Innovation scouting identifies emerging startups and technologies that align with corporate goals, enabling early adoption of groundbreaking solutions. Corporate venturing involves direct investments and partnerships with startups to accelerate innovation and drive strategic growth within the company. Explore how combining innovation scouting and corporate venturing can maximize your organization's innovation potential.

Why it is important

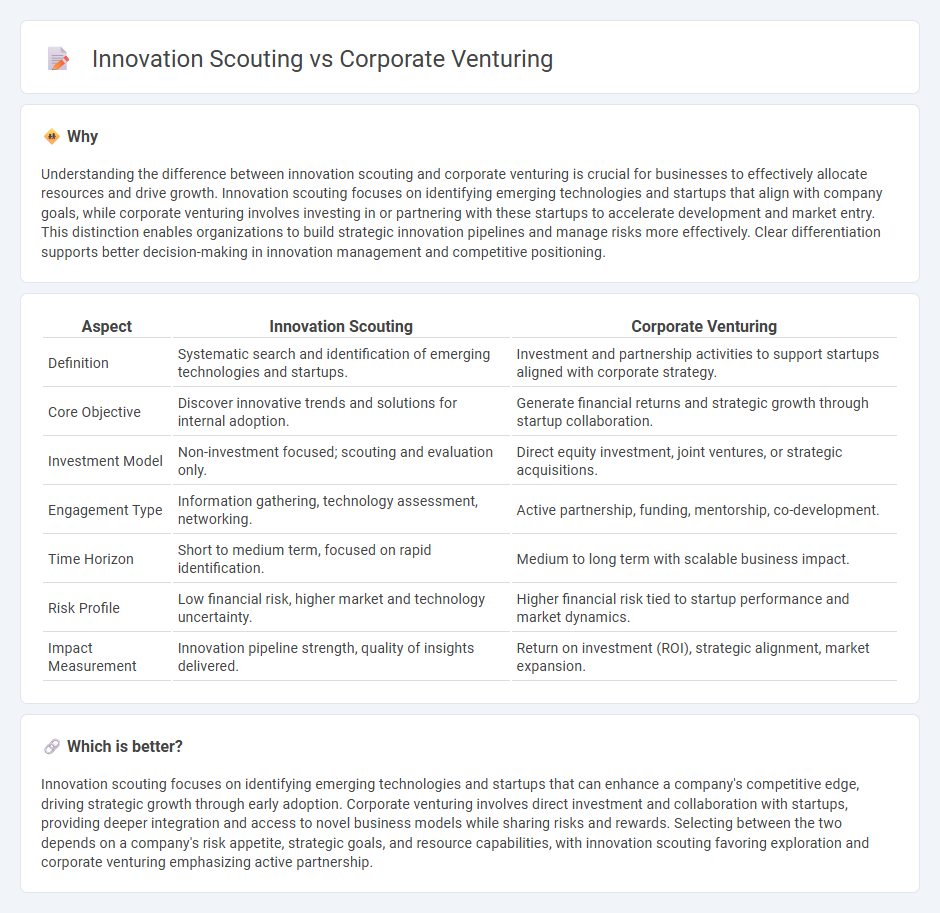

Understanding the difference between innovation scouting and corporate venturing is crucial for businesses to effectively allocate resources and drive growth. Innovation scouting focuses on identifying emerging technologies and startups that align with company goals, while corporate venturing involves investing in or partnering with these startups to accelerate development and market entry. This distinction enables organizations to build strategic innovation pipelines and manage risks more effectively. Clear differentiation supports better decision-making in innovation management and competitive positioning.

Comparison Table

| Aspect | Innovation Scouting | Corporate Venturing |

|---|---|---|

| Definition | Systematic search and identification of emerging technologies and startups. | Investment and partnership activities to support startups aligned with corporate strategy. |

| Core Objective | Discover innovative trends and solutions for internal adoption. | Generate financial returns and strategic growth through startup collaboration. |

| Investment Model | Non-investment focused; scouting and evaluation only. | Direct equity investment, joint ventures, or strategic acquisitions. |

| Engagement Type | Information gathering, technology assessment, networking. | Active partnership, funding, mentorship, co-development. |

| Time Horizon | Short to medium term, focused on rapid identification. | Medium to long term with scalable business impact. |

| Risk Profile | Low financial risk, higher market and technology uncertainty. | Higher financial risk tied to startup performance and market dynamics. |

| Impact Measurement | Innovation pipeline strength, quality of insights delivered. | Return on investment (ROI), strategic alignment, market expansion. |

Which is better?

Innovation scouting focuses on identifying emerging technologies and startups that can enhance a company's competitive edge, driving strategic growth through early adoption. Corporate venturing involves direct investment and collaboration with startups, providing deeper integration and access to novel business models while sharing risks and rewards. Selecting between the two depends on a company's risk appetite, strategic goals, and resource capabilities, with innovation scouting favoring exploration and corporate venturing emphasizing active partnership.

Connection

Innovation scouting identifies emerging technologies and startups with high-growth potential, serving as a foundation for corporate venturing activities. Corporate venturing leverages these insights to strategically invest in or partner with innovative companies, accelerating internal growth and competitive advantage. This synergy enhances a corporation's ability to stay ahead in dynamic markets by integrating external innovation into their business models.

Key Terms

Strategic Partnerships

Corporate venturing involves investing in or collaborating with startups to drive innovation and gain competitive advantage, while innovation scouting focuses on identifying emerging technologies and trends to foster strategic partnerships. Strategic partnerships formed through corporate venturing often lead to co-development opportunities and market expansion, whereas innovation scouting helps corporations stay ahead by integrating cutting-edge solutions. Explore our detailed insights to understand how these approaches can transform your business strategy.

Startup Ecosystem

Corporate venturing involves direct investments or partnerships with startups to drive strategic growth within established companies, while innovation scouting focuses on identifying emerging technologies and innovative solutions in the startup ecosystem. Both approaches aim to integrate external innovation but differ in engagement depth and resource allocation, with corporate venturing often requiring significant capital and governance involvement. Explore the dynamics of startup ecosystem collaborations to maximize innovation impact in your organization.

Technology Foresight

Corporate venturing invests in startups and emerging technologies to accelerate innovation and capture market opportunities. Innovation scouting systematically identifies and evaluates breakthrough technologies and trends using technology foresight methodologies. Explore more to understand how these strategies drive competitive advantage in dynamic markets.

Source and External Links

What is Corporate Venturing? - Corporate venturing involves large companies investing in and supporting startups by taking minority equity stakes directly or via venture funds, aiming for both strategic benefits and financial returns while fostering innovation through incubators, accelerators, and intrapreneurship.

Corporate Venture Building: The Ultimate Guide - Bundl - Corporate venturing allows companies to build, buy, or partner with startups to test new ideas in lean, controlled environments, enabling innovation ecosystems and attracting entrepreneurial talent to drive growth beyond the core business with reduced risk.

Corporate Venturing - Definition, Benefits, Examples - Corporate venturing, also known as corporate venture capital, is direct corporate investment in startups for strategic and financial benefits such as accessing new technologies, markets, and innovation, differing from traditional venture capital by its broader strategic goals.

dowidth.com

dowidth.com