Loss prevention analytics focuses on identifying and mitigating risks related to theft, inventory shrinkage, and employee dishonesty within retail environments, using data-driven insights to enhance operational security. Fraud detection, meanwhile, centers on uncovering deceptive transactions and financial crimes that compromise revenue and customer trust by analyzing patterns in payment data and customer behavior. Discover how advanced analytics integrate these approaches to safeguard retail businesses more effectively.

Why it is important

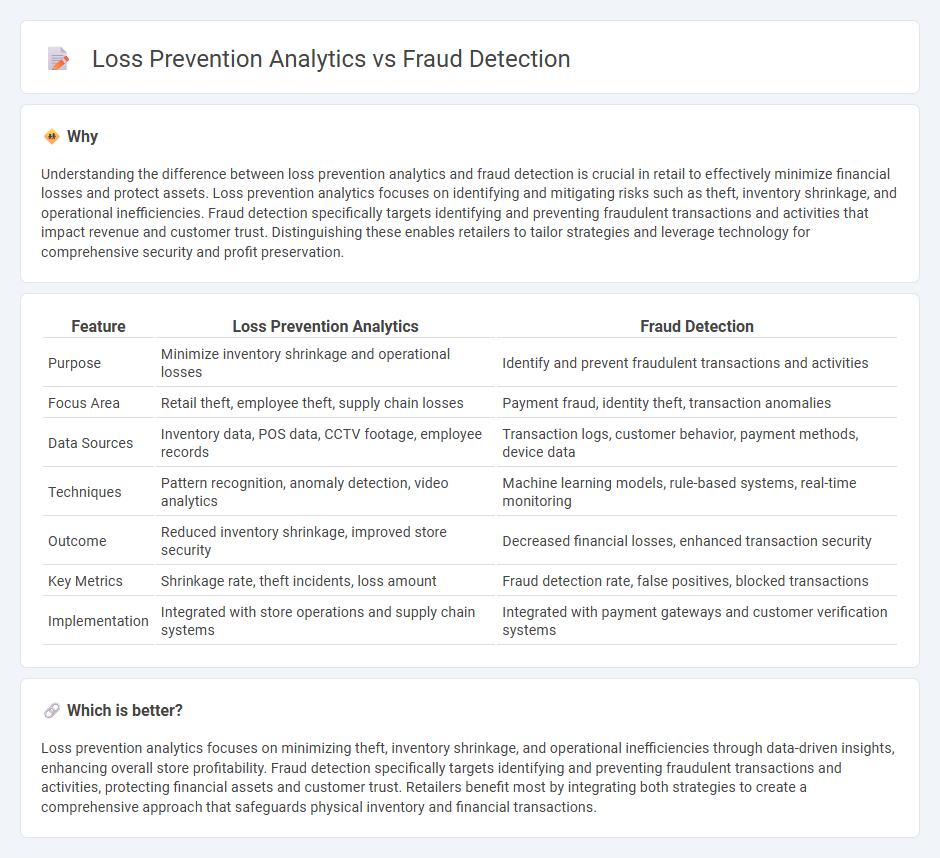

Understanding the difference between loss prevention analytics and fraud detection is crucial in retail to effectively minimize financial losses and protect assets. Loss prevention analytics focuses on identifying and mitigating risks such as theft, inventory shrinkage, and operational inefficiencies. Fraud detection specifically targets identifying and preventing fraudulent transactions and activities that impact revenue and customer trust. Distinguishing these enables retailers to tailor strategies and leverage technology for comprehensive security and profit preservation.

Comparison Table

| Feature | Loss Prevention Analytics | Fraud Detection |

|---|---|---|

| Purpose | Minimize inventory shrinkage and operational losses | Identify and prevent fraudulent transactions and activities |

| Focus Area | Retail theft, employee theft, supply chain losses | Payment fraud, identity theft, transaction anomalies |

| Data Sources | Inventory data, POS data, CCTV footage, employee records | Transaction logs, customer behavior, payment methods, device data |

| Techniques | Pattern recognition, anomaly detection, video analytics | Machine learning models, rule-based systems, real-time monitoring |

| Outcome | Reduced inventory shrinkage, improved store security | Decreased financial losses, enhanced transaction security |

| Key Metrics | Shrinkage rate, theft incidents, loss amount | Fraud detection rate, false positives, blocked transactions |

| Implementation | Integrated with store operations and supply chain systems | Integrated with payment gateways and customer verification systems |

Which is better?

Loss prevention analytics focuses on minimizing theft, inventory shrinkage, and operational inefficiencies through data-driven insights, enhancing overall store profitability. Fraud detection specifically targets identifying and preventing fraudulent transactions and activities, protecting financial assets and customer trust. Retailers benefit most by integrating both strategies to create a comprehensive approach that safeguards physical inventory and financial transactions.

Connection

Loss prevention analytics and fraud detection are interconnected through the use of advanced data analysis techniques that identify unusual transaction patterns and behaviors indicative of theft or fraud in retail environments. By leveraging machine learning algorithms and real-time data monitoring, retailers can detect anomalies such as return fraud, employee theft, and payment fraud more efficiently. Integrating these analytics into retail management systems enhances security measures and minimizes financial losses, improving overall operational integrity.

Key Terms

Transaction Monitoring

Fraud detection primarily focuses on identifying suspicious transactions in real-time using advanced algorithms and machine learning to minimize financial risks. Loss prevention analytics encompasses a broader scope, combining transaction monitoring with operational data to reduce overall losses from theft, errors, or fraud within retail environments. Explore in-depth how transaction monitoring tools optimize both fraud detection and loss prevention strategies.

Shrinkage Analysis

Shrinkage analysis plays a critical role in both fraud detection and loss prevention analytics by identifying discrepancies between recorded inventory and actual stock levels. Fraud detection targets intentional deceit, such as employee theft or fraudulent transactions, while loss prevention analytics encompasses broader causes including administrative errors and supplier fraud. Explore detailed strategies and tools to enhance shrinkage analysis for robust loss control and accurate fraud identification.

Exception Reporting

Fraud detection leverages advanced algorithms and machine learning models to identify suspicious activities, while loss prevention analytics centers on exception reporting to highlight anomalies in transaction patterns or inventory discrepancies. Exception reporting serves as a critical tool in loss prevention by generating alerts for transactions that deviate from predefined norms, enabling quicker investigations and mitigation. Explore more about how exception reporting enhances both fraud detection and loss prevention strategies.

Source and External Links

What is fraud detection and why is it needed? - Fraud detection is the process of identifying fraudulent activities by analyzing customer behavior and data patterns, often enhanced by AI and machine learning, to prevent financial loss and reputation damage through multi-stage analysis and association rule identification.

How Fraud Detection Works: Common Software and Tools - Fraud detection systems collect and aggregate data from multiple sources, perform feature engineering to capture suspicious patterns, and apply rule engines or AI models to identify anomalies in transactions and user behavior, widely used in banking and e-commerce.

Fraud detection: An overview - Fraud detection involves systematically identifying suspicious financial activities through pattern analysis over time to uncover fraud attempts, emphasizing it as a critical component of fraud risk management alongside prevention and investigation.

dowidth.com

dowidth.com