Gig platforms offer flexible work opportunities by connecting freelancers with clients through digital marketplaces, enabling access to diverse projects and income streams. Self-employment provides autonomy and control over business operations but requires managing all aspects of running a venture, including marketing and finances. Explore the advantages and challenges of gig platforms and self-employment to determine the best path for your career.

Why it is important

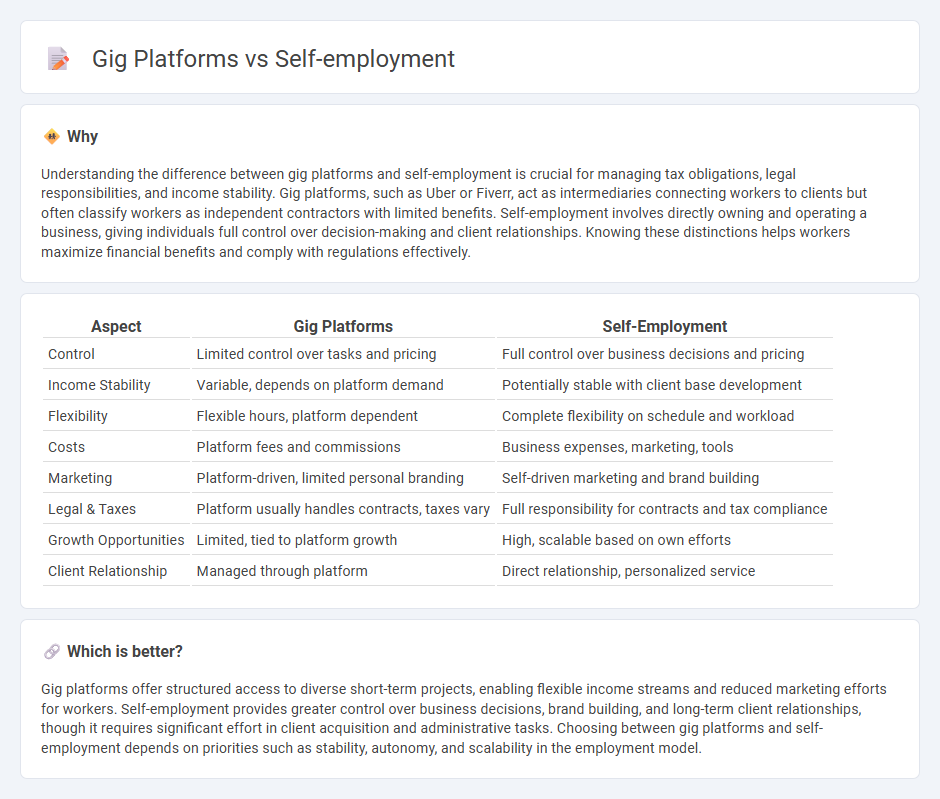

Understanding the difference between gig platforms and self-employment is crucial for managing tax obligations, legal responsibilities, and income stability. Gig platforms, such as Uber or Fiverr, act as intermediaries connecting workers to clients but often classify workers as independent contractors with limited benefits. Self-employment involves directly owning and operating a business, giving individuals full control over decision-making and client relationships. Knowing these distinctions helps workers maximize financial benefits and comply with regulations effectively.

Comparison Table

| Aspect | Gig Platforms | Self-Employment |

|---|---|---|

| Control | Limited control over tasks and pricing | Full control over business decisions and pricing |

| Income Stability | Variable, depends on platform demand | Potentially stable with client base development |

| Flexibility | Flexible hours, platform dependent | Complete flexibility on schedule and workload |

| Costs | Platform fees and commissions | Business expenses, marketing, tools |

| Marketing | Platform-driven, limited personal branding | Self-driven marketing and brand building |

| Legal & Taxes | Platform usually handles contracts, taxes vary | Full responsibility for contracts and tax compliance |

| Growth Opportunities | Limited, tied to platform growth | High, scalable based on own efforts |

| Client Relationship | Managed through platform | Direct relationship, personalized service |

Which is better?

Gig platforms offer structured access to diverse short-term projects, enabling flexible income streams and reduced marketing efforts for workers. Self-employment provides greater control over business decisions, brand building, and long-term client relationships, though it requires significant effort in client acquisition and administrative tasks. Choosing between gig platforms and self-employment depends on priorities such as stability, autonomy, and scalability in the employment model.

Connection

Gig platforms facilitate self-employment by providing flexible, on-demand job opportunities that empower individuals to work independently without traditional employer constraints. These digital marketplaces connect freelancers with clients across various sectors such as ride-sharing, freelance writing, and graphic design, expanding income sources and entrepreneurial possibilities. The rise of gig platforms has significantly reshaped employment dynamics, promoting a shift towards a more decentralized and autonomous workforce.

Key Terms

Autonomy

Self-employment offers complete autonomy, allowing individuals to set their schedules, choose clients, and control business decisions without external interference. Gig platforms provide structured opportunities but often impose rules, task limitations, and algorithms that reduce personal freedom. Explore deeper insights into how autonomy shapes career choices between self-employment and gig economy roles.

Platform Fees

Platform fees on gig platforms typically range from 10% to 30% per transaction, significantly impacting freelancers' net earnings compared to traditional self-employment where such fees are minimal or absent. Self-employed individuals retain full control over their pricing and income but bear all overhead and marketing costs, whereas gig platforms offer streamlined access to clients at the cost of commission fees. Discover how platform fees shape income dynamics and decision-making in freelance work by exploring detailed comparisons and expert insights.

Flexibility

Self-employment offers unparalleled flexibility, allowing individuals to set their own schedules and choose projects aligned with their skills and interests. Gig platforms provide access to a broad range of short-term jobs with flexible hours but often come with varying levels of income stability and platform fees. Explore how each option can match your lifestyle priorities and career goals.

Source and External Links

Self-employment | Explore Careers - CareerOneStop - Self-employment allows individuals to work for themselves in many career fields, offering options like gig work, freelancing, or starting a business, with benefits such as flexible schedules but also challenges requiring self-motivation.

Self-employment: What to know to be your own boss : Career Outlook - Self-employment offers independence and control over your future but also demands preparation, skills, and determination, with growth projections slower than average across occupations.

Self-employment tax (Social Security and Medicare taxes) - IRS - Self-employed individuals pay self-employment tax, which includes Social Security and Medicare taxes, calculated using IRS Schedule SE, differing from wage earners whose taxes are withheld by employers.

dowidth.com

dowidth.com