ESG due diligence evaluates environmental, social, and governance risks within a company's operations and strategy to ensure sustainable and ethical business practices. Supply chain due diligence focuses specifically on identifying and mitigating risks related to suppliers, such as labor rights violations, environmental impact, and regulatory compliance throughout the supply chain. Discover how integrating both ESG and supply chain due diligence enhances corporate responsibility and risk management.

Why it is important

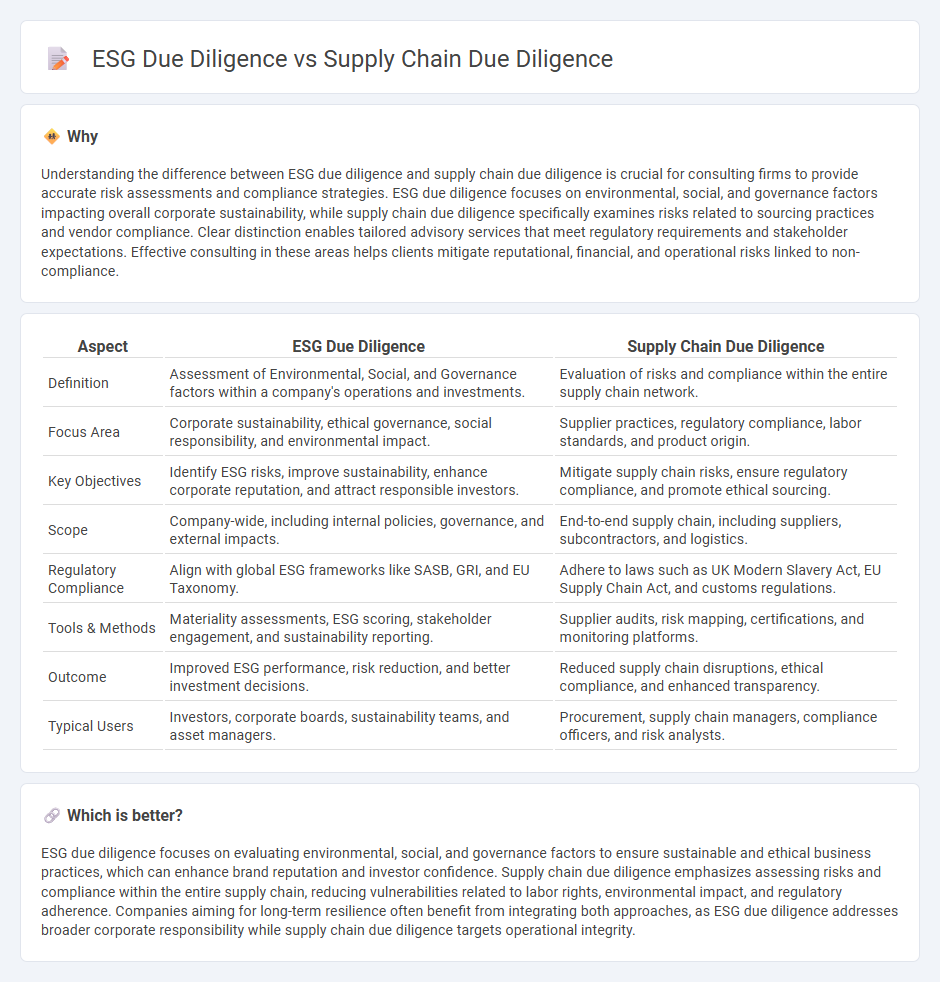

Understanding the difference between ESG due diligence and supply chain due diligence is crucial for consulting firms to provide accurate risk assessments and compliance strategies. ESG due diligence focuses on environmental, social, and governance factors impacting overall corporate sustainability, while supply chain due diligence specifically examines risks related to sourcing practices and vendor compliance. Clear distinction enables tailored advisory services that meet regulatory requirements and stakeholder expectations. Effective consulting in these areas helps clients mitigate reputational, financial, and operational risks linked to non-compliance.

