Digital nomad visas enable professionals to work remotely from foreign countries without changing employers, offering flexibility for extended stays and exploration of new cultures. Intracompany transfer visas facilitate the temporary relocation of employees within multinational corporations, ensuring continuity of employment while leveraging global talent. Explore the key differences and benefits of these visa types to determine the best fit for your international employment goals.

Why it is important

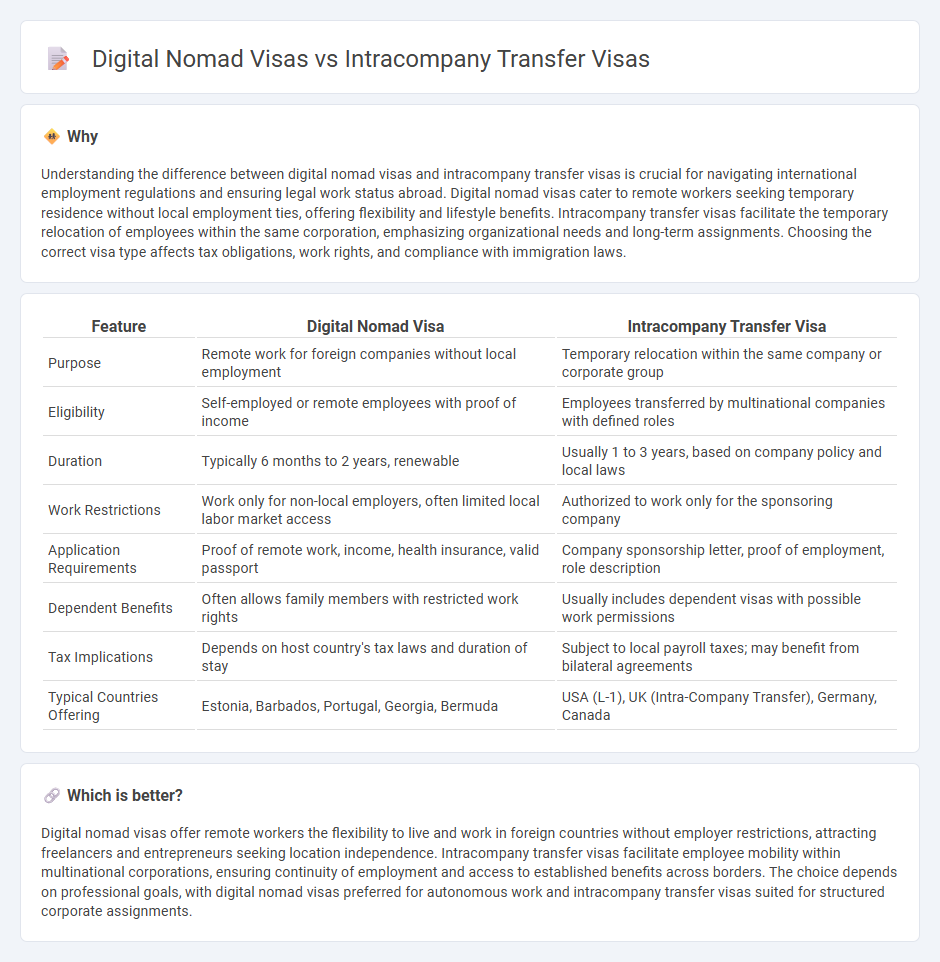

Understanding the difference between digital nomad visas and intracompany transfer visas is crucial for navigating international employment regulations and ensuring legal work status abroad. Digital nomad visas cater to remote workers seeking temporary residence without local employment ties, offering flexibility and lifestyle benefits. Intracompany transfer visas facilitate the temporary relocation of employees within the same corporation, emphasizing organizational needs and long-term assignments. Choosing the correct visa type affects tax obligations, work rights, and compliance with immigration laws.

