Predictive scoring uses historical data and statistical algorithms to forecast a lead's likelihood to convert, enabling sales teams to prioritize efforts efficiently. Behavioral scoring tracks real-time user actions such as website visits, email opens, and content downloads to gauge immediate interest and engagement levels. Explore how combining predictive and behavioral scoring can refine your sales strategy and boost conversion rates.

Why it is important

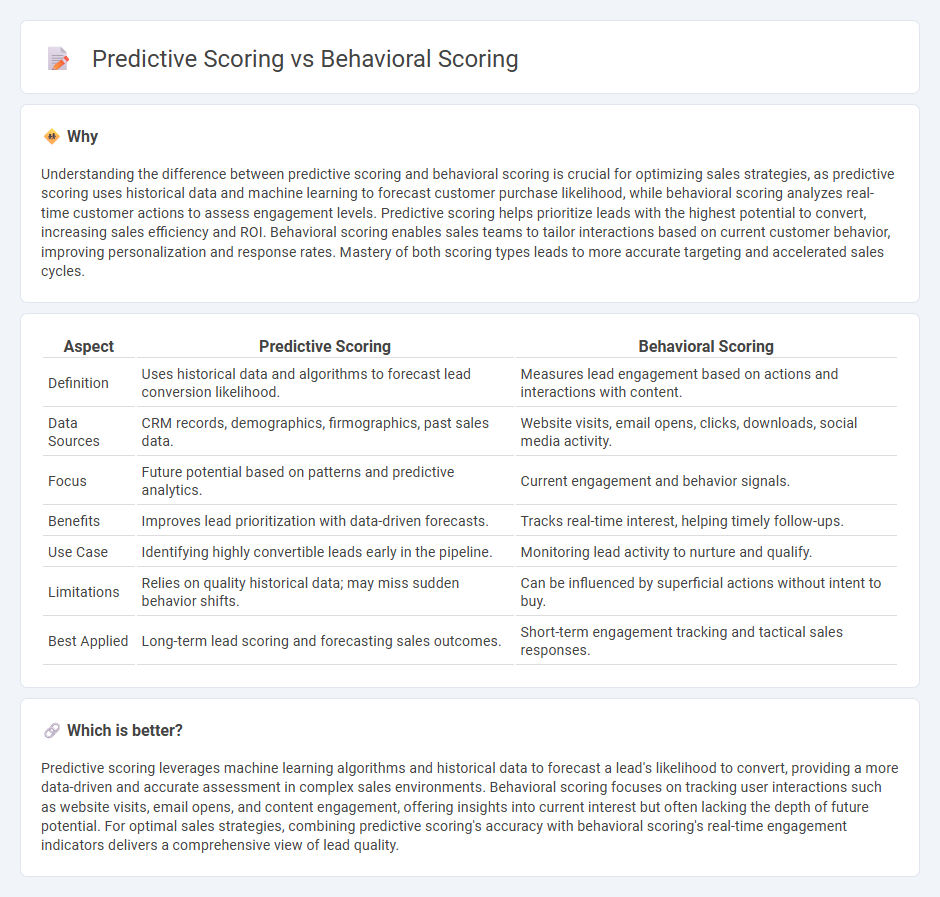

Understanding the difference between predictive scoring and behavioral scoring is crucial for optimizing sales strategies, as predictive scoring uses historical data and machine learning to forecast customer purchase likelihood, while behavioral scoring analyzes real-time customer actions to assess engagement levels. Predictive scoring helps prioritize leads with the highest potential to convert, increasing sales efficiency and ROI. Behavioral scoring enables sales teams to tailor interactions based on current customer behavior, improving personalization and response rates. Mastery of both scoring types leads to more accurate targeting and accelerated sales cycles.

Comparison Table

| Aspect | Predictive Scoring | Behavioral Scoring |

|---|---|---|

| Definition | Uses historical data and algorithms to forecast lead conversion likelihood. | Measures lead engagement based on actions and interactions with content. |

| Data Sources | CRM records, demographics, firmographics, past sales data. | Website visits, email opens, clicks, downloads, social media activity. |

| Focus | Future potential based on patterns and predictive analytics. | Current engagement and behavior signals. |

| Benefits | Improves lead prioritization with data-driven forecasts. | Tracks real-time interest, helping timely follow-ups. |

| Use Case | Identifying highly convertible leads early in the pipeline. | Monitoring lead activity to nurture and qualify. |

| Limitations | Relies on quality historical data; may miss sudden behavior shifts. | Can be influenced by superficial actions without intent to buy. |

| Best Applied | Long-term lead scoring and forecasting sales outcomes. | Short-term engagement tracking and tactical sales responses. |

Which is better?

Predictive scoring leverages machine learning algorithms and historical data to forecast a lead's likelihood to convert, providing a more data-driven and accurate assessment in complex sales environments. Behavioral scoring focuses on tracking user interactions such as website visits, email opens, and content engagement, offering insights into current interest but often lacking the depth of future potential. For optimal sales strategies, combining predictive scoring's accuracy with behavioral scoring's real-time engagement indicators delivers a comprehensive view of lead quality.

Connection

Predictive scoring leverages historical sales data and machine learning algorithms to estimate a prospect's likelihood to convert, while behavioral scoring tracks real-time interactions such as website visits and email engagement. By integrating predictive and behavioral scoring, sales teams gain a dynamic, data-driven insight into lead quality and buying intent, enhancing targeting accuracy. This connection allows for prioritizing leads with the highest conversion probability and crafting personalized follow-ups that align with each prospect's unique behaviors.

Key Terms

**Behavioral Scoring:**

Behavioral scoring evaluates customer interactions, actions, and engagement patterns to assess risk or potential, often used in credit risk management and marketing segmentation. It leverages real-time behavior data such as purchase frequency, website clicks, and response to campaigns to create dynamic risk profiles. Explore how behavioral scoring can enhance decision-making accuracy and customer targeting strategies by learning more today.

Engagement Metrics

Behavioral scoring evaluates customer actions such as website visits, email opens, and click-through rates to measure engagement strength over time. Predictive scoring uses historical engagement data combined with machine learning models to forecast future customer behaviors, such as likelihood to purchase or churn. Discover how integrating both scoring methods can enhance targeted marketing strategies by exploring our comprehensive analysis.

Activity Tracking

Behavioral scoring evaluates customer actions and engagement patterns over time, assigning scores based on activities such as website visits, email opens, and social media interactions, providing a nuanced understanding of user behavior. Predictive scoring leverages machine learning models to forecast future actions or outcomes, like purchase likelihood or churn risk, using historical data and activity tracking as key inputs. Explore deeper insights into how these scoring methods optimize marketing strategies and customer relationship management.

Source and External Links

What is the behavioural credit scoring model, and how does it work? - Behavioral scoring evaluates credit risk by analyzing real-time financial behaviors such as spending patterns and payment consistency rather than relying solely on static credit history data, offering a more accurate and adaptable risk assessment.

Decoding Behavioral Credit Scoring: What You Need to Know? - Behavioral credit scoring assesses creditworthiness by incorporating everyday behaviors like spending habits, online activity, and social interactions alongside traditional financial data to provide a comprehensive view of an individual's credit risk.

What Is Behavioral Analysis for Credit Scoring? - RiskSeal - Behavioral analysis in credit scoring tracks financial habits and behavioral traits in real-time, enabling lenders to predict future repayment reliability more effectively than conventional methods focused solely on past credit history.

dowidth.com

dowidth.com