Scan and go technology revolutionizes retail by enabling customers to scan items with their smartphones while shopping, streamlining the checkout process and reducing wait times. In-app payment, integrated within retail apps, offers a seamless transaction experience by allowing users to pay securely without leaving the app, enhancing convenience and boosting customer satisfaction. Explore the benefits and differences between scan and go and in-app payment to find the best solution for your retail business.

Why it is important

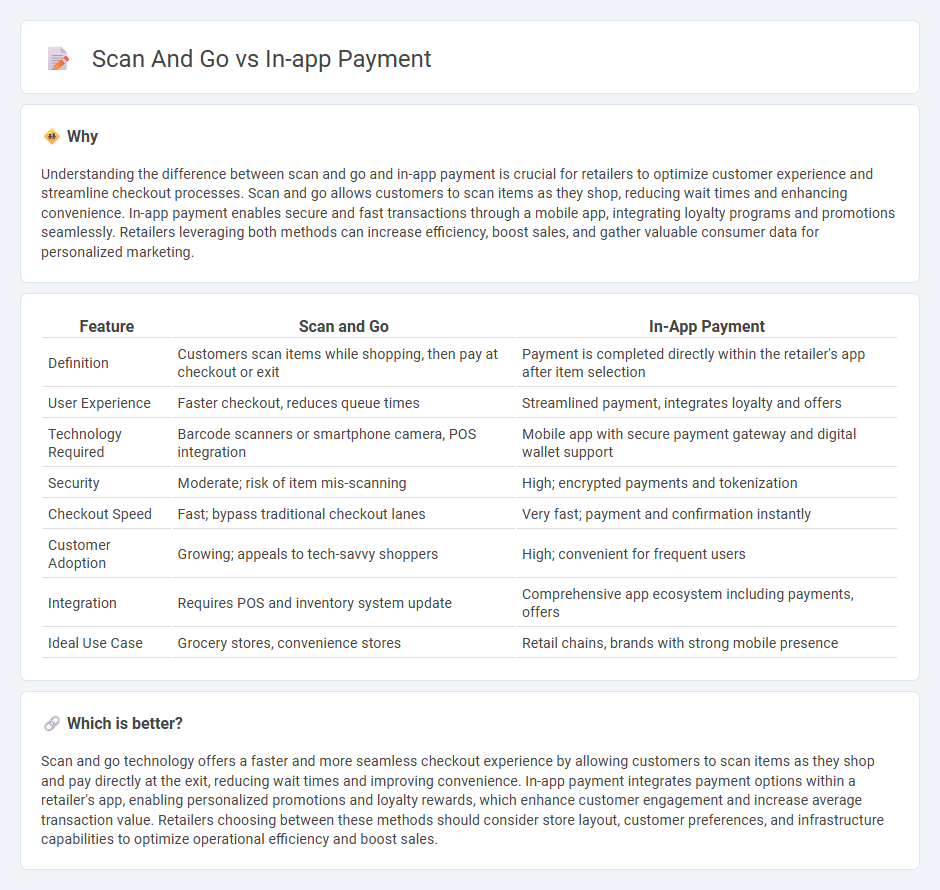

Understanding the difference between scan and go and in-app payment is crucial for retailers to optimize customer experience and streamline checkout processes. Scan and go allows customers to scan items as they shop, reducing wait times and enhancing convenience. In-app payment enables secure and fast transactions through a mobile app, integrating loyalty programs and promotions seamlessly. Retailers leveraging both methods can increase efficiency, boost sales, and gather valuable consumer data for personalized marketing.

Comparison Table

| Feature | Scan and Go | In-App Payment |

|---|---|---|

| Definition | Customers scan items while shopping, then pay at checkout or exit | Payment is completed directly within the retailer's app after item selection |

| User Experience | Faster checkout, reduces queue times | Streamlined payment, integrates loyalty and offers |

| Technology Required | Barcode scanners or smartphone camera, POS integration | Mobile app with secure payment gateway and digital wallet support |

| Security | Moderate; risk of item mis-scanning | High; encrypted payments and tokenization |

| Checkout Speed | Fast; bypass traditional checkout lanes | Very fast; payment and confirmation instantly |

| Customer Adoption | Growing; appeals to tech-savvy shoppers | High; convenient for frequent users |

| Integration | Requires POS and inventory system update | Comprehensive app ecosystem including payments, offers |

| Ideal Use Case | Grocery stores, convenience stores | Retail chains, brands with strong mobile presence |

Which is better?

Scan and go technology offers a faster and more seamless checkout experience by allowing customers to scan items as they shop and pay directly at the exit, reducing wait times and improving convenience. In-app payment integrates payment options within a retailer's app, enabling personalized promotions and loyalty rewards, which enhance customer engagement and increase average transaction value. Retailers choosing between these methods should consider store layout, customer preferences, and infrastructure capabilities to optimize operational efficiency and boost sales.

Connection

Scan and go technology integrates seamlessly with in-app payment systems by allowing customers to scan product barcodes using a mobile app, then complete their purchase directly within the app without waiting in checkout lines. Retailers like Walmart and Amazon leverage this connection to enhance customer convenience, reduce transaction times, and improve store efficiency. This integration supports real-time inventory updates and personalized promotions, driving higher customer engagement and streamlined retail operations.

Key Terms

Mobile Wallet Integration

In-app payment integrates seamlessly with mobile wallets like Apple Pay and Google Pay, offering users a fast, secure checkout experience without leaving the app environment. Scan and go leverages QR code technology paired with mobile wallets to allow real-time item scanning and payment, enhancing convenience and reducing wait times at checkout. Explore how mobile wallet integration can transform your retail strategy by boosting customer engagement and transaction efficiency.

Self-Checkout Technology

Self-checkout technology enhances retail efficiency by enabling customers to complete transactions independently through options like in-app payment and scan and go systems. In-app payment integrates mobile wallets for seamless checkout within store apps, while scan and go leverages barcode scanning to expedite purchases and reduce wait times. Explore the advancements in self-checkout solutions to determine the optimal approach for your retail environment.

QR Code Payment

QR code payment within apps streamlines transactions by enabling instant, contactless scanning directly through smartphones, eliminating the need for physical cards or cash. Scan and Go systems also utilize QR codes, allowing shoppers to scan items as they shop and pay via the app, speeding up checkout and reducing queues. Explore how integrating QR code payments can revolutionize retail experiences and customer convenience.

Source and External Links

What Is In-App Purchase (IAP)? | AppsFlyer Mobile Glossary - In-app purchases are items or services bought within a mobile app, made via app stores, direct app payments, or third-party processors, with app stores like Apple and Google charging commissions on transactions.

What is an in-app purchase? Definition, types & examples - In-app purchases are fees made inside an app beyond the initial download cost, commonly through app store integrations, direct credit card entry, or third-party payment processors like PayPal.

A merchant's guide to in-app payment processing - In-app payment processing enables merchants to accept payments for goods or subscriptions inside an app via secure checkout, requiring integration with payment providers and adherence to app store rules.

dowidth.com

dowidth.com