Sales enablement consulting focuses on optimizing sales processes, training, and tools to boost revenue and streamline customer engagement, while mergers and acquisitions consulting centers on guiding organizations through complex transactions, due diligence, and integration strategies. Both consulting types leverage expert analysis and strategic planning to drive business growth, yet they address distinct challenges within the corporate landscape. Discover how specialized consulting services can transform your business objectives.

Why it is important

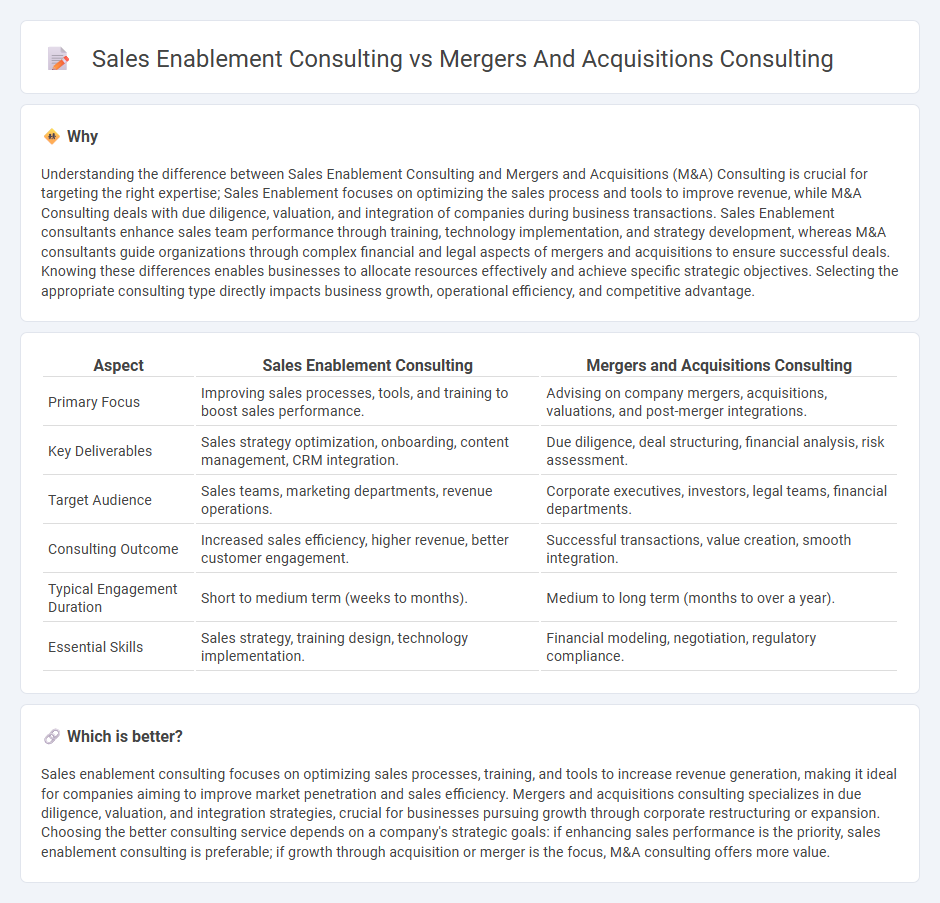

Understanding the difference between Sales Enablement Consulting and Mergers and Acquisitions (M&A) Consulting is crucial for targeting the right expertise; Sales Enablement focuses on optimizing the sales process and tools to improve revenue, while M&A Consulting deals with due diligence, valuation, and integration of companies during business transactions. Sales Enablement consultants enhance sales team performance through training, technology implementation, and strategy development, whereas M&A consultants guide organizations through complex financial and legal aspects of mergers and acquisitions to ensure successful deals. Knowing these differences enables businesses to allocate resources effectively and achieve specific strategic objectives. Selecting the appropriate consulting type directly impacts business growth, operational efficiency, and competitive advantage.

Comparison Table

| Aspect | Sales Enablement Consulting | Mergers and Acquisitions Consulting |

|---|---|---|

| Primary Focus | Improving sales processes, tools, and training to boost sales performance. | Advising on company mergers, acquisitions, valuations, and post-merger integrations. |

| Key Deliverables | Sales strategy optimization, onboarding, content management, CRM integration. | Due diligence, deal structuring, financial analysis, risk assessment. |

| Target Audience | Sales teams, marketing departments, revenue operations. | Corporate executives, investors, legal teams, financial departments. |

| Consulting Outcome | Increased sales efficiency, higher revenue, better customer engagement. | Successful transactions, value creation, smooth integration. |

| Typical Engagement Duration | Short to medium term (weeks to months). | Medium to long term (months to over a year). |

| Essential Skills | Sales strategy, training design, technology implementation. | Financial modeling, negotiation, regulatory compliance. |

Which is better?

Sales enablement consulting focuses on optimizing sales processes, training, and tools to increase revenue generation, making it ideal for companies aiming to improve market penetration and sales efficiency. Mergers and acquisitions consulting specializes in due diligence, valuation, and integration strategies, crucial for businesses pursuing growth through corporate restructuring or expansion. Choosing the better consulting service depends on a company's strategic goals: if enhancing sales performance is the priority, sales enablement consulting is preferable; if growth through acquisition or merger is the focus, M&A consulting offers more value.

Connection

Sales enablement consulting and mergers and acquisitions consulting are connected through their focus on driving business growth and operational efficiency during and after a transaction. Sales enablement consulting enhances the integration of sales teams by aligning sales strategies, tools, and training with new organizational goals, addressing challenges in customer retention and revenue generation. Mergers and acquisitions consulting relies on these insights to ensure smooth sales force integration, optimize cross-selling opportunities, and maximize deal value.

Key Terms

**Mergers and Acquisitions Consulting:**

Mergers and acquisitions consulting specializes in strategic advisory services that facilitate the successful integration and valuation of companies during mergers or acquisitions, ensuring regulatory compliance and optimizing deal structures. This consulting often involves due diligence, financial modeling, risk assessment, and post-merger integration planning to maximize shareholder value and operational efficiency. Discover how expert M&A consulting can drive your business growth and seamless transitions by exploring our comprehensive services.

Due Diligence

Mergers and acquisitions (M&A) consulting prioritizes comprehensive due diligence to assess financial health, business risks, and integration potential of target companies, ensuring informed decision-making. Sales enablement consulting involves due diligence on sales processes, tools, and training effectiveness to optimize revenue generation post-acquisition or during scaling. Explore more to understand the distinct due diligence approaches in M&A and sales enablement consulting for driving strategic growth.

Valuation

Mergers and acquisitions consulting emphasizes valuation methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions to assess a company's worth for potential deals. Sales enablement consulting focuses on boosting revenue and sales performance by optimizing sales processes, tools, and training, indirectly impacting valuation through improved financial metrics. Discover how mastering valuation in both contexts can enhance strategic business decisions.

Source and External Links

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG provides end-to-end M&A consulting, from strategy and target identification to due diligence and post-merger integration, leveraging industry expertise and proprietary tools to drive value creation and minimize common pitfalls.

M&A consulting - EY's M&A consulting teams deliver strategic advisory, due diligence, and post-merger integration services, supported by AI-enabled technology and global sector expertise to optimize deal value and alignment with business objectives.

Mergers & Acquisitions Consulting Services - The Dryden Group specializes in procurement-focused M&A consulting, offering spend analysis, vendor review, and contract renegotiation to streamline operations and maximize cost synergies for merging organizations.

dowidth.com

dowidth.com