Passive income streams generate revenue with minimal ongoing effort by leveraging assets such as rental properties, dividend stocks, or digital products, providing financial stability through consistent cash flow. Scalable business models focus on rapid growth potential by expanding market reach and increasing production without a proportional rise in costs, often utilizing technology platforms or subscription services for exponential income. Explore further to understand which approach aligns best with your entrepreneurial goals and risk tolerance.

Why it is important

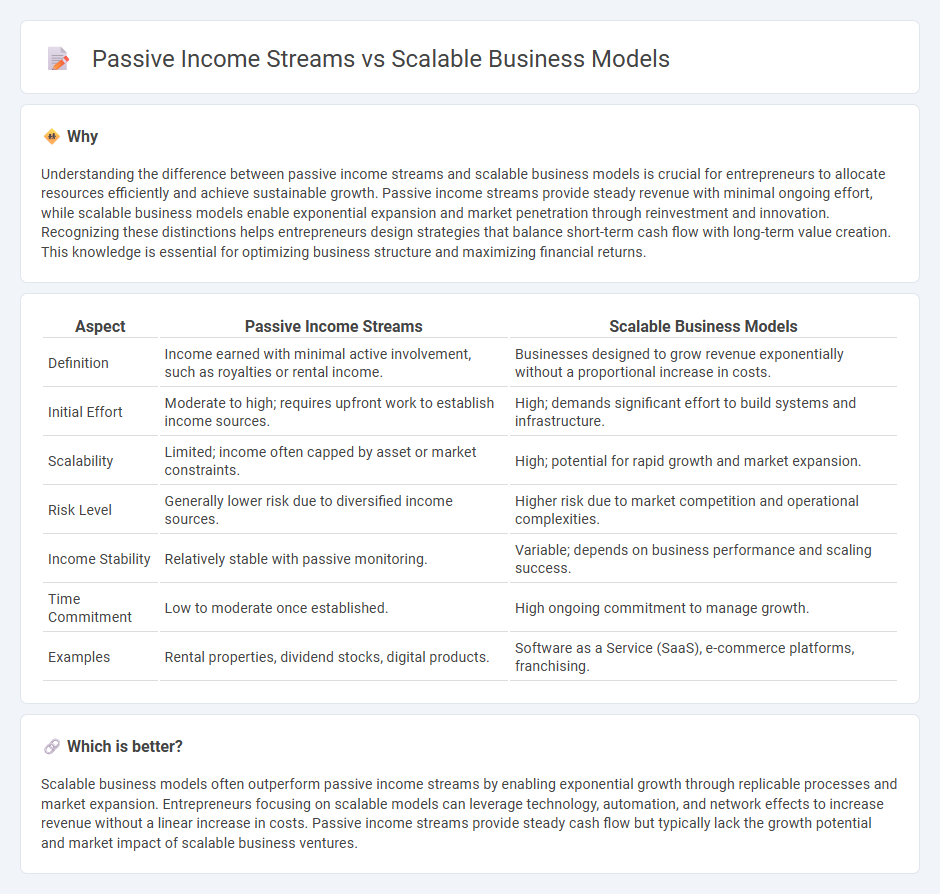

Understanding the difference between passive income streams and scalable business models is crucial for entrepreneurs to allocate resources efficiently and achieve sustainable growth. Passive income streams provide steady revenue with minimal ongoing effort, while scalable business models enable exponential expansion and market penetration through reinvestment and innovation. Recognizing these distinctions helps entrepreneurs design strategies that balance short-term cash flow with long-term value creation. This knowledge is essential for optimizing business structure and maximizing financial returns.

Comparison Table

| Aspect | Passive Income Streams | Scalable Business Models |

|---|---|---|

| Definition | Income earned with minimal active involvement, such as royalties or rental income. | Businesses designed to grow revenue exponentially without a proportional increase in costs. |

| Initial Effort | Moderate to high; requires upfront work to establish income sources. | High; demands significant effort to build systems and infrastructure. |

| Scalability | Limited; income often capped by asset or market constraints. | High; potential for rapid growth and market expansion. |

| Risk Level | Generally lower risk due to diversified income sources. | Higher risk due to market competition and operational complexities. |

| Income Stability | Relatively stable with passive monitoring. | Variable; depends on business performance and scaling success. |

| Time Commitment | Low to moderate once established. | High ongoing commitment to manage growth. |

| Examples | Rental properties, dividend stocks, digital products. | Software as a Service (SaaS), e-commerce platforms, franchising. |

Which is better?

Scalable business models often outperform passive income streams by enabling exponential growth through replicable processes and market expansion. Entrepreneurs focusing on scalable models can leverage technology, automation, and network effects to increase revenue without a linear increase in costs. Passive income streams provide steady cash flow but typically lack the growth potential and market impact of scalable business ventures.

Connection

Passive income streams often rely on scalable business models that enable entrepreneurs to generate revenue with minimal ongoing effort. Scalable models such as digital products, subscription services, and automated online platforms allow income to grow exponentially without proportional increases in costs or time investment. This connection facilitates sustained financial freedom by leveraging systems designed for long-term, low-maintenance profitability.

Key Terms

Growth Potential

Scalable business models offer exponential growth potential by leveraging technology, automation, and systems to increase output without a proportional increase in costs or resources. Passive income streams generate consistent revenue with minimal ongoing effort but often face limitations in scaling significantly without additional investment or strategic expansion. Explore how aligning scalable models with passive income strategies can maximize your financial growth potential.

Automation

Scalable business models leverage automation to efficiently handle increasing workloads without a linear rise in operational costs, optimizing growth and profitability. Passive income streams utilize automation by setting up systems like affiliate marketing, dropshipping, or digital products that generate revenue with minimal ongoing effort. Explore how integrating automation in both approaches can maximize financial freedom and business resilience.

Revenue Consistency

Scalable business models prioritize revenue consistency by enabling growth without a proportional increase in costs, often leveraging technology or digital platforms to reach broader markets. Passive income streams, such as royalties or rental income, offer steady revenue but may lack the dynamic scalability necessary to rapidly increase profits. Explore detailed strategies to balance scalable growth and stable passive income for optimal financial health.

Source and External Links

What Is A Scalable Business Model? Scalable ... - FourWeekMBA - A scalable business model allows a company to increase productivity with the same input by leveraging external resources, automating processes, and outsourcing tasks; examples include software, online courses, and franchising such as Microsoft, online course platforms, and McDonald's franchises.

Scalable Business Model Explained: Tips & Examples - MightyCall - The freemium model is a popular scalable business strategy where a basic product is offered for free to attract users who then upgrade to paid premium tiers, exemplified by companies like HubSpot.

14 Scalable business ideas to grow your profit fast - Printify - Scalable business models often involve minimal upfront investment with rapid growth potential, such as SaaS, eCommerce, online education, and print-on-demand businesses that leverage automation and digital tools for expansion.

dowidth.com

dowidth.com