Worktech stack integrates various tools designed to optimize workforce management, including scheduling, recruitment, and performance tracking, while payroll software focuses specifically on automating salary calculations, tax deductions, and compliance with labor laws. Companies looking to streamline HR processes often evaluate how worktech stacks complement or replace standalone payroll systems for efficient resource allocation. Explore the key differences and benefits to find the ideal human resources technology for your organization.

Why it is important

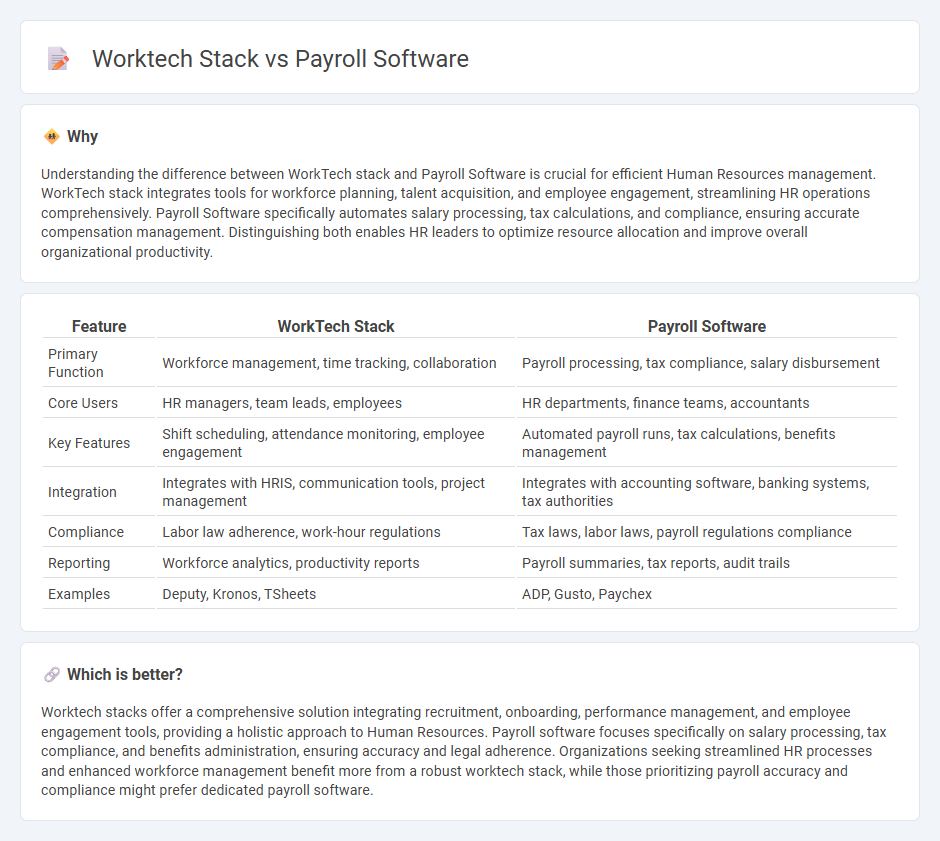

Understanding the difference between WorkTech stack and Payroll Software is crucial for efficient Human Resources management. WorkTech stack integrates tools for workforce planning, talent acquisition, and employee engagement, streamlining HR operations comprehensively. Payroll Software specifically automates salary processing, tax calculations, and compliance, ensuring accurate compensation management. Distinguishing both enables HR leaders to optimize resource allocation and improve overall organizational productivity.

Comparison Table

| Feature | WorkTech Stack | Payroll Software |

|---|---|---|

| Primary Function | Workforce management, time tracking, collaboration | Payroll processing, tax compliance, salary disbursement |

| Core Users | HR managers, team leads, employees | HR departments, finance teams, accountants |

| Key Features | Shift scheduling, attendance monitoring, employee engagement | Automated payroll runs, tax calculations, benefits management |

| Integration | Integrates with HRIS, communication tools, project management | Integrates with accounting software, banking systems, tax authorities |

| Compliance | Labor law adherence, work-hour regulations | Tax laws, labor laws, payroll regulations compliance |

| Reporting | Workforce analytics, productivity reports | Payroll summaries, tax reports, audit trails |

| Examples | Deputy, Kronos, TSheets | ADP, Gusto, Paychex |

Which is better?

Worktech stacks offer a comprehensive solution integrating recruitment, onboarding, performance management, and employee engagement tools, providing a holistic approach to Human Resources. Payroll software focuses specifically on salary processing, tax compliance, and benefits administration, ensuring accuracy and legal adherence. Organizations seeking streamlined HR processes and enhanced workforce management benefit more from a robust worktech stack, while those prioritizing payroll accuracy and compliance might prefer dedicated payroll software.

Connection

Worktech stack integrates various HR technologies, streamlining recruitment, onboarding, and workforce management processes while Payroll Software automates employee compensation, tax calculations, and compliance tracking. The connection between worktech stack and Payroll Software ensures seamless data synchronization, reducing errors and enhancing payroll accuracy. This integration supports efficient workforce analytics and improves overall human resources management.

Key Terms

Automation

Payroll software automates employee payment processing, tax calculations, and compliance, significantly reducing manual errors and saving time. Worktech stacks integrate multiple tools like workforce management, HR, and payroll into a seamless system to enhance operational efficiency and data accuracy. Explore how combining payroll software with a comprehensive worktech stack can optimize automation across your organization.

Integration

Payroll software excels in automating employee compensation, tax calculations, and compliance reporting, streamlining financial operations. Worktech stack integration offers a holistic approach by connecting payroll with HR, scheduling, time tracking, and employee engagement tools, enhancing operational efficiency and data accuracy. Discover how integrating payroll software within a comprehensive worktech stack can transform your workforce management.

Compliance

Payroll software automates salary calculations, tax deductions, and statutory compliance, ensuring accurate adherence to labor laws and tax regulations. In contrast, a worktech stack integrates multiple HR tools, including payroll, time tracking, and compliance management, offering a unified solution for workforce administration. Explore how combining payroll software with a comprehensive worktech stack enhances regulatory compliance and operational efficiency.

Source and External Links

Payroll Software | Online Payroll Services - ADP offers easy and affordable payroll services designed to help businesses manage payroll efficiently and stay compliant with tax regulations.

What Is Payroll Software? - Oracle's overview explains payroll software as an on-premises or cloud-based solution that automates employee payments and ensures compliance with financial regulations.

Payroll Services | Online Payroll Software - Square provides comprehensive payroll services with automated tax filings, integrated with their POS system for efficient payroll processing.

dowidth.com

dowidth.com