The value ladder illustrates how businesses progressively increase customer engagement and revenue by offering a sequence of products or services with escalating value and price points. Customer lifetime value (CLV) quantifies the total revenue a business can expect from a single customer over the entire duration of their relationship. Explore how integrating the value ladder strategy with CLV analysis can optimize your sales growth and customer retention efforts.

Why it is important

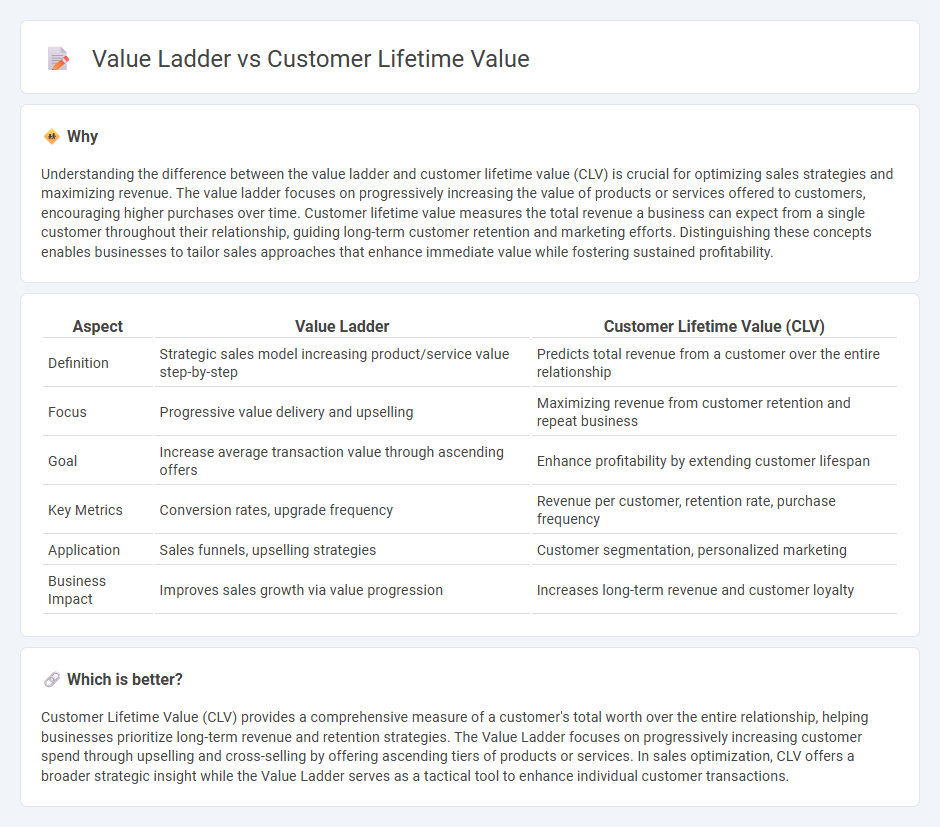

Understanding the difference between the value ladder and customer lifetime value (CLV) is crucial for optimizing sales strategies and maximizing revenue. The value ladder focuses on progressively increasing the value of products or services offered to customers, encouraging higher purchases over time. Customer lifetime value measures the total revenue a business can expect from a single customer throughout their relationship, guiding long-term customer retention and marketing efforts. Distinguishing these concepts enables businesses to tailor sales approaches that enhance immediate value while fostering sustained profitability.

Comparison Table

| Aspect | Value Ladder | Customer Lifetime Value (CLV) |

|---|---|---|

| Definition | Strategic sales model increasing product/service value step-by-step | Predicts total revenue from a customer over the entire relationship |

| Focus | Progressive value delivery and upselling | Maximizing revenue from customer retention and repeat business |

| Goal | Increase average transaction value through ascending offers | Enhance profitability by extending customer lifespan |

| Key Metrics | Conversion rates, upgrade frequency | Revenue per customer, retention rate, purchase frequency |

| Application | Sales funnels, upselling strategies | Customer segmentation, personalized marketing |

| Business Impact | Improves sales growth via value progression | Increases long-term revenue and customer loyalty |

Which is better?

Customer Lifetime Value (CLV) provides a comprehensive measure of a customer's total worth over the entire relationship, helping businesses prioritize long-term revenue and retention strategies. The Value Ladder focuses on progressively increasing customer spend through upselling and cross-selling by offering ascending tiers of products or services. In sales optimization, CLV offers a broader strategic insight while the Value Ladder serves as a tactical tool to enhance individual customer transactions.

Connection

The value ladder enhances customer lifetime value by progressively offering higher-value products or services that deepen customer engagement and increase spending over time. Each step on the value ladder builds trust and satisfaction, encouraging repeat purchases and long-term loyalty. Optimizing this connection maximizes revenue per customer and strengthens overall business growth.

Key Terms

Customer Lifetime Value:

Customer Lifetime Value (CLV) quantifies the total revenue a business expects from a single customer throughout their relationship, emphasizing retention and long-term profitability. Unlike the Value Ladder, which highlights progressive product offerings to increase customer spend, CLV concentrates on maximizing the monetary worth of each customer over time. Explore more to understand how maximizing CLV drives sustainable business growth.

Retention Rate

Customer lifetime value (CLV) measures the total revenue a customer generates over their entire relationship with a business, highlighting the importance of a high retention rate to maximize profitability. The value ladder illustrates increasing levels of customer engagement and spending, emphasizing retention strategies that move customers up to higher-value products or services. Explore how optimizing retention rates impacts both CLV and value ladder progression to boost business growth.

Average Purchase Value

Customer Lifetime Value measures the total revenue a customer generates over the entire relationship, while the Value Ladder emphasizes increasing Average Purchase Value through progressive product or service offerings. Enhancing Average Purchase Value within the Value Ladder directly impacts Customer Lifetime Value by maximizing each transaction's revenue. Explore how optimizing Average Purchase Value can boost both metrics for sustained business growth.

Source and External Links

What is Customer Lifetime Value (CLV)? [Free Calculator] - Customer lifetime value (CLV) is the total revenue a business expects to earn from a customer throughout their entire relationship, measuring all purchases over time rather than a single sale or period, and reflecting customer loyalty with formulas and examples provided.

What is Customer Lifetime Value (CLV)? - CLV represents the total profit from a customer over their entire relationship and is essential for tracking customer retention and loyalty, with two methods to measure it: historic (past spend) and predictive (forecast future value using algorithms).

How to Calculate Customer Lifetime Value (CLV) & Why It Matters - CLV measures the total revenue expected from one customer over their relationship, highlighting that retaining customers is much cheaper than acquiring new ones and that even small retention improvements can significantly boost profits.

dowidth.com

dowidth.com