Peer-to-peer payments enable instant money transfers between individuals using mobile apps, bypassing traditional banking infrastructure and often incurring lower fees. Bank transfers involve moving funds through established financial institutions, providing greater security and higher transaction limits but usually requiring longer processing times and more formal procedures. Explore the differences in convenience, cost, and security to determine which payment method best suits your financial needs.

Why it is important

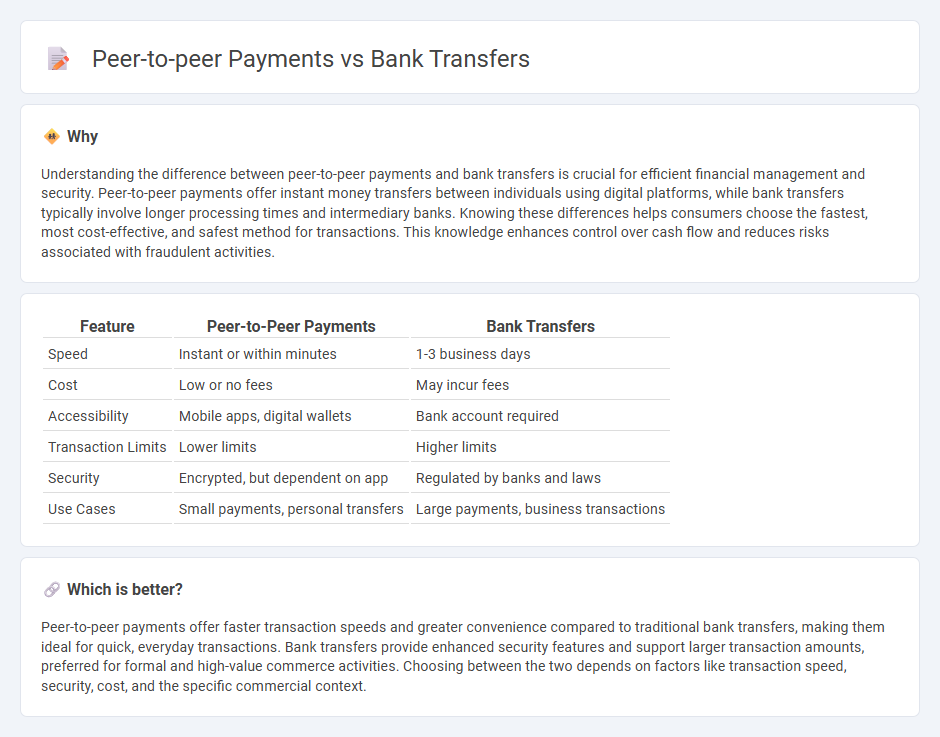

Understanding the difference between peer-to-peer payments and bank transfers is crucial for efficient financial management and security. Peer-to-peer payments offer instant money transfers between individuals using digital platforms, while bank transfers typically involve longer processing times and intermediary banks. Knowing these differences helps consumers choose the fastest, most cost-effective, and safest method for transactions. This knowledge enhances control over cash flow and reduces risks associated with fraudulent activities.

Comparison Table

| Feature | Peer-to-Peer Payments | Bank Transfers |

|---|---|---|

| Speed | Instant or within minutes | 1-3 business days |

| Cost | Low or no fees | May incur fees |

| Accessibility | Mobile apps, digital wallets | Bank account required |

| Transaction Limits | Lower limits | Higher limits |

| Security | Encrypted, but dependent on app | Regulated by banks and laws |

| Use Cases | Small payments, personal transfers | Large payments, business transactions |

Which is better?

Peer-to-peer payments offer faster transaction speeds and greater convenience compared to traditional bank transfers, making them ideal for quick, everyday transactions. Bank transfers provide enhanced security features and support larger transaction amounts, preferred for formal and high-value commerce activities. Choosing between the two depends on factors like transaction speed, security, cost, and the specific commercial context.

Connection

Peer-to-peer payments and bank transfers are interconnected through the use of banking infrastructure and digital platforms that enable direct money movement between individuals. Peer-to-peer payment systems often rely on bank transfers to settle transactions, ensuring funds are securely moved from one user's bank account to another. This integration enhances transaction speed, security, and convenience in digital commerce ecosystems.

Key Terms

Intermediary Institutions

Bank transfers rely heavily on intermediary institutions such as banks and clearinghouses to facilitate the secure movement of funds, often involving longer processing times and additional fees. Peer-to-peer (P2P) payments bypass traditional intermediaries by leveraging digital platforms and blockchain technology, enabling faster and often cheaper transactions directly between users. Discover how the evolving role of intermediaries shapes the future of digital payments and financial inclusivity.

Settlement Time

Bank transfers typically take 1-3 business days to settle due to processing by financial institutions and clearing systems. Peer-to-peer (P2P) payments, facilitated by platforms like Venmo, PayPal, or Zelle, often settle instantly or within minutes, providing faster fund availability. Explore more about how settlement time impacts your choice between these payment methods.

User Authentication

Bank transfers rely heavily on multi-factor authentication methods, including biometric verification and one-time passwords, to ensure secure user identification and prevent unauthorized access. Peer-to-peer payments utilize simplified authentication processes such as app-based PINs or fingerprint scans, balancing convenience with security in real-time transactions. Explore further insights into the evolving authentication technologies in digital financial services.

Source and External Links

Differences Between Wire Transfer and Bank Transfers - A bank transfer is an electronic payment sending money directly between bank accounts, often using the ACH network for domestic transfers, where banks act as intermediaries without needing linked accounts, and funds are verified before transfer.

How a bank transfer works: What businesses need to know - Bank transfers are generally safe electronic fund movements that typically take one to two business days for ACH transfers, with wire transfers processed faster domestically and international transfers taking up to five business days.

How to make a bank transfer - Bank transfers can often be instant or take up to one working day, depending on the bank, and if money is sent to the wrong account, the bank will investigate and attempt to recover the funds within 20 working days.

dowidth.com

dowidth.com