Sales professionals leveraging a high Social Selling Index (SSI) consistently experience larger deal sizes due to enhanced trust and stronger relationships built through digital engagement. Research shows that sellers with top-tier SSI scores close deals that are 40% larger on average compared to peers with lower SSI rankings. Explore how optimizing your social selling strategy can directly impact your deal size and revenue growth.

Why it is important

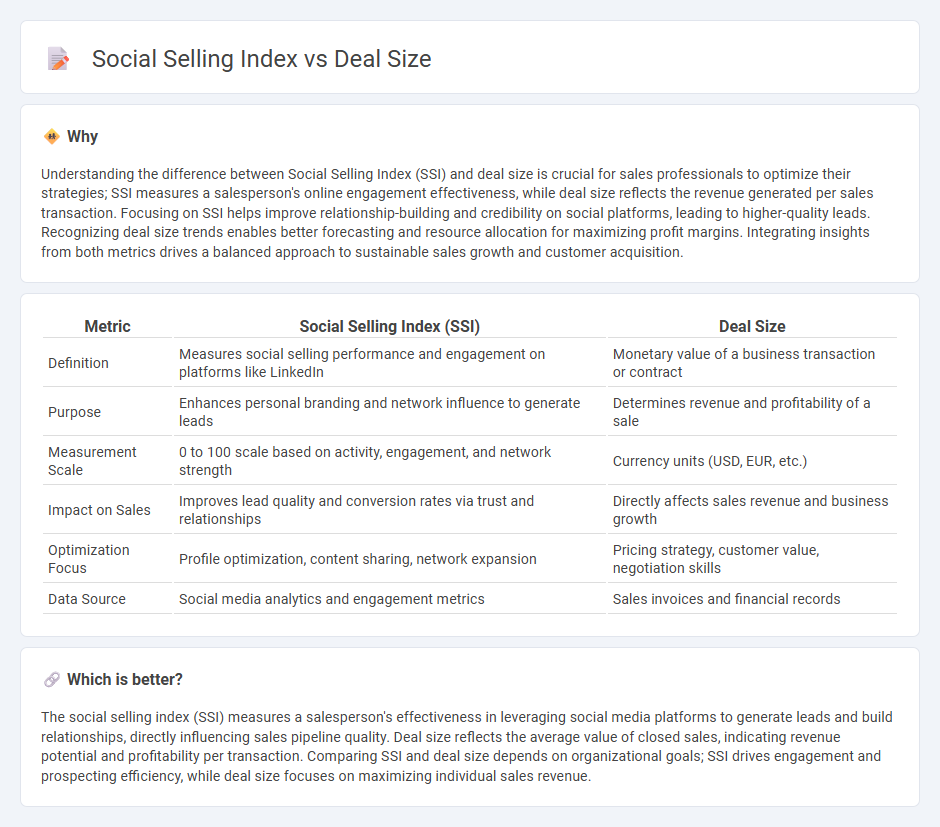

Understanding the difference between Social Selling Index (SSI) and deal size is crucial for sales professionals to optimize their strategies; SSI measures a salesperson's online engagement effectiveness, while deal size reflects the revenue generated per sales transaction. Focusing on SSI helps improve relationship-building and credibility on social platforms, leading to higher-quality leads. Recognizing deal size trends enables better forecasting and resource allocation for maximizing profit margins. Integrating insights from both metrics drives a balanced approach to sustainable sales growth and customer acquisition.

Comparison Table

| Metric | Social Selling Index (SSI) | Deal Size |

|---|---|---|

| Definition | Measures social selling performance and engagement on platforms like LinkedIn | Monetary value of a business transaction or contract |

| Purpose | Enhances personal branding and network influence to generate leads | Determines revenue and profitability of a sale |

| Measurement Scale | 0 to 100 scale based on activity, engagement, and network strength | Currency units (USD, EUR, etc.) |

| Impact on Sales | Improves lead quality and conversion rates via trust and relationships | Directly affects sales revenue and business growth |

| Optimization Focus | Profile optimization, content sharing, network expansion | Pricing strategy, customer value, negotiation skills |

| Data Source | Social media analytics and engagement metrics | Sales invoices and financial records |

Which is better?

The social selling index (SSI) measures a salesperson's effectiveness in leveraging social media platforms to generate leads and build relationships, directly influencing sales pipeline quality. Deal size reflects the average value of closed sales, indicating revenue potential and profitability per transaction. Comparing SSI and deal size depends on organizational goals; SSI drives engagement and prospecting efficiency, while deal size focuses on maximizing individual sales revenue.

Connection

The social selling index (SSI) directly impacts deal size by enhancing a salesperson's credibility and trustworthiness within their network, leading to larger transaction values. Higher SSI scores correlate with improved relationship-building and targeted engagement, which foster stronger client connections and increased sales opportunities. Companies leveraging social selling tools often see a notable rise in average deal size due to more personalized and effective lead nurturing.

Key Terms

Revenue

Higher social selling index (SSI) scores correlate with increased deal sizes and revenue generation, as sales professionals leverage stronger online presence and engagement to build trust with prospects. Companies with top-performing sales teams report a 45% boost in revenue driven by efficient social selling strategies and personalized customer interactions. Discover how optimizing your social selling index can directly impact your revenue growth.

LinkedIn SSI

LinkedIn's Social Selling Index (SSI) measures a professional's effectiveness in establishing a trusted brand, finding the right people, engaging with insights, and building relationships, directly influencing deal sizes in B2B sales. High SSI scores correlate with larger deal sizes as social selling fosters trust and accelerates decision-making processes through meaningful network interactions. Explore how optimizing your LinkedIn SSI can drive increased revenue and stronger client connections.

Lead Qualification

The social selling index (SSI) directly impacts deal size by enhancing lead qualification through improved engagement, relationship building, and trust within professional networks. Higher SSI scores correlate with increased conversion rates and larger deal sizes by effectively identifying and nurturing qualified leads. Explore detailed strategies to leverage SSI for optimizing lead qualification and maximizing deal outcomes.

Source and External Links

Deal Size - upcell Glossary - Deal size is the total monetary worth of an agreement including factors like total revenue, recurring revenue, discounts, fees, and duration, influenced by market trends, industry, value proposition, and sales strategy.

What is Deal Size? Definition and Examples - Saber - Deal size is the monetary value of a sales opportunity or closed contract, often measured as total contract value (TCV) or annual contract value (ACV), serving as a key performance and strategic metric for sales optimization.

Average Deal Size: What It Means for Sales Teams - Mosaic - The average deal size represents the average revenue per closed deal, calculated by dividing total revenue from deals by the number of deals in a set period, and helps evaluate sales performance and pipeline health.

dowidth.com

dowidth.com