Branded currency enhances trade efficiency by providing a standardized medium of exchange backed by a recognized entity, reducing the inefficiencies of direct goods exchange inherent in barter systems. Barter, relying on the direct swap of goods and services, often suffers from the double coincidence of wants, limiting scalability and economic growth. Explore how branded currency transforms commerce by enabling streamlined transactions and broader market participation.

Why it is important

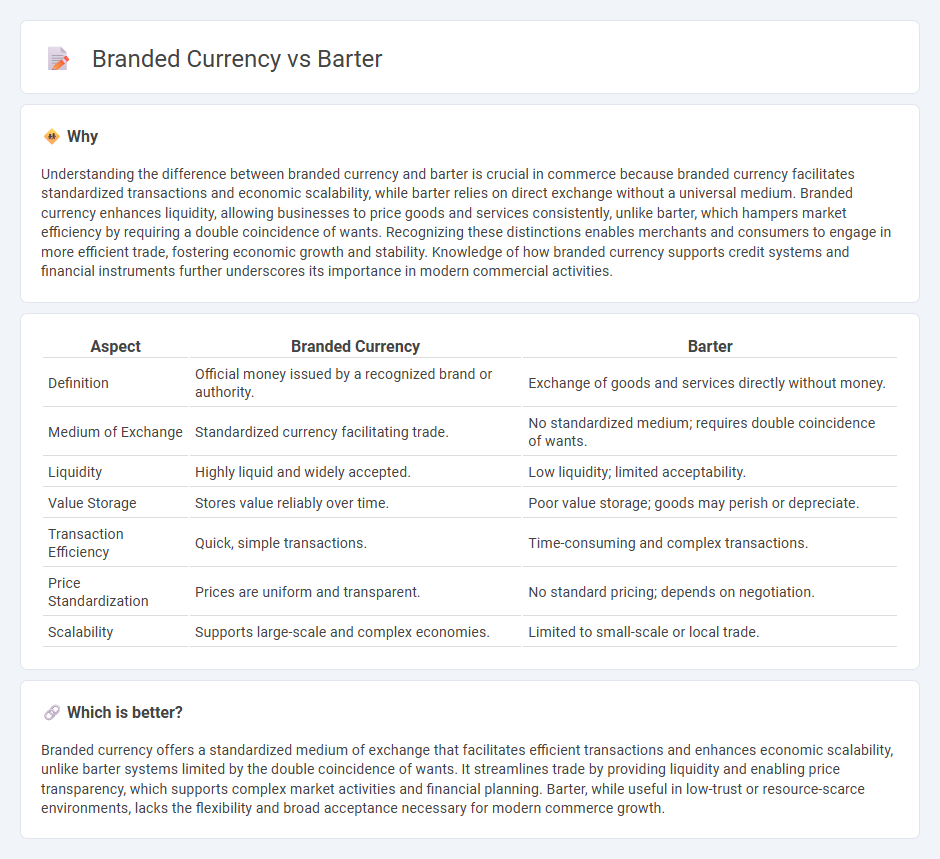

Understanding the difference between branded currency and barter is crucial in commerce because branded currency facilitates standardized transactions and economic scalability, while barter relies on direct exchange without a universal medium. Branded currency enhances liquidity, allowing businesses to price goods and services consistently, unlike barter, which hampers market efficiency by requiring a double coincidence of wants. Recognizing these distinctions enables merchants and consumers to engage in more efficient trade, fostering economic growth and stability. Knowledge of how branded currency supports credit systems and financial instruments further underscores its importance in modern commercial activities.

Comparison Table

| Aspect | Branded Currency | Barter |

|---|---|---|

| Definition | Official money issued by a recognized brand or authority. | Exchange of goods and services directly without money. |

| Medium of Exchange | Standardized currency facilitating trade. | No standardized medium; requires double coincidence of wants. |

| Liquidity | Highly liquid and widely accepted. | Low liquidity; limited acceptability. |

| Value Storage | Stores value reliably over time. | Poor value storage; goods may perish or depreciate. |

| Transaction Efficiency | Quick, simple transactions. | Time-consuming and complex transactions. |

| Price Standardization | Prices are uniform and transparent. | No standard pricing; depends on negotiation. |

| Scalability | Supports large-scale and complex economies. | Limited to small-scale or local trade. |

Which is better?

Branded currency offers a standardized medium of exchange that facilitates efficient transactions and enhances economic scalability, unlike barter systems limited by the double coincidence of wants. It streamlines trade by providing liquidity and enabling price transparency, which supports complex market activities and financial planning. Barter, while useful in low-trust or resource-scarce environments, lacks the flexibility and broad acceptance necessary for modern commerce growth.

Connection

Branded currency and barter both serve as alternative mediums of exchange facilitating trade without relying solely on traditional money. Branded currency represents a localized or company-specific token, promoting loyalty and streamlined transactions within a particular ecosystem. Barter systems directly exchange goods or services, highlighting the fundamental principle of value equivalence underlying branded currencies' design and utility.

Key Terms

Medium of Exchange

Barter systems rely on the direct exchange of goods and services, limiting transactional efficiency due to the double coincidence of wants, while branded currencies serve as widely accepted mediums of exchange facilitating smoother, standardized transactions. Branded currencies enhance liquidity and economic scalability by providing a stable value reference, influencing market dynamics more effectively than barter. Explore the evolution of monetary systems to understand the critical role of branded currency in modern economies.

Store of Value

Barter systems lack a reliable store of value due to the perishability and divisibility issues inherent in goods exchanged, making them inefficient for long-term wealth preservation. Branded currencies, backed by government or institutional trust, provide a stable store of value that facilitates saving and future purchasing power. Explore more to understand how branded currency enhances economic stability and wealth retention.

Standardization

Standardization plays a critical role in the efficiency of branded currency compared to barter systems by providing a consistent unit of value accepted across diverse markets. Unlike barter, which relies on the double coincidence of wants and lacks uniform metrics, branded currency facilitates seamless transactions through recognized denominations and legal backing. Explore how standardization underpins modern economic stability and transactional convenience.

Source and External Links

Barter - Wikipedia - Barter is a system of exchange where goods or services are directly traded without using money, often used in times of monetary crisis or corporate exchanges to convert inventory and protect liquidity.

BARTER definition in American English - Collins Dictionary - Barter is defined as trading goods or services without using money, encompassing both the act of exchanging and the items exchanged.

Barter - Etymology, Origin & Meaning - Etymonline - The word barter dates from the mid-15th century, originating from Old French "barater," meaning to trade or cheat, highlighting the historical association between exchanging goods and bargaining.

dowidth.com

dowidth.com