Predictive scoring uses historical sales data and machine learning algorithms to forecast customer behavior and identify high-potential leads, enhancing sales targeting and conversion rates. Credit scoring evaluates a customer's creditworthiness based on financial metrics, influencing risk management and loan approval processes. Discover how integrating predictive scoring with credit scoring can optimize your sales strategy and improve revenue outcomes.

Why it is important

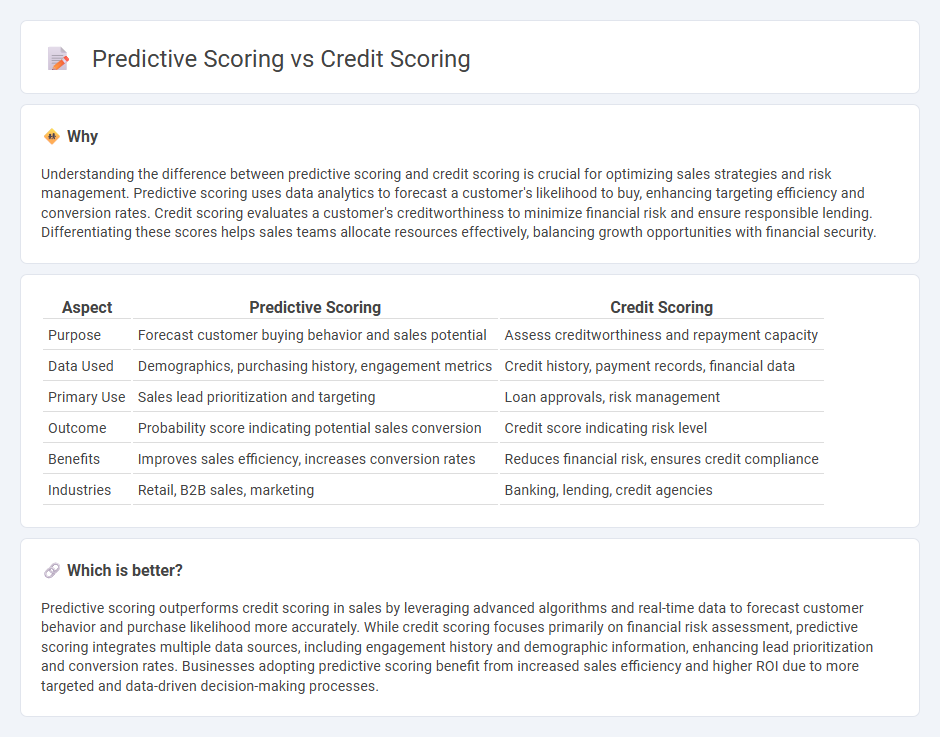

Understanding the difference between predictive scoring and credit scoring is crucial for optimizing sales strategies and risk management. Predictive scoring uses data analytics to forecast a customer's likelihood to buy, enhancing targeting efficiency and conversion rates. Credit scoring evaluates a customer's creditworthiness to minimize financial risk and ensure responsible lending. Differentiating these scores helps sales teams allocate resources effectively, balancing growth opportunities with financial security.

Comparison Table

| Aspect | Predictive Scoring | Credit Scoring |

|---|---|---|

| Purpose | Forecast customer buying behavior and sales potential | Assess creditworthiness and repayment capacity |

| Data Used | Demographics, purchasing history, engagement metrics | Credit history, payment records, financial data |

| Primary Use | Sales lead prioritization and targeting | Loan approvals, risk management |

| Outcome | Probability score indicating potential sales conversion | Credit score indicating risk level |

| Benefits | Improves sales efficiency, increases conversion rates | Reduces financial risk, ensures credit compliance |

| Industries | Retail, B2B sales, marketing | Banking, lending, credit agencies |

Which is better?

Predictive scoring outperforms credit scoring in sales by leveraging advanced algorithms and real-time data to forecast customer behavior and purchase likelihood more accurately. While credit scoring focuses primarily on financial risk assessment, predictive scoring integrates multiple data sources, including engagement history and demographic information, enhancing lead prioritization and conversion rates. Businesses adopting predictive scoring benefit from increased sales efficiency and higher ROI due to more targeted and data-driven decision-making processes.

Connection

Predictive scoring and credit scoring are connected through their use of data-driven algorithms to assess potential risk and customer behavior in sales. Predictive scoring analyzes historical sales and customer interaction data to forecast future buying patterns, while credit scoring evaluates financial reliability and creditworthiness. Integrating both scores enables sales teams to prioritize leads with high purchase probability and low financial risk, optimizing sales strategies and resource allocation.

Key Terms

Risk Assessment

Credit scoring evaluates an individual's creditworthiness by analyzing historical financial behavior, payment history, and debt levels to determine the likelihood of default. Predictive scoring uses advanced algorithms and machine learning to assess a broader range of data points, including non-traditional factors, improving the accuracy of risk assessment models. Explore further to understand how these methodologies transform financial risk management strategies.

Lead Prioritization

Credit scoring evaluates a borrower's creditworthiness based on historical financial data, while predictive scoring leverages machine learning models to anticipate future behaviors such as lead conversion likelihood. In lead prioritization, predictive scoring offers dynamic insights by analyzing real-time behaviors and demographic variables, enabling sales teams to focus on high-potential leads efficiently. Discover how integrating predictive scoring can transform your lead management strategy for better conversion rates.

Approval Criteria

Credit scoring primarily evaluates a borrower's creditworthiness based on historical credit data and payment behavior to determine the likelihood of loan repayment, focusing on default risk. Predictive scoring incorporates a broader set of variables, including behavioral and demographic data, to forecast not just default but also other outcomes like customer lifetime value or approval likelihood. Explore deeper insights into how these scoring models influence approval criteria and decision-making processes.

Source and External Links

What is a credit score? | Consumer Financial Protection Bureau - A credit score is a numerical prediction of how likely you are to repay a loan on time, based on your credit reports, and is used by companies to decide loan eligibility and terms.

CREDIT SCORING APPROACHES GUIDELINES - The World Bank - Credit scoring is a statistical method predicting the probability of loan default, indicating creditworthiness, often used in consumer lending with scores scaled to show risk levels.

Credit Scores | Consumer Advice - Credit scoring systems use factors like bill payment history, debt levels, credit history length, and recent credit applications to calculate a score that estimates the likelihood of timely loan repayment.

dowidth.com

dowidth.com