Comparison Table

| Aspect | ESG Due Diligence | Supply Chain Due Diligence |

|---|---|---|

| Definition | Assessment of Environmental, Social, and Governance factors within a company's operations and investments. | Evaluation of risks and compliance within the entire supply chain network. |

| Focus Area | Corporate sustainability, ethical governance, social responsibility, and environmental impact. | Supplier practices, regulatory compliance, labor standards, and product origin. |

| Key Objectives | Identify ESG risks, improve sustainability, enhance corporate reputation, and attract responsible investors. | Mitigate supply chain risks, ensure regulatory compliance, and promote ethical sourcing. |

| Scope | Company-wide, including internal policies, governance, and external impacts. | End-to-end supply chain, including suppliers, subcontractors, and logistics. |

| Regulatory Compliance | Align with global ESG frameworks like SASB, GRI, and EU Taxonomy. | Adhere to laws such as UK Modern Slavery Act, EU Supply Chain Act, and customs regulations. |

| Tools & Methods | Materiality assessments, ESG scoring, stakeholder engagement, and sustainability reporting. | Supplier audits, risk mapping, certifications, and monitoring platforms. |

| Outcome | Improved ESG performance, risk reduction, and better investment decisions. | Reduced supply chain disruptions, ethical compliance, and enhanced transparency. |

| Typical Users | Investors, corporate boards, sustainability teams, and asset managers. | Procurement, supply chain managers, compliance officers, and risk analysts. |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to ensure sustainable and ethical business practices, which can enhance brand reputation and investor confidence. Supply chain due diligence emphasizes assessing risks and compliance within the entire supply chain, reducing vulnerabilities related to labor rights, environmental impact, and regulatory adherence. Companies aiming for long-term resilience often benefit from integrating both approaches, as ESG due diligence addresses broader corporate responsibility while supply chain due diligence targets operational integrity.

Connection

ESG due diligence and supply chain due diligence are interconnected through their shared focus on evaluating environmental, social, and governance risks within the supply chain. Effective ESG due diligence integrates rigorous supply chain assessments to identify potential compliance issues, ethical breaches, and sustainability challenges. This comprehensive approach supports risk mitigation, enhances corporate responsibility, and fosters long-term value creation in consulting engagements.

Key Terms

Risk Assessment

Supply chain due diligence primarily involves evaluating risks related to supplier compliance, labor standards, and material sourcing to ensure operational integrity and regulatory adherence. ESG due diligence encompasses a broader scope, integrating environmental, social, and governance factors to assess long-term sustainability impacts along with financial performance. Explore our detailed analysis to better understand how these risk assessment frameworks complement each other in corporate responsibility.

Regulatory Compliance

Supply chain due diligence targets risks in sourcing, labor practices, and environmental impact within the supply chain, ensuring alignment with regulations such as the UK Modern Slavery Act and the EU Conflict Minerals Regulation. ESG due diligence takes a broader approach, integrating environmental, social, and governance criteria across corporate operations and investments to meet standards like the EU Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD). Explore detailed comparisons and compliance strategies to optimize your risk management framework.

Stakeholder Impact

Supply chain due diligence emphasizes identifying and mitigating risks related to labor practices, environmental harm, and human rights violations within the supply chain to protect all stakeholders from adverse effects. ESG due diligence broadens this scope by integrating environmental, social, and governance factors to assess the overall sustainability and ethical impact on investors, communities, and regulators. Explore further to understand how each approach prioritizes stakeholder impact and drives responsible business practices.

Source and External Links

How to Conduct Supply Chain Due Diligence | GEP Blogs - Supply chain due diligence is the process of gathering information and examining records to assess risks and opportunities in the supply chain, requiring companies to develop risk-management strategies and take actions to ensure ethical and environmental compliance under regulations like the EU Supply Chain Due Diligence Directive.

3 things to know when performing supplier due diligence - Moody's - Supplier due diligence is crucial for identifying and mitigating risks from third-party suppliers, ensuring companies meet regulatory obligations, safeguard reputation, and have strategic foresight over complex, global supply chain challenges.

An introduction to Supply Chain Due Diligence Best Practice - Achilles - Best practices for supply chain due diligence involve developing and monitoring risk mitigation processes, evaluating supplier performance, engaging stakeholders, publishing compliance reports, and seeking external expert support to ensure responsible business conduct and continuous improvement.

dowidth.com

dowidth.com