Due diligence deep dives involve systematic analysis of financial, operational, and legal aspects to assess risks and validate opportunities before transactions. Growth strategy focuses on identifying market expansion, competitive positioning, and innovative business models to drive sustainable revenue increase. Explore our consulting services to understand how these approaches can optimize your business outcomes.

Why it is important

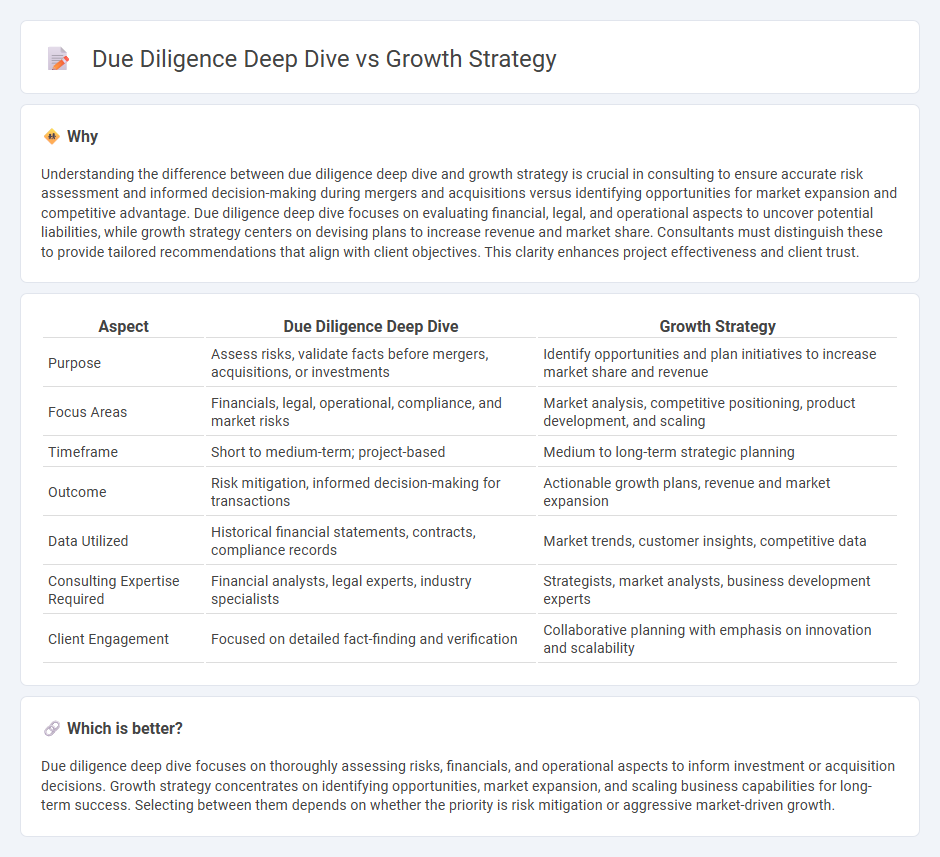

Understanding the difference between due diligence deep dive and growth strategy is crucial in consulting to ensure accurate risk assessment and informed decision-making during mergers and acquisitions versus identifying opportunities for market expansion and competitive advantage. Due diligence deep dive focuses on evaluating financial, legal, and operational aspects to uncover potential liabilities, while growth strategy centers on devising plans to increase revenue and market share. Consultants must distinguish these to provide tailored recommendations that align with client objectives. This clarity enhances project effectiveness and client trust.

Comparison Table

| Aspect | Due Diligence Deep Dive | Growth Strategy |

|---|---|---|

| Purpose | Assess risks, validate facts before mergers, acquisitions, or investments | Identify opportunities and plan initiatives to increase market share and revenue |

| Focus Areas | Financials, legal, operational, compliance, and market risks | Market analysis, competitive positioning, product development, and scaling |

| Timeframe | Short to medium-term; project-based | Medium to long-term strategic planning |

| Outcome | Risk mitigation, informed decision-making for transactions | Actionable growth plans, revenue and market expansion |

| Data Utilized | Historical financial statements, contracts, compliance records | Market trends, customer insights, competitive data |

| Consulting Expertise Required | Financial analysts, legal experts, industry specialists | Strategists, market analysts, business development experts |

| Client Engagement | Focused on detailed fact-finding and verification | Collaborative planning with emphasis on innovation and scalability |

Which is better?

Due diligence deep dive focuses on thoroughly assessing risks, financials, and operational aspects to inform investment or acquisition decisions. Growth strategy concentrates on identifying opportunities, market expansion, and scaling business capabilities for long-term success. Selecting between them depends on whether the priority is risk mitigation or aggressive market-driven growth.

Connection

Due diligence deep dive uncovers critical insights and potential risks that shape the foundation of a robust growth strategy. Analyzing financials, market conditions, and operational efficiencies during due diligence enables consultants to identify strategic opportunities and resource allocation for scalable expansion. Integrating these findings ensures informed decision-making that aligns growth initiatives with long-term business objectives.

Key Terms

Market Analysis

Growth strategy emphasizes identifying market opportunities, customer segmentation, and competitive positioning to drive business expansion. Due diligence deep dive in market analysis involves verifying market size, growth rates, trends, regulatory environment, and competitive dynamics to assess investment risks. Explore comprehensive market analysis techniques to optimize both growth strategy and due diligence outcomes.

Synergy Assessment

Synergy assessment plays a critical role in both growth strategy and due diligence, evaluating potential value creation from mergers or acquisitions through operational, financial, and market integrations. Growth strategies harness synergy assessments to identify opportunities that drive expansion and competitive advantage, while due diligence uses them to rigorously validate risks and benefits before transaction approval. Explore how in-depth synergy analysis can optimize decision-making processes and maximize post-deal outcomes.

Risk Identification

Growth strategy emphasizes identifying potential risks that could hinder expansion, including market volatility, competitive threats, and operational challenges. Due diligence deep dive concentrates on a thorough risk assessment by examining financial records, legal compliance, and management structures to uncover hidden liabilities. Explore detailed analyses on risk identification techniques within both growth strategy and due diligence to strengthen decision-making processes.

Source and External Links

Proven Business Growth Strategies for Success - A growth strategy is a plan to expand a business, involving steps like setting clear goals, analyzing the current position, choosing strategies such as market penetration, market development, product development, and diversification, all organized within a comprehensive Growth Strategy Framework.

Effective Growth Strategy for Tech CEOs: Key Insights - Growth strategy evolves through stages including readiness to scale by building infrastructure and streamlining operations, growth acceleration by expanding market share and optimizing marketing, and expansion by entering new markets and forming strategic partnerships.

Company Growth Strategy: 7 Key Steps for Business - A growth strategy outlines ways to expand business aspects like revenue or customers, typically involving tactics such as adding new locations, investing in customer acquisition, expanding product lines, and tailoring strategies to the industry and target market.

dowidth.com

dowidth.com