A ghost pipeline refers to sales opportunities that appear active but lack genuine buyer interest, skewing forecast accuracy and resource allocation. Stale deals, on the other hand, are prospects that have gone dormant without recent engagement or progress, often requiring requalification or removal from the pipeline. Discover how identifying and managing ghost pipelines and stale deals can boost your sales efficiency.

Why it is important

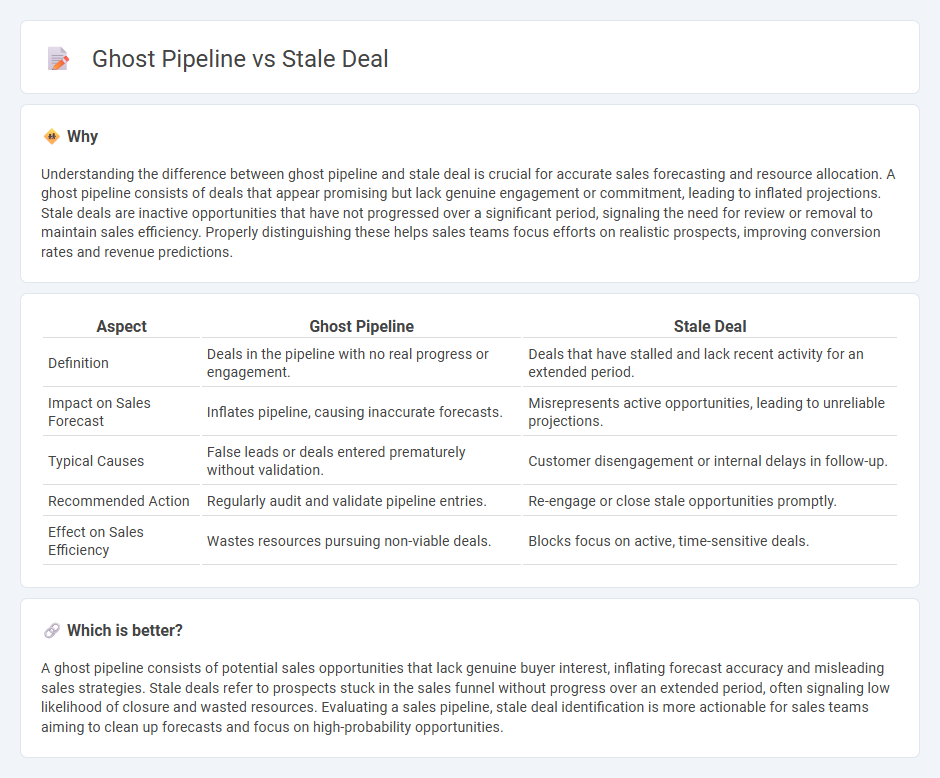

Understanding the difference between ghost pipeline and stale deal is crucial for accurate sales forecasting and resource allocation. A ghost pipeline consists of deals that appear promising but lack genuine engagement or commitment, leading to inflated projections. Stale deals are inactive opportunities that have not progressed over a significant period, signaling the need for review or removal to maintain sales efficiency. Properly distinguishing these helps sales teams focus efforts on realistic prospects, improving conversion rates and revenue predictions.

Comparison Table

| Aspect | Ghost Pipeline | Stale Deal |

|---|---|---|

| Definition | Deals in the pipeline with no real progress or engagement. | Deals that have stalled and lack recent activity for an extended period. |

| Impact on Sales Forecast | Inflates pipeline, causing inaccurate forecasts. | Misrepresents active opportunities, leading to unreliable projections. |

| Typical Causes | False leads or deals entered prematurely without validation. | Customer disengagement or internal delays in follow-up. |

| Recommended Action | Regularly audit and validate pipeline entries. | Re-engage or close stale opportunities promptly. |

| Effect on Sales Efficiency | Wastes resources pursuing non-viable deals. | Blocks focus on active, time-sensitive deals. |

Which is better?

A ghost pipeline consists of potential sales opportunities that lack genuine buyer interest, inflating forecast accuracy and misleading sales strategies. Stale deals refer to prospects stuck in the sales funnel without progress over an extended period, often signaling low likelihood of closure and wasted resources. Evaluating a sales pipeline, stale deal identification is more actionable for sales teams aiming to clean up forecasts and focus on high-probability opportunities.

Connection

Ghost pipelines and stale deals both indicate inefficiencies in sales forecasting and pipeline management. Ghost pipelines refer to deals that appear active but lack genuine buyer interest, leading to misleading revenue projections. Stale deals are opportunities that have not progressed in the sales cycle for an extended period, often causing pipeline stagnation and reduced close rates.

Key Terms

Deal Stagnation

Deal stagnation often results from stale deals that fail to progress through the sales pipeline, causing revenue delays and forecasting inaccuracies. Ghost pipelines occur when deals appear active but lack genuine buyer engagement, further contributing to pipeline inefficiencies. Explore effective strategies to identify and overcome deal stagnation for improved sales outcomes.

Sales Forecasting

Stale deals are outdated sales opportunities that remain inactive, skewing sales forecasting accuracy and leading to overestimated pipeline values. Ghost pipelines consist of deals that appear promising but lack genuine buyer engagement, resulting in unreliable sales predictions and poor resource allocation. Explore effective strategies to identify and manage both stale deals and ghost pipelines to enhance your sales forecasting precision.

Pipeline Health

Stale deal and ghost pipeline both undermine accurate sales forecasting by inflating pipeline value with outdated or non-progressing opportunities. Maintaining pipeline health requires regularly reviewing deal activity, advancing qualified leads, and removing inactive prospects to enhance sales predictability. Learn more about effective pipeline management strategies to boost revenue accuracy.

Source and External Links

What are stale deals? How do they work? - Support : Freshworks - Stale deals are sales deals that have aged beyond a typical conversion timeframe, causing their likelihood of closing to diminish, indicated by the deal turning red after a preset "staling age" in a CRM pipeline to help sales teams prioritize or remove unlikely conversions.

Capital Markets Glossary | Stale or Staleness - Datasite - In finance, "stale" refers to financial statements that are older than the required periods for inclusion in offering documents, indicating outdated or expired information for deal processes.

How to Revive Stalled Deals with Effective Re-Engagement Strategies - Stale or stalled deals occur when prospects disengage due to indecision, shifting priorities, or timing issues, and effective re-engagement requires personalized outreach, value-driven communication, and using CRM tools to revive the sales conversation.

dowidth.com

dowidth.com