Comparison Table

| Feature | Digital Nomad Visa | Intracompany Transfer Visa |

|---|---|---|

| Purpose | Remote work for foreign companies without local employment | Temporary relocation within the same company or corporate group |

| Eligibility | Self-employed or remote employees with proof of income | Employees transferred by multinational companies with defined roles |

| Duration | Typically 6 months to 2 years, renewable | Usually 1 to 3 years, based on company policy and local laws |

| Work Restrictions | Work only for non-local employers, often limited local labor market access | Authorized to work only for the sponsoring company |

| Application Requirements | Proof of remote work, income, health insurance, valid passport | Company sponsorship letter, proof of employment, role description |

| Dependent Benefits | Often allows family members with restricted work rights | Usually includes dependent visas with possible work permissions |

| Tax Implications | Depends on host country's tax laws and duration of stay | Subject to local payroll taxes; may benefit from bilateral agreements |

| Typical Countries Offering | Estonia, Barbados, Portugal, Georgia, Bermuda | USA (L-1), UK (Intra-Company Transfer), Germany, Canada |

Which is better?

Digital nomad visas offer remote workers the flexibility to live and work in foreign countries without employer restrictions, attracting freelancers and entrepreneurs seeking location independence. Intracompany transfer visas facilitate employee mobility within multinational corporations, ensuring continuity of employment and access to established benefits across borders. The choice depends on professional goals, with digital nomad visas preferred for autonomous work and intracompany transfer visas suited for structured corporate assignments.

Connection

Digital nomad visas and intracompany transfer visas both facilitate cross-border employment by enabling professionals to legally work in foreign countries while maintaining connections to their primary employers. Digital nomad visas target remote workers seeking flexible international work arrangements, whereas intracompany transfer visas allow multinational companies to relocate employees temporarily between global offices. Together, these visa types support the growing trend of global workforce mobility and international business operations.

Key Terms

Work authorization

Intracompany transfer visas grant employees legal work authorization within multinational companies, allowing seamless relocation among global branches with employer sponsorship and specific duration limits. Digital nomad visas offer remote workers the ability to live and work legally in foreign countries without traditional employment ties, typically requiring proof of income and health insurance but lacking permanent work authorization for local companies. Explore detailed requirements and benefits to determine which visa best supports your international work plans.

Employer sponsorship

Intracompany transfer visas require strong employer sponsorship where the company actively facilitates employee relocation to foreign branches, ensuring compliance with immigration regulations. Digital nomad visas typically do not mandate employer sponsorship, as these visas cater to remote workers who maintain employment outside the host country independently. Explore the specific sponsorship criteria and application processes to determine which visa aligns best with your professional situation.

Remote work eligibility

Intracompany transfer visas enable employees of multinational companies to relocate temporarily while maintaining their position within the company, ensuring eligibility for remote work tied to internal business operations. Digital nomad visas cater to freelancers and remote workers seeking location flexibility without establishing local employment, often requiring proof of income and remote work capabilities. Explore detailed comparisons to determine which visa aligns best with your remote work needs.

Source and External Links

What is an Intra-Company Transfer? | A Guide to ICT Visa ... - An intra-company transfer visa allows multinational companies to relocate employees to different country branches, typically requiring 6-12 months employment, managerial or specialized roles, and salary thresholds, with specific visa routes such as the UK ICT visa, US L-1 visa, Canada ICT Work Permit, EU ICT Directive, and UAE permits.

L1 Visa Intracompany Transfer: A Complete Legal Guide - The L1 visa for intracompany transfers allows temporary relocation of managers, executives, or specialized knowledge workers to the U.S. if they have worked continuously for at least one year abroad in the last three years, involving a qualified relationship between the foreign and U.S. entities.

L-1: Intracompany Transfer Visas - The L-1 visa enables transfer of executives, managers, or specialized employees to U.S. branches or to establish new branches, allows dual intent for green card applications, and requires a qualifying relationship between the foreign and U.S. employer entities.

dowidth.com

dowidth.com