Sweat equity marketplaces enable entrepreneurs to exchange time and skills for ownership in startups, fostering collaboration without immediate capital investment. Grant funding offers non-repayable financial support from governmental or private organizations, providing critical resources for innovation and growth. Explore more insights on how these financing methods impact entrepreneurial success and sustainability.

Why it is important

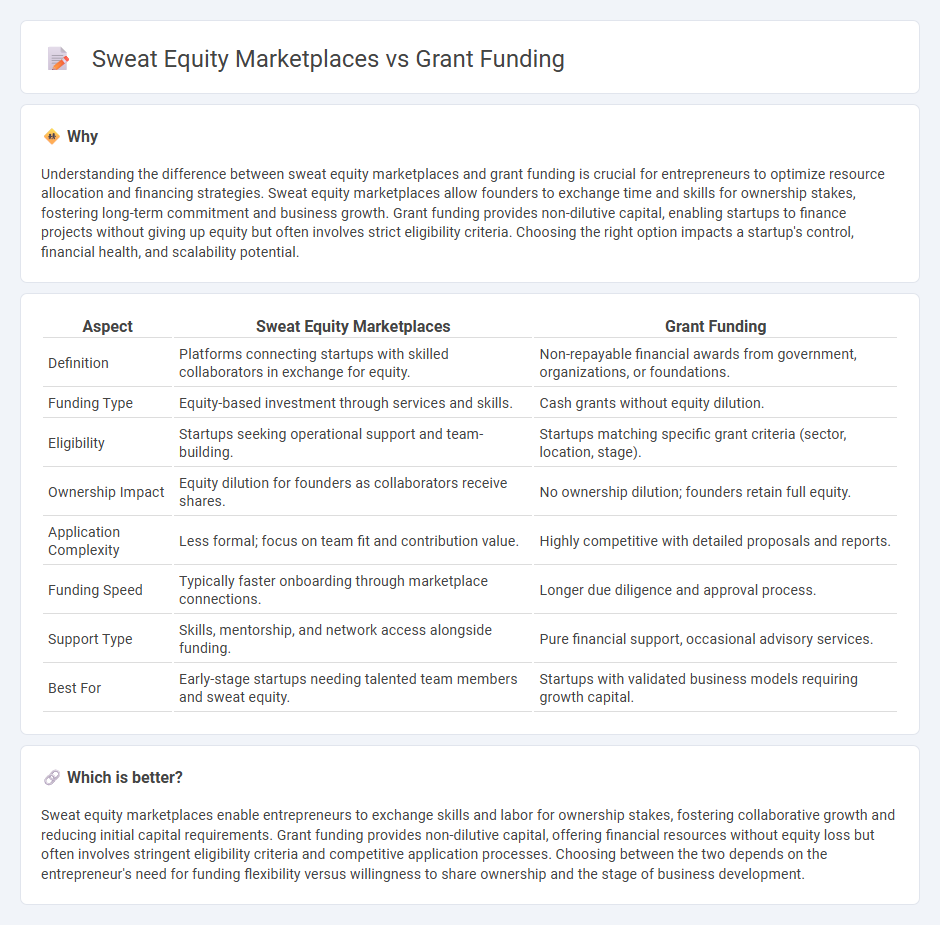

Understanding the difference between sweat equity marketplaces and grant funding is crucial for entrepreneurs to optimize resource allocation and financing strategies. Sweat equity marketplaces allow founders to exchange time and skills for ownership stakes, fostering long-term commitment and business growth. Grant funding provides non-dilutive capital, enabling startups to finance projects without giving up equity but often involves strict eligibility criteria. Choosing the right option impacts a startup's control, financial health, and scalability potential.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Grant Funding |

|---|---|---|

| Definition | Platforms connecting startups with skilled collaborators in exchange for equity. | Non-repayable financial awards from government, organizations, or foundations. |

| Funding Type | Equity-based investment through services and skills. | Cash grants without equity dilution. |

| Eligibility | Startups seeking operational support and team-building. | Startups matching specific grant criteria (sector, location, stage). |

| Ownership Impact | Equity dilution for founders as collaborators receive shares. | No ownership dilution; founders retain full equity. |

| Application Complexity | Less formal; focus on team fit and contribution value. | Highly competitive with detailed proposals and reports. |

| Funding Speed | Typically faster onboarding through marketplace connections. | Longer due diligence and approval process. |

| Support Type | Skills, mentorship, and network access alongside funding. | Pure financial support, occasional advisory services. |

| Best For | Early-stage startups needing talented team members and sweat equity. | Startups with validated business models requiring growth capital. |

Which is better?

Sweat equity marketplaces enable entrepreneurs to exchange skills and labor for ownership stakes, fostering collaborative growth and reducing initial capital requirements. Grant funding provides non-dilutive capital, offering financial resources without equity loss but often involves stringent eligibility criteria and competitive application processes. Choosing between the two depends on the entrepreneur's need for funding flexibility versus willingness to share ownership and the stage of business development.

Connection

Sweat equity marketplaces enable entrepreneurs to exchange their skills and labor for ownership stakes, effectively reducing the need for upfront capital. These platforms often complement grant funding by providing initial operational support, allowing startups to validate ideas before securing non-dilutive grants. Combining sweat equity marketplaces with grant funding accelerates early-stage business growth and mitigates financial risk.

Key Terms

Non-dilutive Capital

Non-dilutive capital in grant funding provides startups and small businesses with crucial financial resources without requiring equity exchange, preserving ownership stakes. Sweat equity marketplaces enable entrepreneurs to contribute time and skills in exchange for partial ownership, often diluting shares but reducing upfront monetary needs. Explore the advantages and potential strategies of leveraging non-dilutive capital through grant funding and sweat equity platforms to maximize growth without sacrificing control.

Equity Compensation

Equity compensation in grant funding typically involves non-dilutive capital where recipients retain full ownership, contrasting with sweat equity marketplaces where investors exchange services or labor for partial company ownership, resulting in dilution. Companies leveraging sweat equity benefit from operational expertise without upfront cash, but must carefully structure agreements to balance control and growth. Explore deeper insights into how equity compensation shapes startup financing strategies and ownership dynamics.

Platform Mediation

Grant funding marketplaces facilitate non-dilutive capital flow by connecting startups with public and private funding sources, emphasizing transparent platform mediation that ensures equitable distribution and compliance. Sweat equity marketplaces mediate the exchange of labor for ownership stakes, leveraging platform mechanisms to verify work contributions and manage equity allocation efficiently. Explore in-depth how platform mediation shapes the dynamics between financial and labor investments in these marketplaces.

Source and External Links

GrantWatch: Grants for Nonprofits, Businesses and Individuals - A comprehensive platform providing access to thousands of current grants from federal, state, corporate, and foundation sources for nonprofits, businesses, and individuals.

Grants | U.S. Small Business Administration - Information on limited SBA grants primarily for nonprofits and organizations supporting entrepreneurship and manufacturing, with no grants for starting or expanding businesses.

Home Page | Grants & Funding - The NIH portal offers federal grant opportunities supporting scientific research and development for researchers at all career stages, including compliance guidelines and policy resources.

dowidth.com

dowidth.com