Embedded finance integrates financial services directly into non-financial platforms, enabling businesses to offer seamless payment, lending, and insurance solutions within their existing ecosystems. Neobanking, on the other hand, refers to fully digital banks that operate without physical branches, focusing on user-friendly mobile banking and streamlined financial products. Explore the evolving roles of embedded finance and neobanking in transforming entrepreneurial financial strategies.

Why it is important

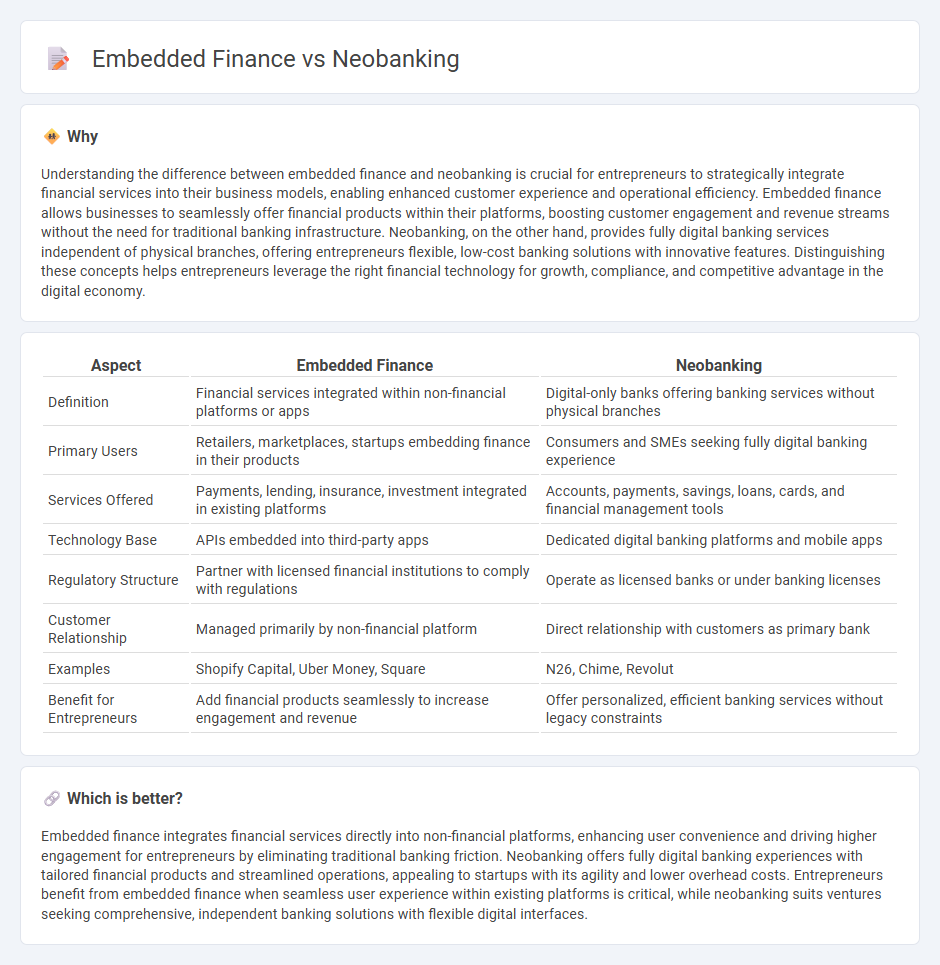

Understanding the difference between embedded finance and neobanking is crucial for entrepreneurs to strategically integrate financial services into their business models, enabling enhanced customer experience and operational efficiency. Embedded finance allows businesses to seamlessly offer financial products within their platforms, boosting customer engagement and revenue streams without the need for traditional banking infrastructure. Neobanking, on the other hand, provides fully digital banking services independent of physical branches, offering entrepreneurs flexible, low-cost banking solutions with innovative features. Distinguishing these concepts helps entrepreneurs leverage the right financial technology for growth, compliance, and competitive advantage in the digital economy.

Comparison Table

| Aspect | Embedded Finance | Neobanking |

|---|---|---|

| Definition | Financial services integrated within non-financial platforms or apps | Digital-only banks offering banking services without physical branches |

| Primary Users | Retailers, marketplaces, startups embedding finance in their products | Consumers and SMEs seeking fully digital banking experience |

| Services Offered | Payments, lending, insurance, investment integrated in existing platforms | Accounts, payments, savings, loans, cards, and financial management tools |

| Technology Base | APIs embedded into third-party apps | Dedicated digital banking platforms and mobile apps |

| Regulatory Structure | Partner with licensed financial institutions to comply with regulations | Operate as licensed banks or under banking licenses |

| Customer Relationship | Managed primarily by non-financial platform | Direct relationship with customers as primary bank |

| Examples | Shopify Capital, Uber Money, Square | N26, Chime, Revolut |

| Benefit for Entrepreneurs | Add financial products seamlessly to increase engagement and revenue | Offer personalized, efficient banking services without legacy constraints |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing user convenience and driving higher engagement for entrepreneurs by eliminating traditional banking friction. Neobanking offers fully digital banking experiences with tailored financial products and streamlined operations, appealing to startups with its agility and lower overhead costs. Entrepreneurs benefit from embedded finance when seamless user experience within existing platforms is critical, while neobanking suits ventures seeking comprehensive, independent banking solutions with flexible digital interfaces.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling entrepreneurs to offer seamless payment, lending, and banking solutions within their products. Neobanking leverages digital technology to provide streamlined, user-centric banking services, often partnering with embedded finance platforms to expand financial accessibility for startups and small businesses. This synergy empowers entrepreneurs to access tailored financial tools, simplify transactions, and enhance customer experiences without traditional banking constraints.

Key Terms

Digital Banking Platform

Neobanking offers fully digital banking services through specialized platforms, providing seamless account management, payments, and personalized financial products without traditional branch infrastructure. Embedded finance integrates financial services directly into non-bank platforms, enabling businesses to offer banking features like lending or payments within their apps, enhancing customer experience and increasing engagement. Explore how digital banking platforms shape the future of seamless financial services and customer-centric innovation.

API Integration

Neobanking and embedded finance both rely heavily on API integration to deliver seamless financial services, with neobanks using APIs to create full-fledged digital banking platforms, while embedded finance embeds financial features directly into non-financial apps via APIs. Effective API integration enables neobanks to offer personalized user experiences, real-time data access, and advanced financial products, whereas embedded finance APIs facilitate on-demand payments, lending, and insurance within everyday applications. Explore more to understand how API integration differentiates these innovative financial models and drives their growth.

Banking-as-a-Service (BaaS)

Neobanking offers fully digital banking services independently, while embedded finance integrates financial products directly into non-financial platforms via Banking-as-a-Service (BaaS). BaaS enables third-party providers to access banking infrastructure through APIs, enhancing customer experience with seamless financial functionalities embedded in apps or websites. Explore how BaaS transforms customer engagement and drives innovation in financial ecosystems.

Source and External Links

What are neobanks, and how do they work? - Neobanks are digital-only banks operating via mobile apps and websites, offering services similar to traditional banks but with lower fees and enhanced digital features, targeting users like millennials and the underbanked.

What is a Neobank? How It Works, Examples, Pros & Cons - Neobanks are fintech companies providing exclusively online financial services through apps or websites, often without full banking licenses, focusing on specialized products or customer segments.

What Is a Neobank? - A neobank is a tech firm partnering with established banks to offer digital banking services like checking and savings accounts, typically with lower fees but limited in-person support.

dowidth.com

dowidth.com