A ghost pipeline contains sales opportunities that appear promising but lack genuine potential or engagement from prospects, leading to misleading forecasts. Inflated pipelines, on the other hand, involve overestimating deal values or quantities to create an exaggerated sense of growth, which can skew performance metrics. Explore effective strategies to identify and manage ghost and inflated pipelines for more accurate sales forecasting.

Why it is important

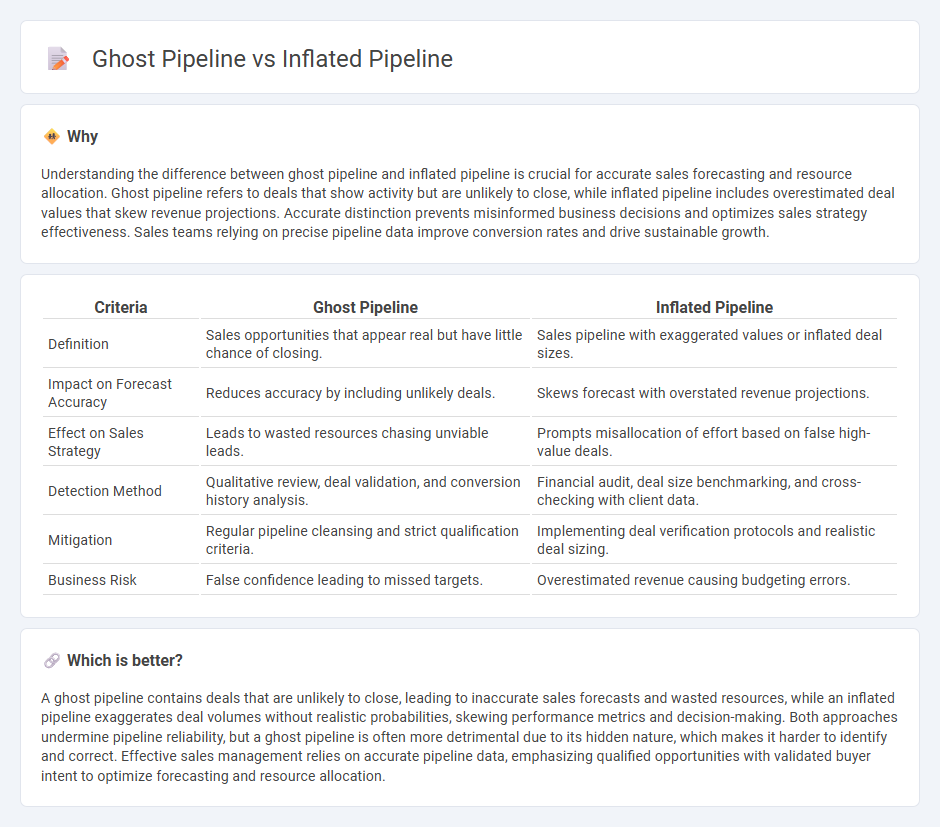

Understanding the difference between ghost pipeline and inflated pipeline is crucial for accurate sales forecasting and resource allocation. Ghost pipeline refers to deals that show activity but are unlikely to close, while inflated pipeline includes overestimated deal values that skew revenue projections. Accurate distinction prevents misinformed business decisions and optimizes sales strategy effectiveness. Sales teams relying on precise pipeline data improve conversion rates and drive sustainable growth.

Comparison Table

| Criteria | Ghost Pipeline | Inflated Pipeline |

|---|---|---|

| Definition | Sales opportunities that appear real but have little chance of closing. | Sales pipeline with exaggerated values or inflated deal sizes. |

| Impact on Forecast Accuracy | Reduces accuracy by including unlikely deals. | Skews forecast with overstated revenue projections. |

| Effect on Sales Strategy | Leads to wasted resources chasing unviable leads. | Prompts misallocation of effort based on false high-value deals. |

| Detection Method | Qualitative review, deal validation, and conversion history analysis. | Financial audit, deal size benchmarking, and cross-checking with client data. |

| Mitigation | Regular pipeline cleansing and strict qualification criteria. | Implementing deal verification protocols and realistic deal sizing. |

| Business Risk | False confidence leading to missed targets. | Overestimated revenue causing budgeting errors. |

Which is better?

A ghost pipeline contains deals that are unlikely to close, leading to inaccurate sales forecasts and wasted resources, while an inflated pipeline exaggerates deal volumes without realistic probabilities, skewing performance metrics and decision-making. Both approaches undermine pipeline reliability, but a ghost pipeline is often more detrimental due to its hidden nature, which makes it harder to identify and correct. Effective sales management relies on accurate pipeline data, emphasizing qualified opportunities with validated buyer intent to optimize forecasting and resource allocation.

Connection

Sales teams often face the challenge of managing ghost pipelines, where deals appear active but lack genuine buyer intent, causing inflated pipeline metrics that misrepresent true revenue potential. Inflated pipelines arise when such phantom opportunities accumulate, leading to unrealistic sales forecasts and skewed performance assessments. Effective pipeline hygiene and rigorous qualification criteria are essential to distinguish legitimate prospects from ghost entries, ensuring accurate sales projections and resource allocation.

Key Terms

Forecast Accuracy

Inflated pipelines occur when sales forecasts are based on overly optimistic deal evaluations, leading to inflated revenue projections that distort forecast accuracy. Ghost pipelines consist of deals unlikely to close, creating false confidence and undermining reliable sales predictions. Explore proven methods to distinguish and manage inflated and ghost pipelines for enhanced forecasting precision.

Deal Qualification

Inflated pipelines often include unvetted or low-quality leads, leading to inaccurate forecasting and wasted resources during the deal qualification process. Ghost pipelines contain deals that never progress or close, skewing performance metrics and misguiding sales strategy adjustments. Explore effective strategies to accurately qualify deals and optimize pipeline health for improved sales outcomes.

Sales Commit

An inflated pipeline misrepresents potential deals, leading to unrealistic sales forecasts and missed quotas, while a ghost pipeline contains opportunities that never materialize or progress. Both practices distort the Sales Commit accuracy, causing challenges in resource allocation and performance evaluation. Discover how to identify and manage these pipeline issues to enhance your sales forecasting precision.

Source and External Links

3 Sales Pipeline Management Principles to Live By - An inflated sales pipeline is one filled with many low-probability opportunities that stagnate in the funnel, creating a false sense of security around sales targets, frustrating leadership, and resulting in lost revenue and wasted resources.

Should You Increase Your Pipeline from 3-5X? - While a healthy pipeline coverage ratio is about 3:1, inflating the pipeline coverage beyond this can mask true lead quality and create false security, though some companies do so for risk mitigation, revenue predictability, and scalability.

The Great Pipeline Deflation: How Senior Execs Called Out ... - In investment banking and M&A, pipeline inflation has meant deals were forecasted more on hope than reality, but recent macroeconomic conditions have exposed these inflated pipelines, leading to a reckoning in the industry.

dowidth.com

dowidth.com