Due diligence deep dive involves a comprehensive examination of financial, legal, and operational aspects to validate the accuracy of information and uncover potential liabilities. Risk assessment focuses on identifying, analyzing, and prioritizing risks to mitigate their impact on the business or investment. Explore more to understand how these processes enhance strategic decision-making and safeguard value.

Why it is important

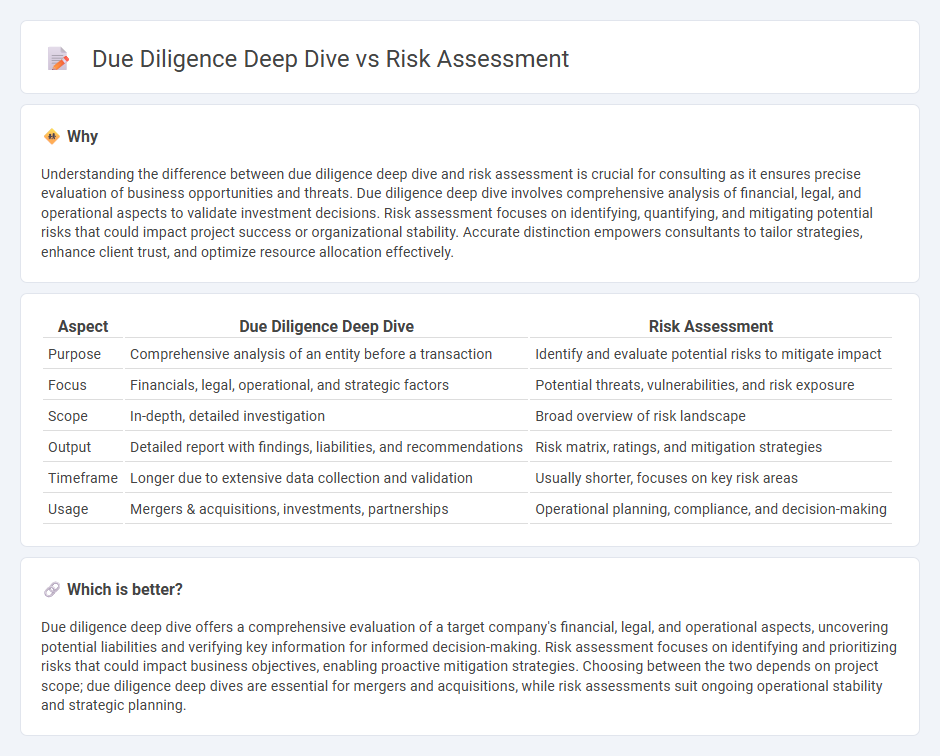

Understanding the difference between due diligence deep dive and risk assessment is crucial for consulting as it ensures precise evaluation of business opportunities and threats. Due diligence deep dive involves comprehensive analysis of financial, legal, and operational aspects to validate investment decisions. Risk assessment focuses on identifying, quantifying, and mitigating potential risks that could impact project success or organizational stability. Accurate distinction empowers consultants to tailor strategies, enhance client trust, and optimize resource allocation effectively.

Comparison Table

| Aspect | Due Diligence Deep Dive | Risk Assessment |

|---|---|---|

| Purpose | Comprehensive analysis of an entity before a transaction | Identify and evaluate potential risks to mitigate impact |

| Focus | Financials, legal, operational, and strategic factors | Potential threats, vulnerabilities, and risk exposure |

| Scope | In-depth, detailed investigation | Broad overview of risk landscape |

| Output | Detailed report with findings, liabilities, and recommendations | Risk matrix, ratings, and mitigation strategies |

| Timeframe | Longer due to extensive data collection and validation | Usually shorter, focuses on key risk areas |

| Usage | Mergers & acquisitions, investments, partnerships | Operational planning, compliance, and decision-making |

Which is better?

Due diligence deep dive offers a comprehensive evaluation of a target company's financial, legal, and operational aspects, uncovering potential liabilities and verifying key information for informed decision-making. Risk assessment focuses on identifying and prioritizing risks that could impact business objectives, enabling proactive mitigation strategies. Choosing between the two depends on project scope; due diligence deep dives are essential for mergers and acquisitions, while risk assessments suit ongoing operational stability and strategic planning.

Connection

Due diligence deep dive involves comprehensive analysis of financial, legal, and operational aspects to identify potential risks in business transactions. Risk assessment evaluates these identified risks to measure their impact and likelihood, guiding decision-making and mitigation strategies. Together, they ensure informed consulting advice by uncovering hidden liabilities and quantifying threats.

Key Terms

Threat Identification

Threat identification in risk assessment prioritizes pinpointing vulnerabilities within organizational systems to prevent potential breaches. Due diligence expands this scope by rigorously verifying the credibility of partners, vendors, or investments to mitigate external risks. Explore more about optimizing your security strategies with comprehensive threat identification methods.

Compliance Analysis

Risk assessment evaluates potential threats to organizational compliance by identifying vulnerabilities, assessing regulatory obligations, and measuring the impact of non-compliance. Due diligence in compliance analysis involves thorough investigation of third parties, contracts, and operational processes to ensure adherence to legal standards and mitigate reputational risks. Explore further to understand how integrating both approaches strengthens your compliance strategy and safeguards your business.

Remediation Planning

Risk assessment identifies potential vulnerabilities and threats within an organization, laying the groundwork for effective remediation planning by prioritizing critical risks. Due diligence involves a comprehensive evaluation of compliance, financial, and operational aspects to ensure informed decision-making and tailored remediation strategies. Explore detailed methodologies and best practices in remediation planning to enhance organizational resilience and compliance.

Source and External Links

What is a Risk Assessment? | Definition from TechTarget - Risk assessment is the process of identifying hazards that could negatively affect an organization's ability to conduct business, involving steps such as hazard identification, evaluation of risk impact, recording findings, and regularly updating the assessment.

Risk assessment - Wikipedia - Risk assessment is a process for identifying hazards and evaluating their likelihood and consequences to mitigate negative impacts on individuals, assets, and the environment, forming a key part of risk management.

Risk Assessment: Process, Tools, & Techniques | SafetyCulture - A risk assessment systematically identifies hazards and analyzes potential impacts to determine necessary control measures and prioritize them according to their likelihood and severity to ensure workplace safety.

dowidth.com

dowidth.com