ESG due diligence focuses on evaluating environmental, social, and governance factors to identify potential risks and opportunities in sustainability practices, regulatory compliance, and ethical standards. Cultural due diligence assesses organizational values, employee engagement, leadership styles, and corporate culture alignment to ensure smooth integration during mergers and acquisitions or strategic changes. Explore further to understand how both types of due diligence enhance decision-making and long-term value creation.

Why it is important

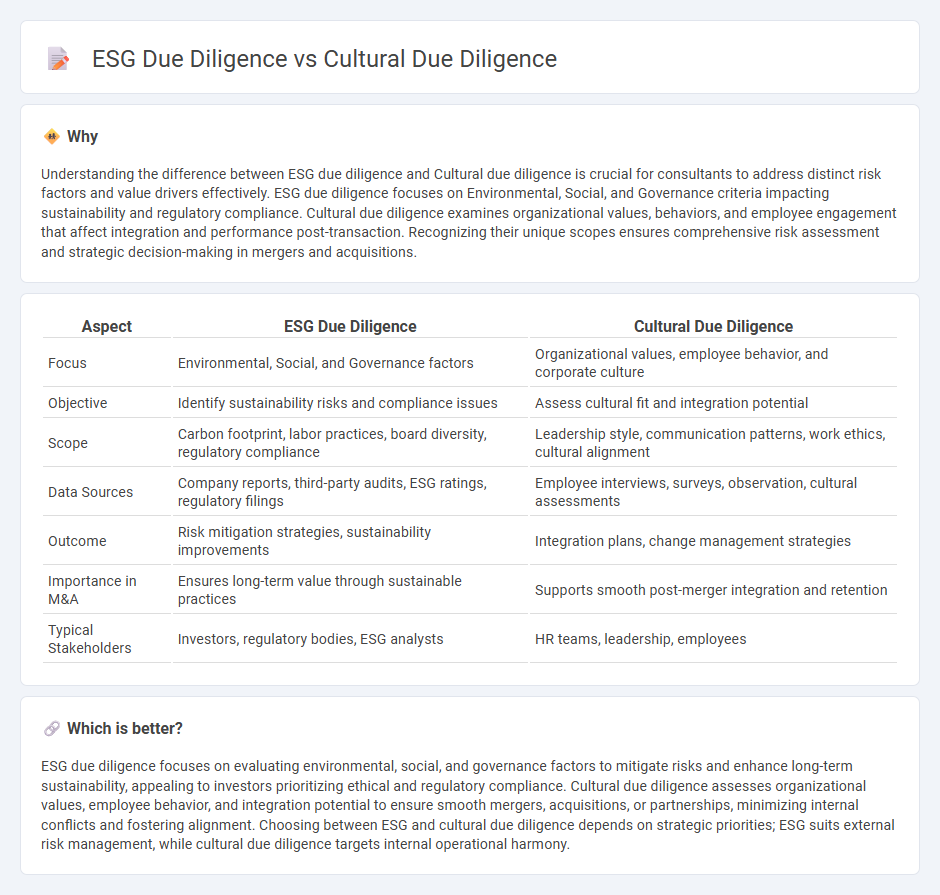

Understanding the difference between ESG due diligence and Cultural due diligence is crucial for consultants to address distinct risk factors and value drivers effectively. ESG due diligence focuses on Environmental, Social, and Governance criteria impacting sustainability and regulatory compliance. Cultural due diligence examines organizational values, behaviors, and employee engagement that affect integration and performance post-transaction. Recognizing their unique scopes ensures comprehensive risk assessment and strategic decision-making in mergers and acquisitions.

Comparison Table

| Aspect | ESG Due Diligence | Cultural Due Diligence |

|---|---|---|

| Focus | Environmental, Social, and Governance factors | Organizational values, employee behavior, and corporate culture |

| Objective | Identify sustainability risks and compliance issues | Assess cultural fit and integration potential |

| Scope | Carbon footprint, labor practices, board diversity, regulatory compliance | Leadership style, communication patterns, work ethics, cultural alignment |

| Data Sources | Company reports, third-party audits, ESG ratings, regulatory filings | Employee interviews, surveys, observation, cultural assessments |

| Outcome | Risk mitigation strategies, sustainability improvements | Integration plans, change management strategies |

| Importance in M&A | Ensures long-term value through sustainable practices | Supports smooth post-merger integration and retention |

| Typical Stakeholders | Investors, regulatory bodies, ESG analysts | HR teams, leadership, employees |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to mitigate risks and enhance long-term sustainability, appealing to investors prioritizing ethical and regulatory compliance. Cultural due diligence assesses organizational values, employee behavior, and integration potential to ensure smooth mergers, acquisitions, or partnerships, minimizing internal conflicts and fostering alignment. Choosing between ESG and cultural due diligence depends on strategic priorities; ESG suits external risk management, while cultural due diligence targets internal operational harmony.

Connection

ESG due diligence and Cultural due diligence are interconnected processes that evaluate environmental, social, governance factors alongside organizational values, behaviors, and cultural fit to mitigate risks in mergers and acquisitions. Both assessments provide critical insights into a company's sustainability practices and internal dynamics, ensuring alignment with investor expectations and long-term strategic goals. Integrating ESG and cultural due diligence enhances decision-making by identifying potential liabilities and fostering a cohesive post-transaction integration.

Key Terms

Organizational Values Alignment

Cultural due diligence examines the alignment of organizational values, beliefs, and behaviors to ensure a cohesive workplace culture, while ESG due diligence evaluates environmental, social, and governance practices impacting sustainability and ethical conduct. Both approaches are critical for assessing long-term risks and value creation, with organizational values alignment playing a pivotal role in integrating culture into broader ESG frameworks. Discover how aligning cultural due diligence with ESG strategies strengthens governance and drives responsible business growth.

Social Responsibility Assessment

Cultural due diligence evaluates organizational values, employee engagement, and workplace diversity to ensure alignment with business objectives and social norms. ESG due diligence prioritizes Environmental, Social, and Governance criteria, with the social component assessing labor practices, human rights, and community impact. Discover how these distinct frameworks drive responsible business decisions by exploring their specific social responsibility assessment methods.

Stakeholder Engagement

Cultural due diligence emphasizes understanding the values, beliefs, and behaviors of stakeholders, ensuring alignment with organizational culture and fostering genuine relationships for long-term success. ESG due diligence centers on evaluating environmental, social, and governance factors, with stakeholder engagement aimed at assessing risks and opportunities related to sustainability and corporate responsibility. Explore deeper insights into how integrating cultural and ESG due diligence enhances stakeholder engagement strategies for comprehensive risk management.

Source and External Links

Reading the Culture Clues: Cultural Due Diligence During M&A - Cultural due diligence in mergers and acquisitions involves analyzing organizational values, rituals, heroes, networks, codes, and stories to understand and intentionally integrate differing cultures for successful synergy.

Conducting a Culture Due Diligence - M&A Leadership Council - Cultural due diligence identifies potential cultural clashes early in M&A, highlights best practices like fostering open communication and involving employees, and emphasizes the need for ongoing monitoring and adjustment.

M&A Due Diligence: Don't Forget the Culture - MarshBerry - Effective cultural due diligence evaluates cultural compatibility to reduce post-merger risks, retain key talent, and maximize integration value by identifying what cultural strengths to preserve or adapt.

dowidth.com

dowidth.com