Resale arbitrage involves purchasing products at a lower price from retail stores or online platforms and then selling them at a higher price for profit, leveraging price differences across markets. Consignment is a retail strategy where sellers provide goods to a retailer who sells the items on their behalf, paying the consignor only after the merchandise is sold. Explore the distinct benefits and challenges of resale arbitrage and consignment to optimize your retail strategy.

Why it is important

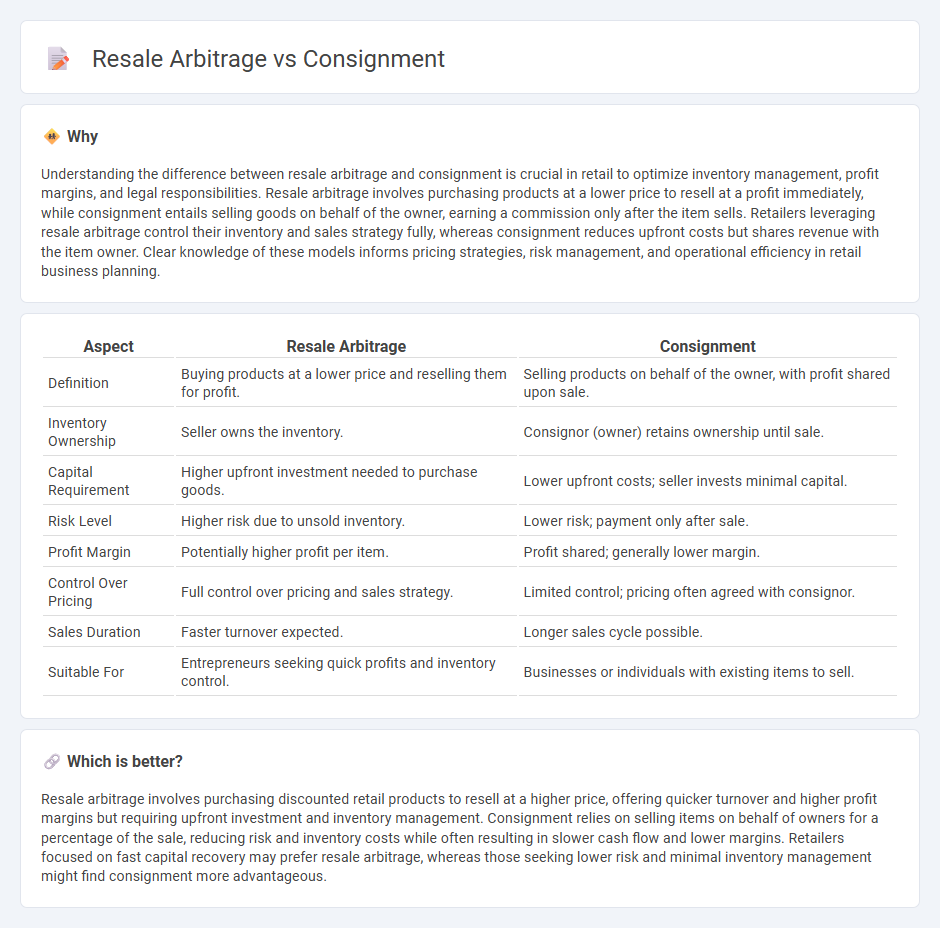

Understanding the difference between resale arbitrage and consignment is crucial in retail to optimize inventory management, profit margins, and legal responsibilities. Resale arbitrage involves purchasing products at a lower price to resell at a profit immediately, while consignment entails selling goods on behalf of the owner, earning a commission only after the item sells. Retailers leveraging resale arbitrage control their inventory and sales strategy fully, whereas consignment reduces upfront costs but shares revenue with the item owner. Clear knowledge of these models informs pricing strategies, risk management, and operational efficiency in retail business planning.

Comparison Table

| Aspect | Resale Arbitrage | Consignment |

|---|---|---|

| Definition | Buying products at a lower price and reselling them for profit. | Selling products on behalf of the owner, with profit shared upon sale. |

| Inventory Ownership | Seller owns the inventory. | Consignor (owner) retains ownership until sale. |

| Capital Requirement | Higher upfront investment needed to purchase goods. | Lower upfront costs; seller invests minimal capital. |

| Risk Level | Higher risk due to unsold inventory. | Lower risk; payment only after sale. |

| Profit Margin | Potentially higher profit per item. | Profit shared; generally lower margin. |

| Control Over Pricing | Full control over pricing and sales strategy. | Limited control; pricing often agreed with consignor. |

| Sales Duration | Faster turnover expected. | Longer sales cycle possible. |

| Suitable For | Entrepreneurs seeking quick profits and inventory control. | Businesses or individuals with existing items to sell. |

Which is better?

Resale arbitrage involves purchasing discounted retail products to resell at a higher price, offering quicker turnover and higher profit margins but requiring upfront investment and inventory management. Consignment relies on selling items on behalf of owners for a percentage of the sale, reducing risk and inventory costs while often resulting in slower cash flow and lower margins. Retailers focused on fast capital recovery may prefer resale arbitrage, whereas those seeking lower risk and minimal inventory management might find consignment more advantageous.

Connection

Resale arbitrage and consignment both focus on monetizing pre-owned goods by leveraging market demand for discounted or unique items. Resale arbitrage involves buying products at a lower price to resell them for profit, while consignment allows individuals to sell items through third-party stores or platforms, sharing proceeds without upfront purchasing. These methods optimize inventory turnover and provide sustainable retail options by tapping into circular economy trends.

Key Terms

Inventory Ownership

Consignment inventory remains legally owned by the supplier until sold, minimizing upfront costs for retailers who only pay after a sale is made. Resale arbitrage involves purchasing products outright from one market to resell at a higher price, requiring full inventory ownership and capital investment by the seller. Explore deeper insights on inventory ownership and financial implications in consignment versus resale arbitrage models.

Profit Margin

Consignment typically offers lower profit margins since sellers receive a percentage of the final sale price, while resale arbitrage allows for higher margins by purchasing items at a discount and selling at market value. Profitability in consignment depends on the vendor's commission rate, often ranging from 20% to 50%, reducing the seller's net revenue. Explore detailed strategies and case studies to maximize your profits in both models.

Risk Allocation

Consignment involves the supplier retaining ownership of inventory until it sells, reducing upfront risk for the retailer but placing risk of unsold stock on the consignor. Resale arbitrage requires purchasing products outright, transferring inventory risk entirely to the retailer but allowing greater control over pricing and sales strategy. Explore detailed risk profiles and financial implications to determine which model best suits your business goals.

Source and External Links

What is Consignment, How It Works, and Examples - Consignment is a business model where one party sells goods on behalf of another party (the consignor) for a fee or commission, frequently used for second-hand or niche products like clothing, antiques, or jewelry.

Consignment - Wikipedia - Consignment is a process where ownership stays with the consignor while the consignee is entrusted to sell or care for the goods, with specific accounting rules governing control and revenue recognition.

Labels Consignment - Bellingham - Labels Consignment is a local consignment store offering a wide variety of merchandise, where individuals can bring in gently-used items to sell on consignment during business hours without appointment.

dowidth.com

dowidth.com