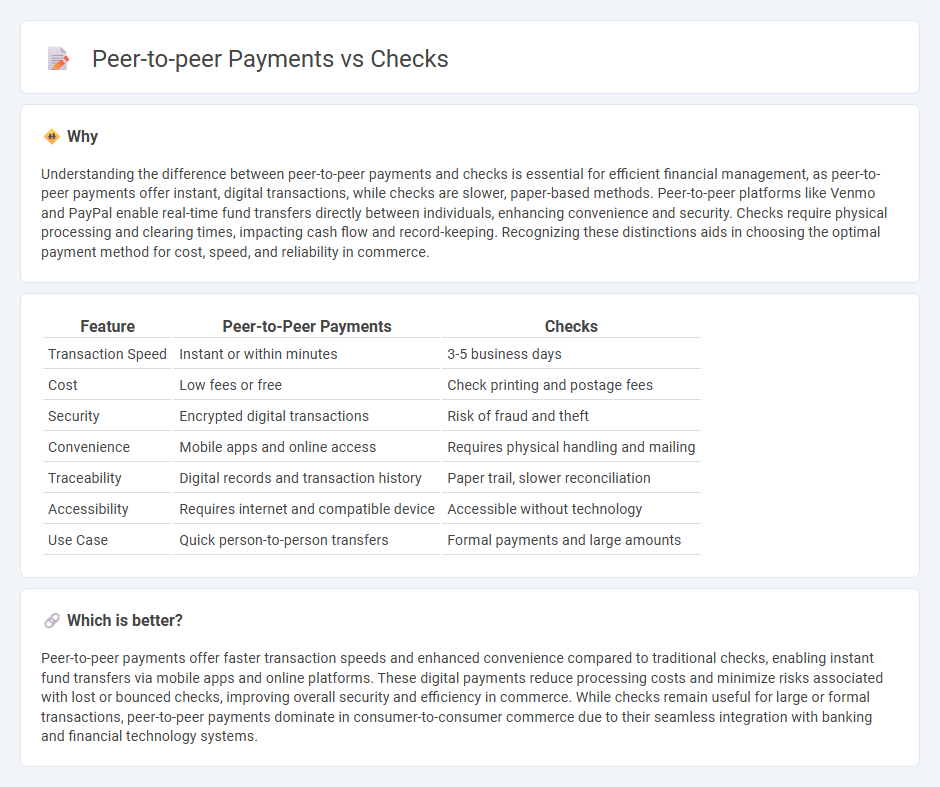

Understanding the difference between peer-to-peer payments and checks is essential for efficient financial management, as peer-to-peer payments offer instant, digital transactions, while checks are slower, paper-based methods. Peer-to-peer platforms like Venmo and PayPal enable real-time fund transfers directly between individuals, enhancing convenience and security. Checks require physical processing and clearing times, impacting cash flow and record-keeping. Recognizing these distinctions aids in choosing the optimal payment method for cost, speed, and reliability in commerce.

Comparison Table

| Feature | Peer-to-Peer Payments | Checks |

|---|---|---|

| Transaction Speed | Instant or within minutes | 3-5 business days |

| Cost | Low fees or free | Check printing and postage fees |

| Security | Encrypted digital transactions | Risk of fraud and theft |

| Convenience | Mobile apps and online access | Requires physical handling and mailing |

| Traceability | Digital records and transaction history | Paper trail, slower reconciliation |

| Accessibility | Requires internet and compatible device | Accessible without technology |

| Use Case | Quick person-to-person transfers | Formal payments and large amounts |

Which is better?

Peer-to-peer payments offer faster transaction speeds and enhanced convenience compared to traditional checks, enabling instant fund transfers via mobile apps and online platforms. These digital payments reduce processing costs and minimize risks associated with lost or bounced checks, improving overall security and efficiency in commerce. While checks remain useful for large or formal transactions, peer-to-peer payments dominate in consumer-to-consumer commerce due to their seamless integration with banking and financial technology systems.

Connection

Peer-to-peer payments and checks both serve as methods for transferring funds directly between individuals, facilitating seamless financial transactions without the need for intermediaries like banks. While checks represent a traditional, paper-based payment instrument requiring manual processing, peer-to-peer payments utilize digital platforms and mobile apps for instant electronic transfers. Both methods emphasize person-to-person financial exchanges, with peer-to-peer payments enhancing speed and convenience compared to the slower clearance times associated with checks.

Key Terms

Endorsement

Endorsement on checks involves the payee signing the back to authorize transfer or cashing, ensuring controlled and secure payment processing. Peer-to-peer payments use digital verification methods such as biometrics or PINs, streamlining approval without physical signatures. Explore more to understand the security implications and user experience differences between these endorsement methods.

Digital Wallet

Digital wallets offer instant, secure peer-to-peer payments, eliminating the processing delays and physical handling required by traditional checks. Unlike checks, which rely on manual processing and bank clearance times, digital wallets utilize encrypted technology for real-time fund transfers and transaction tracking. Explore how digital wallets are revolutionizing payment methods by providing convenience, speed, and enhanced security.

Clearing

Checks rely on traditional clearing processes involving banks and clearinghouses, which can take several business days to settle funds securely. Peer-to-peer payments utilize digital networks and real-time clearing systems, enabling nearly instantaneous fund transfers directly between users. Discover how evolving clearing technologies are transforming payment efficiency and security.

Source and External Links

Bradford Exchange Checks: Order Personal Checks from ... - Offers a wide variety of personal checks with unique designs reflecting many interests, plus personalized accessories like checkbook covers and address labels, all available for secure online ordering.

Walmart Checks: Order Personal Checks and Accessories - Provides thousands of personal and designer checks in various styles including patriotic, scenic, and licensed themes, with fast, secure ordering and additional accessories such as checkbook covers and business cards.

Checks Unlimited: Order Personal Checks From An Industry ... - Offers high-quality personal checks with advanced security features, diverse styles including classic and special edition designs, plus fraud protection programs and coordinating accessories for secure financial transactions.

dowidth.com

dowidth.com