A ghost pipeline represents deals that appear promising but lack genuine buyer intent, often resulting in stalled sales processes and inaccurate forecasting. In contrast, a pipe-dream deal is an overly optimistic projection with low probability of closing, usually based on assumptions rather than concrete data. Explore key differences and strategies to identify and manage these sales pipeline challenges effectively.

Why it is important

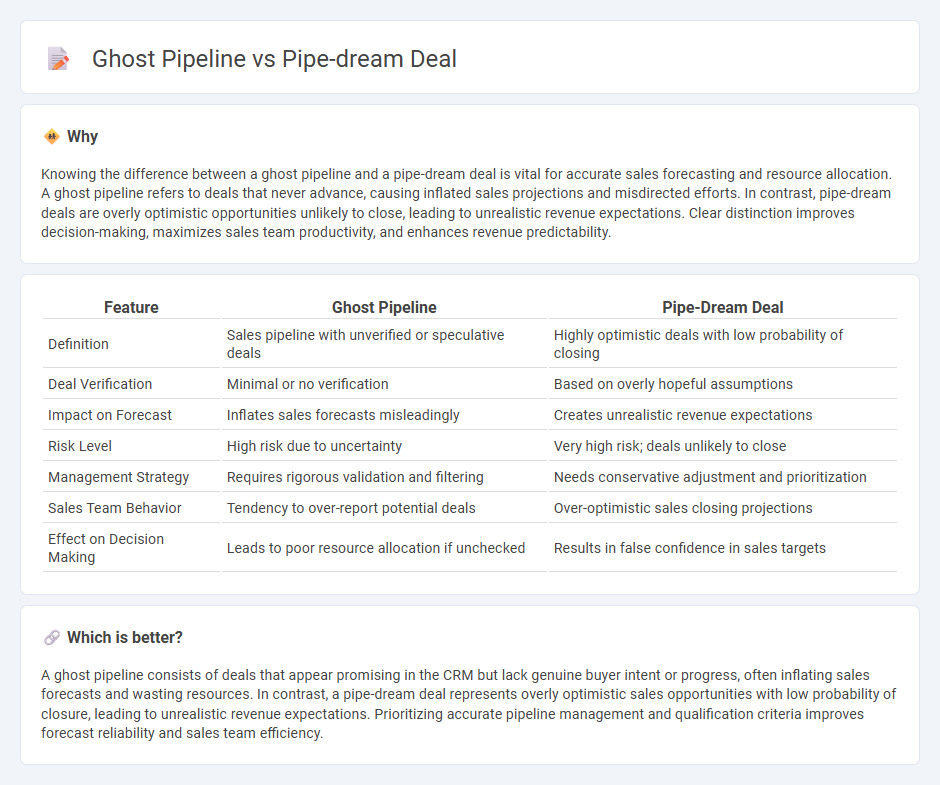

Knowing the difference between a ghost pipeline and a pipe-dream deal is vital for accurate sales forecasting and resource allocation. A ghost pipeline refers to deals that never advance, causing inflated sales projections and misdirected efforts. In contrast, pipe-dream deals are overly optimistic opportunities unlikely to close, leading to unrealistic revenue expectations. Clear distinction improves decision-making, maximizes sales team productivity, and enhances revenue predictability.

Comparison Table

| Feature | Ghost Pipeline | Pipe-Dream Deal |

|---|---|---|

| Definition | Sales pipeline with unverified or speculative deals | Highly optimistic deals with low probability of closing |

| Deal Verification | Minimal or no verification | Based on overly hopeful assumptions |

| Impact on Forecast | Inflates sales forecasts misleadingly | Creates unrealistic revenue expectations |

| Risk Level | High risk due to uncertainty | Very high risk; deals unlikely to close |

| Management Strategy | Requires rigorous validation and filtering | Needs conservative adjustment and prioritization |

| Sales Team Behavior | Tendency to over-report potential deals | Over-optimistic sales closing projections |

| Effect on Decision Making | Leads to poor resource allocation if unchecked | Results in false confidence in sales targets |

Which is better?

A ghost pipeline consists of deals that appear promising in the CRM but lack genuine buyer intent or progress, often inflating sales forecasts and wasting resources. In contrast, a pipe-dream deal represents overly optimistic sales opportunities with low probability of closure, leading to unrealistic revenue expectations. Prioritizing accurate pipeline management and qualification criteria improves forecast reliability and sales team efficiency.

Connection

Ghost pipelines and pipe-dream deals both represent sales opportunities that appear promising but lack genuine potential to close. Ghost pipelines refer to inflated or non-existent leads artificially maintained in CRM systems, while pipe-dream deals are overly optimistic sales projections unlikely to materialize. Understanding their connection helps sales teams improve forecast accuracy and allocate resources more effectively.

Key Terms

Qualification

In sales, a pipe-dream deal represents an unlikely opportunity lacking solid qualification, while a ghost pipeline contains deals that appear promising but are essentially non-viable due to poor lead validation. Effective qualification processes filter out pipe-dream deals and ghost pipelines by rigorously assessing customer needs, budget, authority, and timeline. Discover more about optimizing your sales pipeline to enhance deal accuracy and improve conversion rates.

Forecast Accuracy

Forecast accuracy distinguishes a pipe-dream deal, grounded in realistic projections, from a ghost pipeline filled with overestimated opportunities. Reliable data analytics and historical performance metrics are pivotal in validating sales forecasts and ensuring pipeline credibility. Explore deeper strategies to enhance pipeline accuracy and sales forecasting efficiency.

Buyer Engagement

Pipe-dream deals often result from overambitious promises lacking buyer engagement, while ghost pipelines feature inflated opportunity counts with minimal genuine interest. High-quality buyer interactions are crucial to convert opportunities into reliable sales forecasts, reducing pipeline inaccuracies. Explore proven strategies to enhance buyer engagement and transform your sales pipeline's integrity.

Source and External Links

PIPE Dreams: Investors Roll Dice With Private Investments - "Pipe-dream deal" relates to Private Investments in Public Equity (PIPEs), which often involve buying securities at a discount with returns that are typically skewed, where most deals lose money but a few yield large profits, thus resembling a lottery-like investment strategy.

A PIPE dream - Financier Worldwide - A "PIPE-dream deal" refers to PIPE transactions that allow private equity firms to purchase significant stakes in public companies at discounted prices, often gaining governance rights like board seats, especially attractive during economic turbulence.

PIPE-Works and PIPE-Dreams (Part II) - Verdad - The term "PIPE-dream" in this context categorizes PIPE deals sold at premiums or above median multiples, which tend to underperform compared to other PIPE investments; excluding these improves overall returns significantly.

dowidth.com

dowidth.com