Predictive scoring leverages historical sales data and machine learning algorithms to rank leads based on their likelihood to convert, optimizing sales resource allocation and boosting revenue efficiency. Customer lifetime value (CLV) modeling estimates the total revenue a business can expect from a single customer throughout their relationship, guiding strategic decisions in marketing and retention efforts. Explore the nuances of predictive scoring and CLV modeling to enhance your sales strategy with data-driven insights.

Why it is important

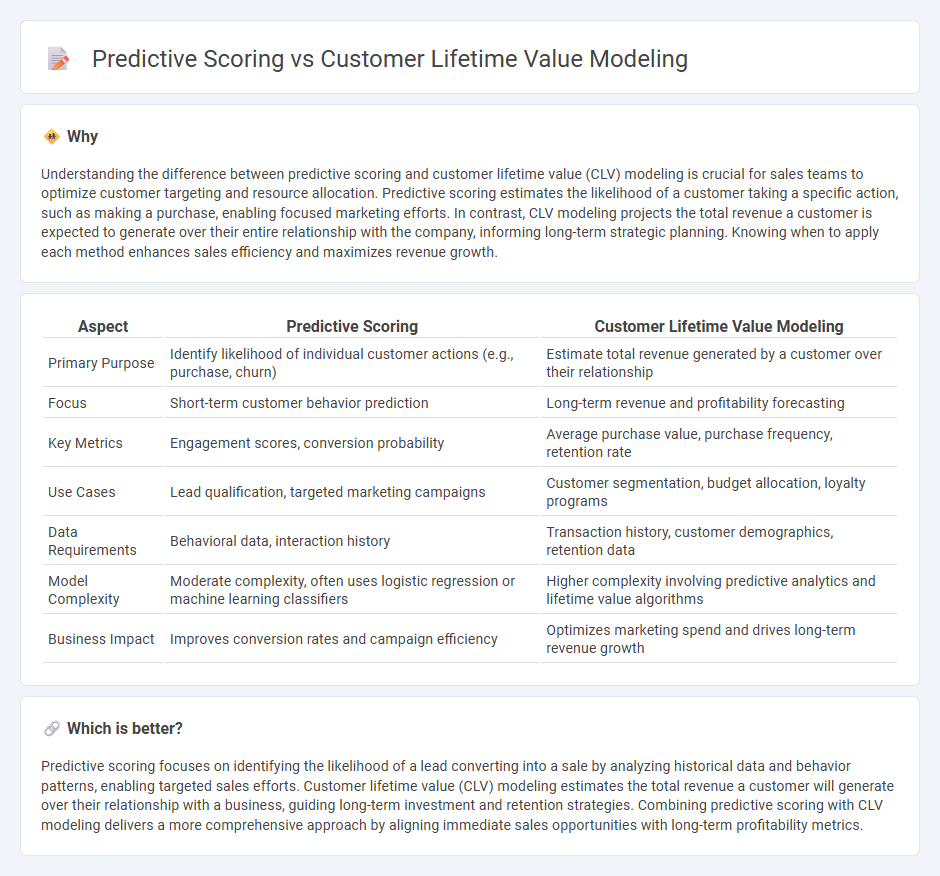

Understanding the difference between predictive scoring and customer lifetime value (CLV) modeling is crucial for sales teams to optimize customer targeting and resource allocation. Predictive scoring estimates the likelihood of a customer taking a specific action, such as making a purchase, enabling focused marketing efforts. In contrast, CLV modeling projects the total revenue a customer is expected to generate over their entire relationship with the company, informing long-term strategic planning. Knowing when to apply each method enhances sales efficiency and maximizes revenue growth.

Comparison Table

| Aspect | Predictive Scoring | Customer Lifetime Value Modeling |

|---|---|---|

| Primary Purpose | Identify likelihood of individual customer actions (e.g., purchase, churn) | Estimate total revenue generated by a customer over their relationship |

| Focus | Short-term customer behavior prediction | Long-term revenue and profitability forecasting |

| Key Metrics | Engagement scores, conversion probability | Average purchase value, purchase frequency, retention rate |

| Use Cases | Lead qualification, targeted marketing campaigns | Customer segmentation, budget allocation, loyalty programs |

| Data Requirements | Behavioral data, interaction history | Transaction history, customer demographics, retention data |

| Model Complexity | Moderate complexity, often uses logistic regression or machine learning classifiers | Higher complexity involving predictive analytics and lifetime value algorithms |

| Business Impact | Improves conversion rates and campaign efficiency | Optimizes marketing spend and drives long-term revenue growth |

Which is better?

Predictive scoring focuses on identifying the likelihood of a lead converting into a sale by analyzing historical data and behavior patterns, enabling targeted sales efforts. Customer lifetime value (CLV) modeling estimates the total revenue a customer will generate over their relationship with a business, guiding long-term investment and retention strategies. Combining predictive scoring with CLV modeling delivers a more comprehensive approach by aligning immediate sales opportunities with long-term profitability metrics.

Connection

Predictive scoring uses historical customer data and behavioral patterns to estimate the likelihood of future purchases, directly influencing customer lifetime value (CLV) modeling by identifying high-value prospects. Accurate predictive scores enable businesses to tailor marketing efforts and allocate resources efficiently, maximizing revenue from long-term customer relationships. Integrating these methods enhances sales strategies by forecasting customer profitability and optimizing acquisition and retention tactics.

Key Terms

**Customer Lifetime Value Modeling:**

Customer Lifetime Value (CLV) modeling quantifies the total revenue a business can expect from a single customer throughout their relationship, using transaction history and behavior patterns. It integrates factors such as purchase frequency, average order value, and retention rates to forecast long-term profitability per customer. Explore how advanced CLV modeling techniques can enhance targeted marketing strategies and maximize customer ROI.

Retention Rate

Customer lifetime value modeling quantifies the total revenue a customer is expected to generate, emphasizing long-term profitability, while predictive scoring estimates the likelihood of specific customer actions, such as retention or churn. Retention rate is a crucial metric in both approaches, as higher retention increases lifetime value and improves predictive accuracy for targeted marketing. Explore detailed strategies to enhance retention and leverage these models for maximizing customer loyalty and revenue growth.

Churn Prediction

Customer lifetime value (CLV) modeling estimates the total revenue a customer is expected to generate over their entire relationship with a business, integrating factors like purchase frequency, average order value, and retention rates. Predictive scoring for churn prediction specifically forecasts the likelihood of a customer discontinuing service using behavioral data, engagement metrics, and demographic attributes. Explore how combining CLV modeling with churn predictive scoring enhances retention strategies and maximizes revenue potential.

Source and External Links

Customer Lifetime Value models - Oracle Help Center - Provides a ready-to-use data science model that estimates a customer's value over time based on profile, transaction patterns, and customizable timeframes.

Customer Lifetime Value (CLV): What Is It and How to Calculate It - Demonstrates a practical CLV calculation using average order value, purchase frequency, gross margin, and churn rate to derive per-customer lifetime value.

Customer lifetime value - Wikipedia - Presents a classic formula for CLV under constant margin and retention rates, highlighting the relationship between margin, retention, discount rate, and the present value of future customer cash flows.

dowidth.com

dowidth.com