Tiny acquisitions focus on purchasing small, profitable businesses with established cash flow, offering entrepreneurs a lower-risk entry into ownership compared to starting from scratch. Micro SaaS involves developing compact, niche software solutions with recurring subscription revenue, emphasizing scalability and minimal operational complexity. Explore the unique advantages and strategic considerations of tiny acquisitions versus micro SaaS to determine the best entrepreneurial path for you.

Why it is important

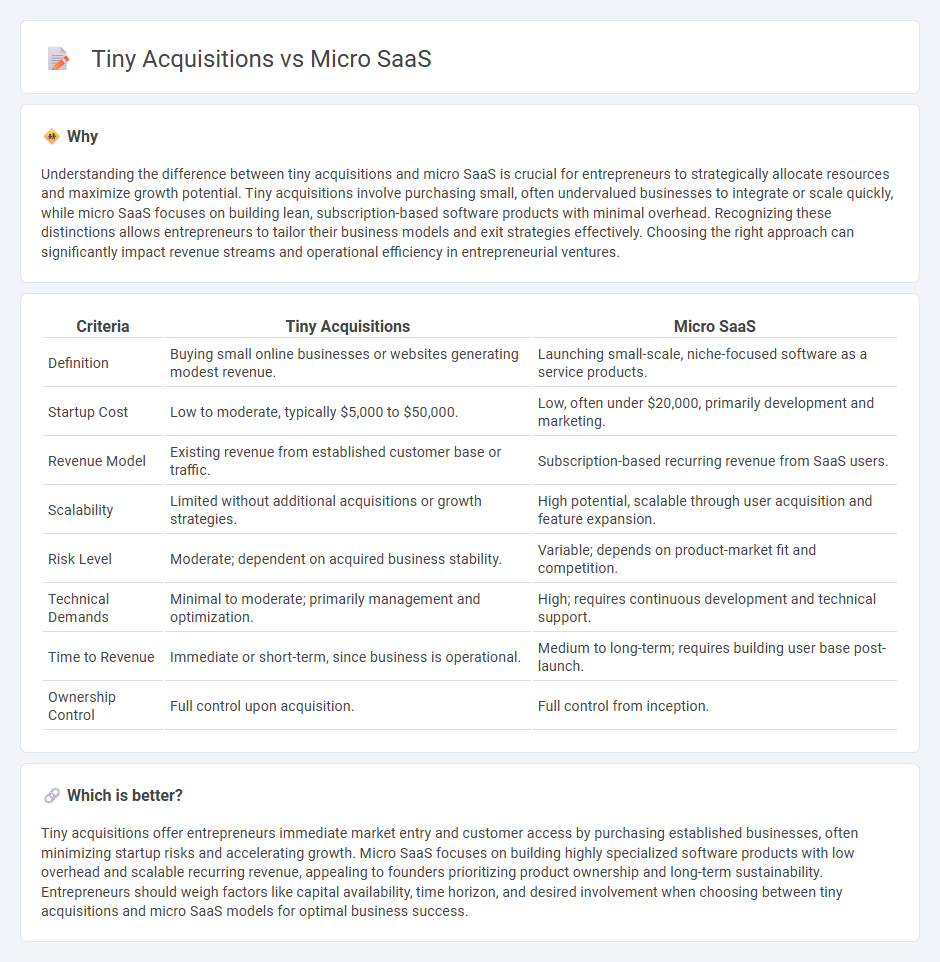

Understanding the difference between tiny acquisitions and micro SaaS is crucial for entrepreneurs to strategically allocate resources and maximize growth potential. Tiny acquisitions involve purchasing small, often undervalued businesses to integrate or scale quickly, while micro SaaS focuses on building lean, subscription-based software products with minimal overhead. Recognizing these distinctions allows entrepreneurs to tailor their business models and exit strategies effectively. Choosing the right approach can significantly impact revenue streams and operational efficiency in entrepreneurial ventures.

Comparison Table

| Criteria | Tiny Acquisitions | Micro SaaS |

|---|---|---|

| Definition | Buying small online businesses or websites generating modest revenue. | Launching small-scale, niche-focused software as a service products. |

| Startup Cost | Low to moderate, typically $5,000 to $50,000. | Low, often under $20,000, primarily development and marketing. |

| Revenue Model | Existing revenue from established customer base or traffic. | Subscription-based recurring revenue from SaaS users. |

| Scalability | Limited without additional acquisitions or growth strategies. | High potential, scalable through user acquisition and feature expansion. |

| Risk Level | Moderate; dependent on acquired business stability. | Variable; depends on product-market fit and competition. |

| Technical Demands | Minimal to moderate; primarily management and optimization. | High; requires continuous development and technical support. |

| Time to Revenue | Immediate or short-term, since business is operational. | Medium to long-term; requires building user base post-launch. |

| Ownership Control | Full control upon acquisition. | Full control from inception. |

Which is better?

Tiny acquisitions offer entrepreneurs immediate market entry and customer access by purchasing established businesses, often minimizing startup risks and accelerating growth. Micro SaaS focuses on building highly specialized software products with low overhead and scalable recurring revenue, appealing to founders prioritizing product ownership and long-term sustainability. Entrepreneurs should weigh factors like capital availability, time horizon, and desired involvement when choosing between tiny acquisitions and micro SaaS models for optimal business success.

Connection

Tiny acquisitions often serve as exit strategies for micro SaaS businesses, offering entrepreneurs quick liquidity and market validation. Micro SaaS companies, characterized by their niche focus and low overhead, attract buyers seeking streamlined, revenue-generating assets without extensive integration challenges. This synergy accelerates growth cycles and diversifies entrepreneurial portfolios in the software industry.

Key Terms

Niche Market

Micro SaaS companies excel in targeting highly specific niche markets with tailored software solutions that address unique customer pain points, offering scalability and low operational costs. Tiny acquisitions often complement larger enterprises by integrating specialized products or services that enhance market reach and value proposition without significant overhead. Explore the strategic advantages and operational nuances of micro SaaS versus tiny acquisitions to maximize niche market impact.

Bootstrapping

Bootstrapping a micro SaaS involves developing a scalable, niche software product with minimal upfront investment, relying on organic growth and customer revenue. Tiny acquisitions, by contrast, require upfront capital to purchase small, often underperforming businesses that can be optimized or integrated for incremental growth. Explore how choosing between micro SaaS and tiny acquisitions impacts your bootstrapping strategy and long-term business sustainability.

Exit Strategy

Micro SaaS businesses offer scalable, niche software solutions with low overhead and predictable recurring revenue, appealing to founders targeting sustainable growth and modest exits. Tiny acquisitions, typically small startups or products acquired by larger companies, provide quick liquidity and validation but often yield less long-term control or scalability. Explore detailed strategies to align your exit plan with your business model and growth goals.

Source and External Links

10 top micro SaaS examples: Building profitable apps for success - Micro SaaS refers to small-scale cloud-based software businesses targeting specific niches, typically managed by solo founders or small teams without external funding, focusing on efficiency and profitability with minimal resources.

Micro SaaS: What It Is and How to Build One | HackerNoon - Micro SaaS focuses on a single product solving a specific niche problem, is self-funded, simpler than regular SaaS, and targets specialized markets instead of broad audiences.

What is a Micro-SaaS and How to Create One - Micro SaaS products are small, simple SaaS offerings that serve very narrow markets with one functional purpose and can be created and launched quickly compared to broader SaaS applications.

dowidth.com

dowidth.com