Entrepreneurship includes diverse income streams such as passive income and product-based revenue. Passive income generates earnings with minimal ongoing effort through investments, royalties, or rental properties, while product-based income relies on actively selling goods, requiring inventory management and customer engagement. Explore key strategies to maximize both income types and boost your entrepreneurial success.

Why it is important

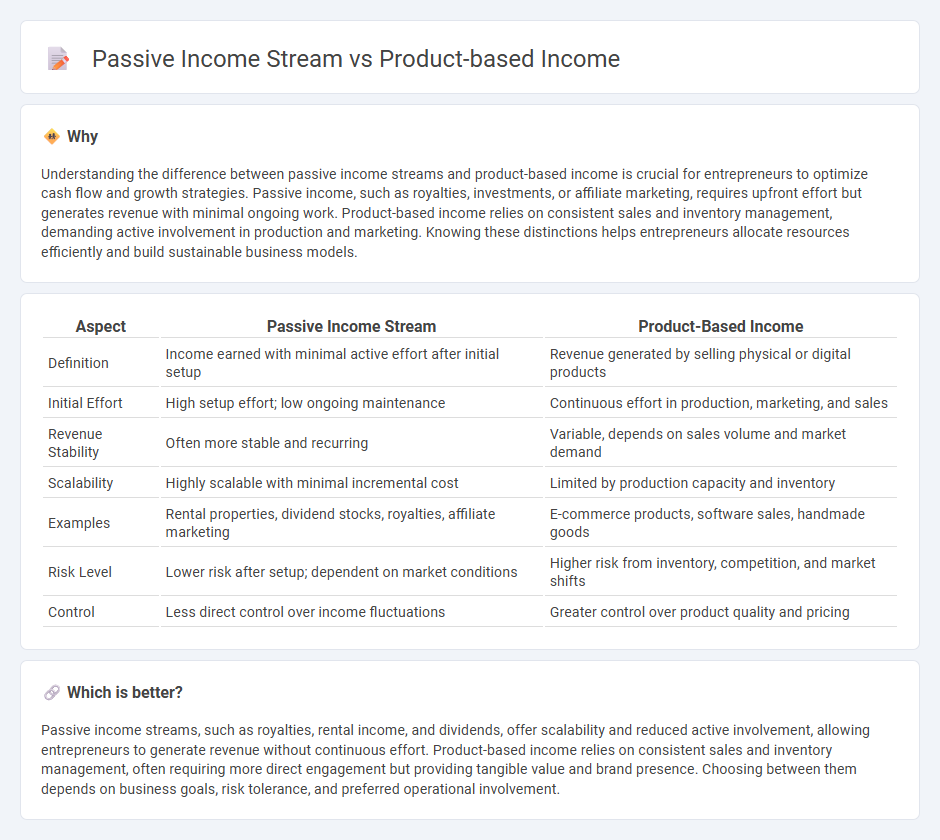

Understanding the difference between passive income streams and product-based income is crucial for entrepreneurs to optimize cash flow and growth strategies. Passive income, such as royalties, investments, or affiliate marketing, requires upfront effort but generates revenue with minimal ongoing work. Product-based income relies on consistent sales and inventory management, demanding active involvement in production and marketing. Knowing these distinctions helps entrepreneurs allocate resources efficiently and build sustainable business models.

Comparison Table

| Aspect | Passive Income Stream | Product-Based Income |

|---|---|---|

| Definition | Income earned with minimal active effort after initial setup | Revenue generated by selling physical or digital products |

| Initial Effort | High setup effort; low ongoing maintenance | Continuous effort in production, marketing, and sales |

| Revenue Stability | Often more stable and recurring | Variable, depends on sales volume and market demand |

| Scalability | Highly scalable with minimal incremental cost | Limited by production capacity and inventory |

| Examples | Rental properties, dividend stocks, royalties, affiliate marketing | E-commerce products, software sales, handmade goods |

| Risk Level | Lower risk after setup; dependent on market conditions | Higher risk from inventory, competition, and market shifts |

| Control | Less direct control over income fluctuations | Greater control over product quality and pricing |

Which is better?

Passive income streams, such as royalties, rental income, and dividends, offer scalability and reduced active involvement, allowing entrepreneurs to generate revenue without continuous effort. Product-based income relies on consistent sales and inventory management, often requiring more direct engagement but providing tangible value and brand presence. Choosing between them depends on business goals, risk tolerance, and preferred operational involvement.

Connection

Passive income streams often emerge from product-based income models through scalable assets like digital products, subscriptions, or royalties. Entrepreneurs can leverage product-based revenue to generate ongoing cash flow without continuous active involvement. This connection enables sustainable business growth while minimizing time investment.

Key Terms

Inventory Management

Product-based income requires active inventory management, including procurement, storage, and order fulfillment, which directly impacts cash flow and operational costs. Passive income streams, such as digital products or dropshipping, minimize inventory handling, reducing overhead and risks associated with stock management. Explore strategies to optimize your inventory management for maximizing both income streams.

Recurring Revenue

Product-based income generates revenue through direct sales of goods or services, often requiring continuous effort to maintain customer acquisition and fulfillment. Passive income streams, particularly those emphasizing recurring revenue models like subscriptions or memberships, deliver consistent cash flow with minimal ongoing input. Explore efficient strategies to build sustainable recurring revenue for lasting financial stability.

Automation

Product-based income relies on selling goods or services, requiring continuous effort in production, inventory management, and customer service. Passive income streams leverage automation through systems like subscription models, affiliate marketing, or digital products, minimizing active involvement while generating revenue consistently. Explore how automation transforms income strategies and unlocks financial freedom.

Source and External Links

The Expert's Guide to What is Sales of Product Income... - Product-based income refers to the revenue generated specifically from selling goods or products, which is the main source of revenue for product-based businesses and crucial for measuring financial performance and guiding strategic decisions.

Difference Between Product Based Vs. Service Based Company - Product-based companies earn income by creating and selling products that offer solutions to customers, typically providing fixed salaries to employees, whereas income depends on product sales generated.

Product Revenue | Scrum.org - Product revenue is the total income an individual product generates and indicates product performance, though it must be analyzed alongside costs to understand profitability fully.

dowidth.com

dowidth.com